Gold prices slide further as easing US-China tensions curb haven demand

The European Open

Heading into the European open, Stock futures signaled declines in European markets and a steady session for Wall Street with the S&P 500 marginally higher.

Sentiment remains relatively stable for now but there is a 90-day deadline hanging over markets which may cast a shadow. Given the flip-flopping we have seen by the Trump administration, one could forgive market participants for not overly committing just yet.

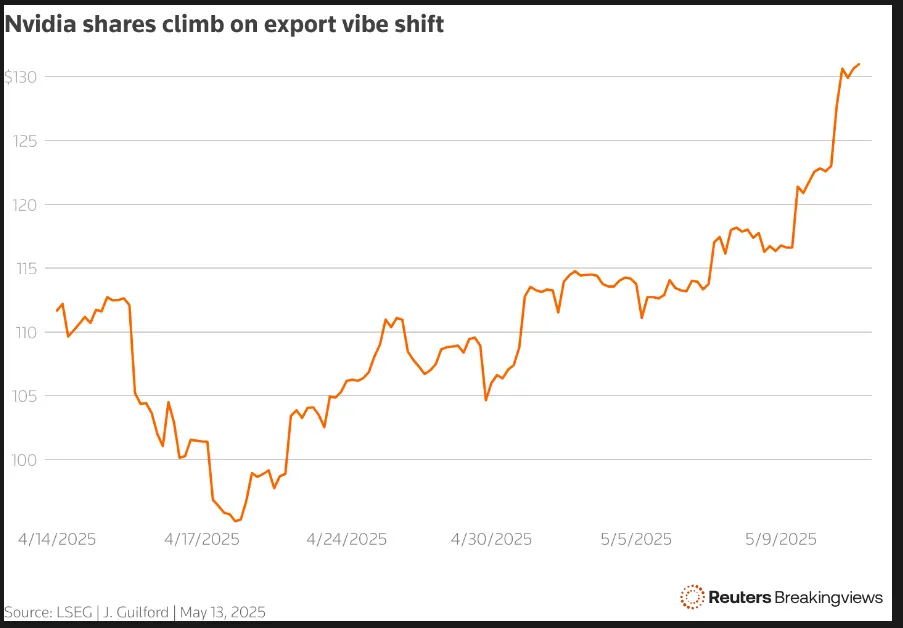

Tech stocks are gaining attention again after U.S. chipmakers Nvidia and AMD announced major AI deals in the Middle East, coinciding with Trump’s visit to Saudi Arabia.

Nvidia’s stock jumped on Tuesday, boosting the company’s value to $3 trillion and CEO Jensen Huang’s wealth to $120 billion.

Source: LSEG

On the FX front, the US dollar index stayed steady at 100.87 after its biggest drop in over three weeks. It had risen 1% on Monday, reaching a one-month high, as hopes grew that easing U.S.-China trade tensions could prevent a global recession.

The dollar rose 0.24% to 7.2122 yuan in offshore trading, after hitting a six-month low at 7.1791 yuan on Tuesday.

Meanwhile, the dollar fell 0.41% to 146.89/JPY, continuing Tuesday’s 0.66% decline. On Monday, it saw its biggest jump since March 2020, rising 2.14%. It also slipped 0.1% to 0.8384 Swiss francs.

The euro traded at 1.1191 and the British pound at $1.3307, with little change in either currency pair ahead of the European session.

Currency Strength Chart

Source: OANDA Labs

Commodities remain interesting, with Gold continuing to face headwinds following the weekend. Gold trades around $100 off Friday’s daily close, around the $3324/oz handle with a brief attempt at a recovery fizzling away yesterday. For now, the precious metal may struggle if sentiment continues to improve or if the current status quo remains unchanged.

Brent crude oil prices jumped nearly 2.6% yesterday, hitting their highest level since late April.

There have been growing concerns among US oil companies as Oil prices flirted with the $60 a barrel mark. President Trump had pledged to lower Oil prices to benefit consumers as well as increase US production. However, if oil prices dip significantly, it will affect the profitability of US firms. In a way, it appears President Trump may struggle to deliver on both promises moving forward.

The main driver was the threat of more sanctions on Iranian oil exports. The US Treasury imposed sanctions on a group involved in shipping Iranian oil to China, and President Trump mentioned the possibility of stricter sanctions if no nuclear deal with Iran is reached. Trump has often warned about reducing Iran’s oil exports to zero. Although this is unlikely, there’s still potential for a significant decrease, as Iran currently exports around 1.6 million barrels per day.

Later today, we will get the OPEC monthly oil report, and it should be an interesting one, given the desire by OPEC+ + countries to continue with aggressive supply hikes.

Asian Session Market Wrap

Asia’s main stock index went up, driven by tech companies, as investors waited for earnings reports from big Chinese tech firms this week.

Regional tech stocks rose for a fourth straight day after Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD) said they would sell chips to a Saudi AI company for a $10 billion data center project. Meanwhile, US stock futures stayed steady.

China’s top tech giant, Tencent (HK:0700), will release earnings on Wednesday, followed by Alibaba (NYSE:BABA) on Thursday. These results could show how the two key firms are handling geopolitical challenges and whether Chinese tech stocks might continue their recovery.

Australia’s wages grew more than expected in the first quarter, reflecting a tight job market boosted by increased public-sector hiring

Economic Data Releases

From a data standpoint, it is not a busy day with limited data release. However, the following events could still stoke volatility while the overarching trade deal narrative remains firmly in play.

- Germany, Spain report final CPI figures for April

- Europe earnings: Burberry Group full year, ABN Amro Bank Q1

- Bank of England Governor Andrew Bailey speaks in Amsterdam

- Fed Bank of New York Q1 report on household debt and credit

- Fed Vice Chair Philip Jefferson speaks on the economic outlook at a virtual conference

- OPEC Monthly Report (Tentative)

- EIA crude oil inventories

Chart of the Day - DXY

The US Dollar Index (DXY) rally appears to be fizzling out after the index rallied to a 1-month high on Monday.

Yesterday saw a bearish engulfing candle close on the daily timeframe, with the index slightly down during Asian trade.

The market’s reaction since Monday suggests significant bearish appetite for the US Dollar with yesterday’s lower-than-expected inflation print unlikely to help.

The grind higher, when looked at in comparison to the decline, also suggests that bearish interest remains strong.

If the DXY is to maintain its current uptrend and extend its recovery, a hold above the psychological 100.00 handle may be key.

For now, though, immediate support rests at 100.61 and 100.00 before the 99.57 handle comes into focus.

A bullish continuation may bring recent highs around 102.00 back into focus before the 102.16 and 102.64 handle become areas of concern.

US Dollar Index (DXY) Daily Chart, May 14, 2025

Source: TradingView.com