IonQ CRO Alameddine Rima sells $4.6m in shares

- The EUR/USD pair struggles near 1.1050 amid upbeat US data and declining inflation in Europe.

- Traders brace for volatility ahead of crucial US employment data impacting rate expectations.

- A potential policy divergence between the Fed and ECB may signal further declines for the euro.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

The EUR/USD pair remains under pressure, hovering just below 1.1050 during Thursday's European session as it tests three-week lows. Traders are on edge as a confluence of factors impacts the currency pair, leading to heightened volatility.

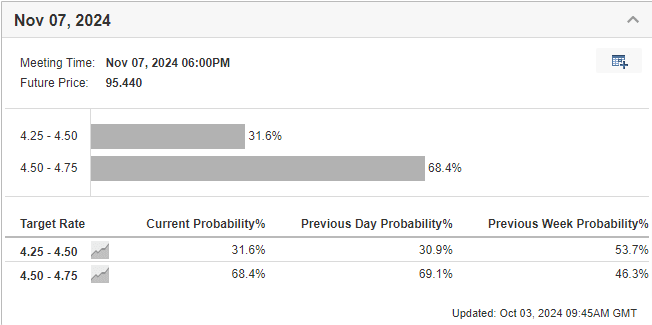

Recent strength in the US Dollar plays a significant role, stemming from diminishing expectations for large Federal Reserve rate cuts and escalating tensions in the Middle East.

On the flip side, growing speculation around a potential 50 basis point rate cut by the European Central Bank in October has weighed on the euro.

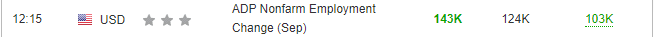

The strong ADP data released yesterday in the US showed that the labor market remains resilient. This may cause the Fed to consider a smaller cut in November.

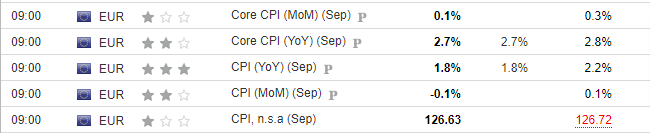

Meanwhile, The euro is weakening after lower-than-expected inflation data for September brings the official headline rate of inflation in the eurozone to 1.8%, the first time it has fallen below the European Central Bank’s (ECB) target of 2.0% in 39 months.

This data raises the likelihood that the ECB will adopt a more aggressive approach to cutting interest rates, which could further weigh on the euro by discouraging foreign capital inflows.

Such a move might also heighten the chances of a another cut by the ECB, potentially leading to a more pronounced divergence in monetary policy compared to the Fed in the days ahead.

US Data Boosts US Dollar

Recent US data strengthens the narrative that the Federal Reserve may adopt a more gradual approach to interest rate cuts, particularly as the labor market remains robust.

This shift has already started to reflect in the upward movement of the DXY. However, tomorrow's employment data will be crucial for shaping expectations and influencing market pricing.

Currently, downward pressure persists on the EUR/USD pair.

How to Trade the EUR/USD?

The euro dipped as low as 1.103 against the dollar amid the ongoing downward trend this week.

Should tomorrow’s employment data come in strong, we could see the dollar continue its recovery, prompting EUR/USD to test the support level around 1.099.

A double top pattern has formed on the EUR/USD daily chart during the August-September period. If the pair dips below 1.10, it may trigger a decline toward 1.07.

Additionally, falling below the ECB's inflation target has paved the way for a quicker rate cut by the central bank. This potential policy divergence is another key factor that could contribute to further declines in the EUR/USD pair.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.