Oklo stock tumbles as Financial Times scrutinizes valuation

The economic calendar is full of key data from the US this week, which should make for a volatile week for all the major pairs. But the fact we also have an interest rate decision from the ECB to look forward to means the EUR/USD will be among the more active pairs, making it the currency pair of the week to watch.

What’s Next for Dollar After Rising for 8 Consecutive Weeks?

The Dollar Index (DXY) rose for the eighth consecutive week, closing above 105.00 on Friday. But the rally in the yen on Monday on the back of hawkish comments from BOJ Governor Ueda, who said that the BoJ could have sufficient data by the end of the year to determine whether rates should stay negative or not, caused the Dollar Index to move back below the 105.00 level. By Tuesday morning, however, the DXY was bouncing back, thanks to renewed weakness in pairs such as EUR/USD and GBP/USD.

Without a significant change in the current macro backdrop, the dollar continues to find buyers on the dips. The greenback has been supported in recent weeks by US data continuing to surprise to the upside, while weakness in foreign data and currencies also helped to provide indirect support. We had better-than-expected ISM services PMI and weekly jobless claims data last week, putting some doubts over the narrative that the labor market tightness was easing.

Eurozone and Chinese data, in particular, have been rather weak, and correspondingly we have seen the euro and yuan slump against the dollar. But there was some relief for the yuan on Monday as the PBOC set the daily fixing stronger and by a record margin while also delivering a verbal intervention to correct one-sided moves in the market. It remains to be seen, however whether the latest efforts will have any lasting impact. I am doubtful.

US CPI Expected to Accelerate

Investors’ focus will turn to Wednesday’s publication of CPI and other key US data due to be released later this week. The inflation data could influence the Fed’s decision whether to hike further or not. The market appears convinced that the hiking is done.

But thanks to the resilience of the US economy, traders are expecting interest rates to remain at current levels longer than they had previously been expecting. This is what has helped to keep the dollar underpinned in recent weeks.

Judging by what economists are expecting from the latest CPI report, i.e., an acceleration to +3.6% y/y from +3.2% in the previous month, the dollar could remain supported for a while yet. If inflation data turns out to be even stronger, then this could push the EUR/USD below the 1.07 handle decidedly.

ECB Policy Decision Looms

While the upcoming US inflation data will probably provide the same directional bias for all the major pairs, the EUR/USD will be facing an additional test from Thursday’s ECB meeting, which could move the euro sharply.

The single currency has come under pressure of late, owing to growth concerns both over the Eurozone and China, with the latter being one of the largest export destinations for European goods.

Data after data has disappointed, with Eurozone GDP being revised lower last week and a number of German indicators all missing the mark. The probability of a final rate hike at this ECB meeting has fallen sharply. The key risk now is if the ECB hikes anyway, which should send the euro spiking higher – even if temporarily.

EUR/USD: Key Data to Watch this Week

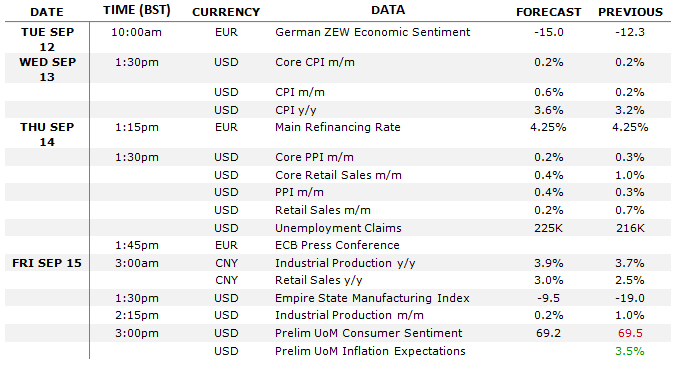

As well as the upcoming US CPI report and ECB rate decision, this week’s economic calendar is full of key data from the US, which should make for a volatile week for all the major pairs. Here are the key data highlights relevant to the EUR/USD this week:

You will notice that I have intentionally left the Chinese data in the calendar as well. This is because Chinese data tends to impact the EUR as Beijing is a key trading partner of the Eurozone.

EUR/USD: Technical Analysis

The lower highs and lower lows on the EUR/USD mean that the technical outlook remains bearish until the charts tell us otherwise. Key resistance is around the 1.0765-75 area, which was previously supported.

Even if the EUR/USD rises a little more than that zone, this won’t necessarily be the end of the bearish trend. The bulls will still be eying a higher high above 1.0945 for confirmation. On the downside, the next major target for the bears is liquidity below the May 2023 low of 1.0635.

Source:TradingView.com