TSX jumps amid Fed rate cut hopes, ongoing U.S. government shutdown

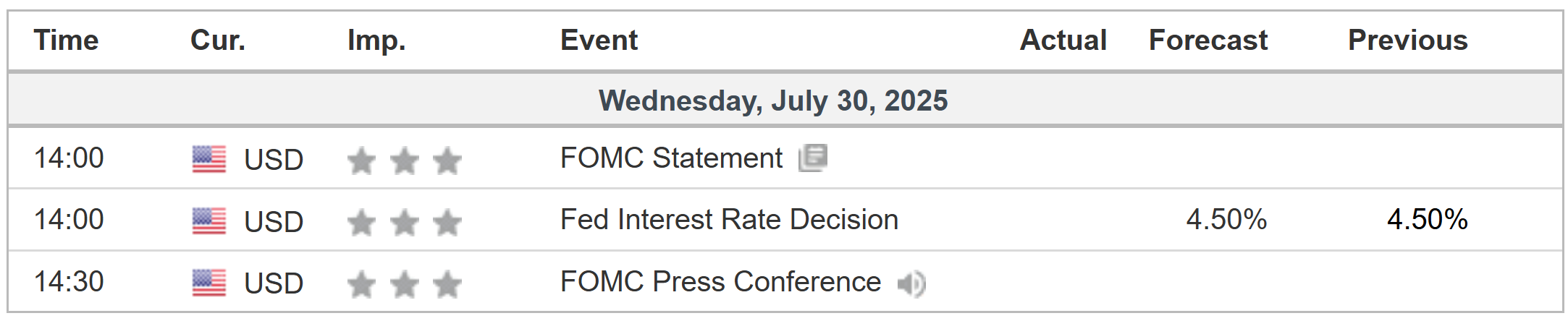

- The Fed’s July FOMC meeting concludes on Wednesday at 2:00 PM ET.

- The US central bank is forecast to hold interest rates steady for a fifth consecutive meeting.

- The real intrigue lies in Chair Jerome Powell’s post-meeting press conference, where even a subtle shift in tone could send shockwaves through equities and bonds.

- Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners for up 50% off amid the summer sale!

The Federal Reserve’s July Federal Open Market Committee (FOMC) meeting arrives at a pivotal time, as markets, policymakers, and the White House all look for signals on the Fed’s next move. Expectations are nearly unanimous: the US central bank will hold the federal funds rate steady at 4.25%–4.50% for a fifth consecutive meeting.

Source: Investing.com

However, the market’s real focus is whether Powell will crack the door open to a September rate cut, especially as recent inflation data turned softer than anticipated. Historically, Powell has signalled upcoming policy moves with careful wording rather than outright promises, so investors will be parsing every phrase for clues.

What to Watch

- Interest Rate Decision (2:00 PM ET): The FOMC is widely expected to hold the federal funds rate steady. Interest rate traders assign a 97% probability to no change, as per the Investing.com Fed Monitor Tool.

- FOMC Statement (2:00 PM ET): Analysts expect the statement to maintain that labor market conditions are “solid” but may drop previous language about “diminished” risks to reflect heightened economic uncertainty. References to inflation progress and whether the Fed views it as “resuming its decline” could be noteworthy.

- Dissent Watch: Governors Christopher Waller and Michelle Bowman are likely to dissent in favor of a rate cut, which would be an unusual split for a “hold” decision and may itself move markets.

- Powell’s Press Conference (2:30 PM ET): Powell will be asked what would give the committee the "greater confidence" it needs to cut rates. His answer will be telling. If he lays out a clear, achievable path (e.g., a few more reports showing inflation around 0.2% month-over-month), it will be seen as a green light for September. If his answer is vague and open-ended, it will dampen hopes.

- Political Pressure: With President Trump and other officials calling for faster rate cuts, Powell is expected to depoliticize the discussion and reiterate the Fed’s independence, focusing on the committee’s longstanding objectives and scenario-based approach.

September Cut Hint

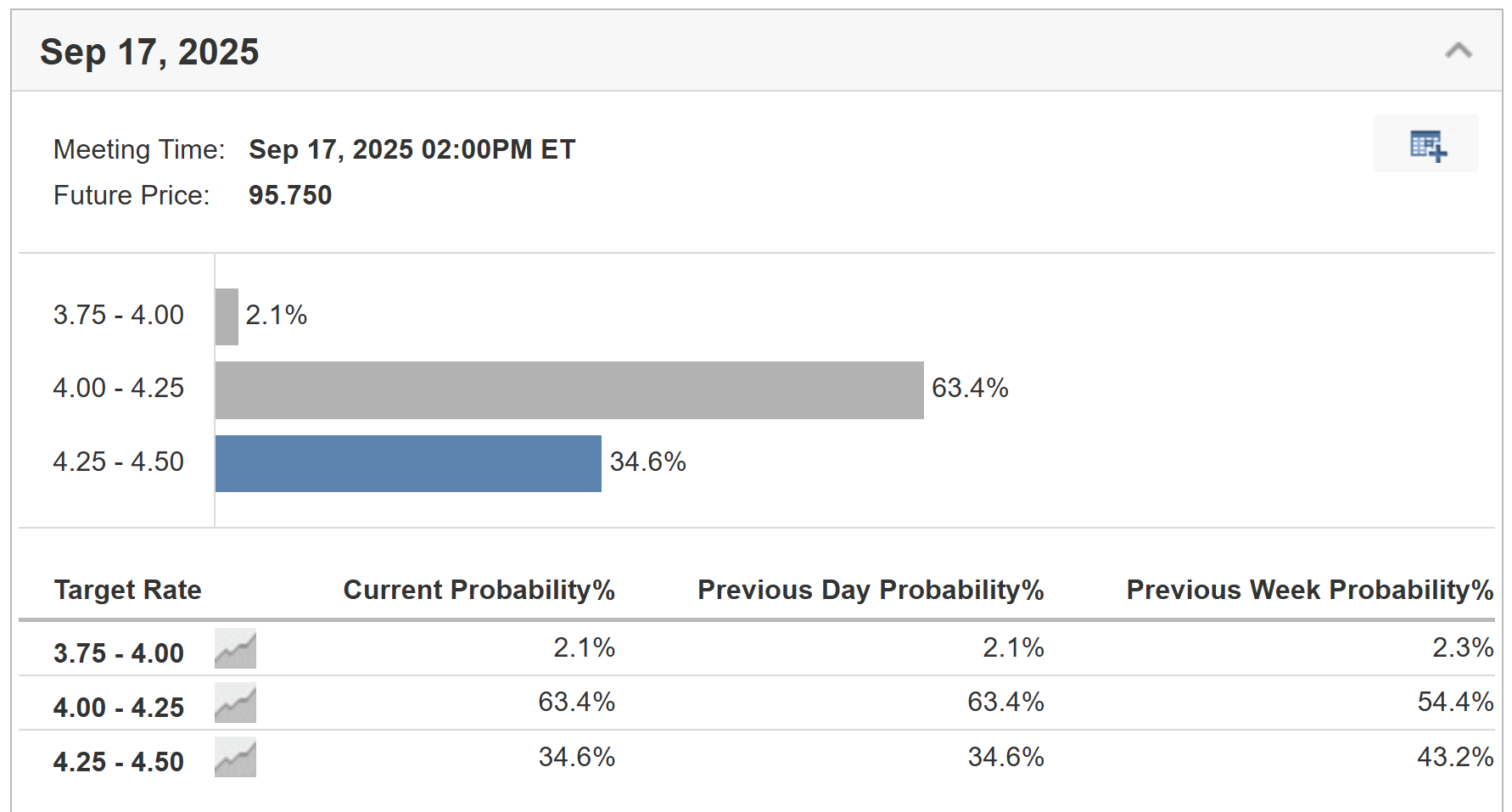

The probability of a September cut is rising on Wall Street’s radar and currently stands at about 65%. While Powell is unlikely to explicitly commit to September, he could drop subtle hints that the Fed is moving closer to easing policy.

Source: Investing.com

Pay close attention to his characterization of the current policy rate. Does he continue to call it "restrictive" or does he lean towards "sufficiently restrictive"? The latter implies the work is done and the Fed is just waiting for the right moment to ease.

Market Implications

- Equities: A dovish hint from Powell about September could boost equity markets, particularly rate-sensitive sectors like tech and consumer discretionary, while a steady rate decision with vague or neutral forward guidance could lead to choppy trading, as markets dislike indecision.

- US Dollar: A pause is largely priced in, so the USD may remain neutral unless Powell delivers a hawkish surprise. A dovish signal could weaken the dollar as September cut expectations strengthen.

- Bonds: Treasury yields may hold steady unless Powell’s comments shift expectations for future rates. Any hint of prolonged high rates could push yields higher.

Bottom Line

Expect Powell to keep his cards close but acknowledge the softening inflation trend—likely teeing up September as a “live” meeting for a cut. If he does, risk assets could jump; if not, expect heightened volatility as traders recalibrate.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now and save 50% on all Pro plans and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.