These stocks have the greatest “leverage” to rising gold prices: BofA

- Stocks are tanking as markets price in higher for longer scenario

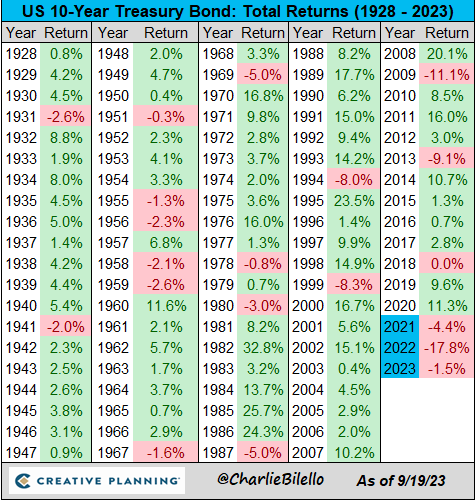

- Meanwhile, bonds have declined for 2 years in a row and are on track for a third bearish year

- As economic weakness sets in eventually and rates peak, bonds may become attractive

With all eyes fixated on the recent stock market decline in the aftermath of the Federal Reserve's indication that it will keep interest rates higher for longer, there's another facet of the financial landscape certainly worth investors' consideration.

Over the last few years, bonds have weathered their fair share of challenges, experiencing a notable multi-year period of lower yields, mostly on the back of net-zero interest rates in most developed economies.

However, as yields stay stubbornly high as a consequence of the current macroeconomic picture, and as the stock market landscape appears to grow more uncertain, these seemingly overlooked assets might just reemerge as an attractive option for investors seeking the assurance of secure, long-term returns once more.

Source: Charlie Bilello

We're now entering the third year of a bear market in bonds, as seen in the chart above. But, conditions might be getting more favorable. There are several reasons for this, including:

- The economy weakening in the long-term: A broad economic slowdown is likely to hit the US and Europe in 2024. (bonds have historically performed well in such situations).

- Inflation slowing down despite the recent rebound: The ECB seems to have already reached a turning point, and the Fed has vowed to keep rates higher for longer. We will hardly see rates move much higher from here.

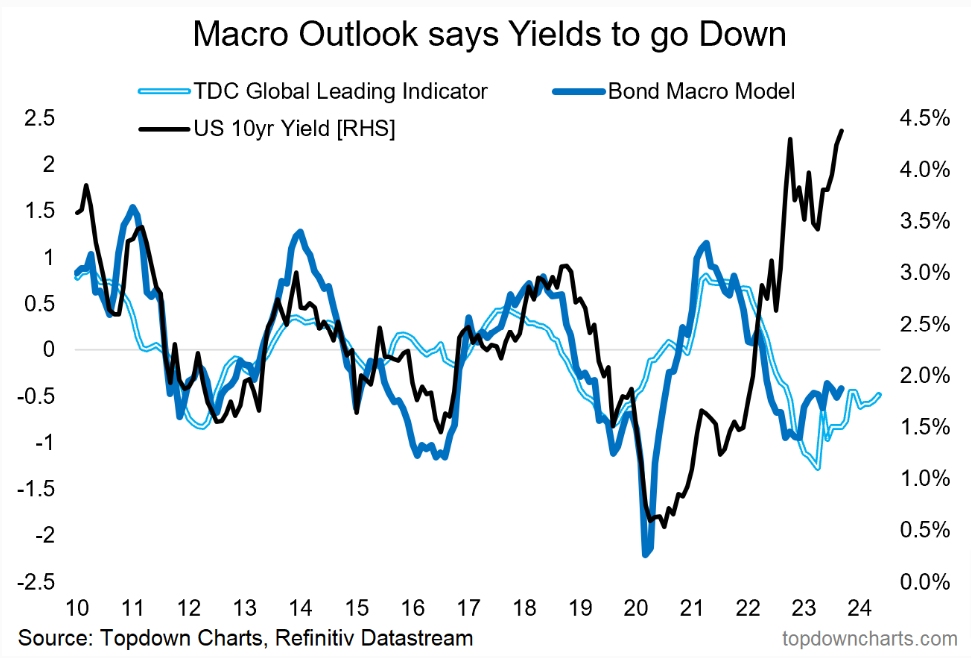

Source: Topdown Charts, Refinitiv

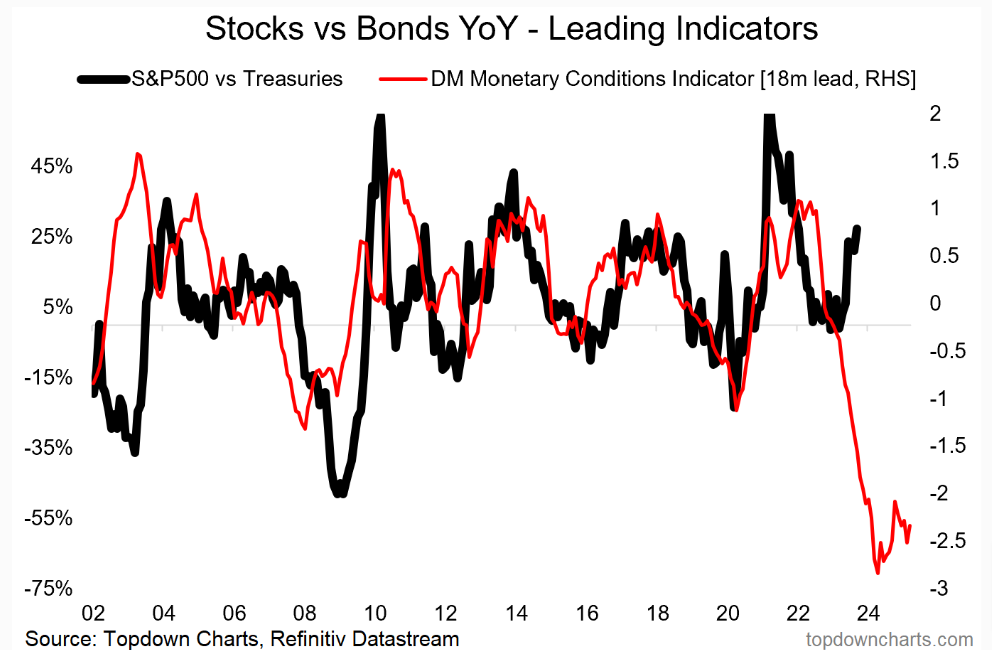

Source: Topdown Charts, Refinitiv

It's worth noting that there's a noticeable disconnect in both macroeconomic scenarios and relative valuations when we compare bonds to the stock market right now. Usually, such divergences tend to self-correct, at least to some extent, with time.

Now, that doesn't mean you should be in a hurry to buy 50-year duration bonds. Instead, it suggests a prudent approach of considering the extension of bond durations within your investment portfolio, particularly if you have a long-term perspective. Targeting bond durations falling within the range of 8 to 13 years could potentially align your portfolio with these evolving market dynamics.

When you look back in history, the current valuations are quite intriguing, which could make balanced portfolios quite attractive once again.

Bottom Line

Given the looming possibility of an extended phase of elevated interest rates, it's advisable for investors to review their investment strategies carefully. Bonds, traditionally regarded as a conservative option, could reestablish themselves as a symbol of dependability and stability in a global economy marked by persistent uncertainties. A fundamental principle of successful investing involves not just foreseeing market shifts but also adjusting to them.

Bonds, notwithstanding recent challenges, may once again become a cornerstone of a diversified and robust investment portfolio, offering both peace of mind and the prospect of sustained financial security over the long haul.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author does not own the stocks mentioned in the analysis.