UnitedHealth tests AI system to streamline medical claims processing - Bloomberg

- Reports Q1 2022 results on Tuesday, Sept. 21, after the close

- Revenue expectation: $21.9 billion

- EPS expectation: $4.94

The COVID-fueled party may just be over for FedEx (NYSE:FDX). After an unexpected surge in demand for its delivery services during the pandemic, the freight and logistics giant is now struggling to control costs and hire workers.

These challenges are likely to hurt the bottom-line of the Memphis, Tennessee-based parcel carrier when it reports its fiscal 2022, first quarter earnings tomorrow. Sales will likely decline to $21.9 billion from $22.6 billion in the previous period, according to analysts consensus estimates. The per share adjusted profit will also fall to $4.94 from $5.01.

These subdued expectations have hurt the shares of the transportation colossus. The stock is down more than 20% since the June high of $319.90. It closed on Friday at $255.22.

Investors turned bullish on FedEx early this year, encouraged by growing demand for the company’s delivery services during the pandemic when shoppers switched to e-commerce during lockdowns and an overall stay-at-home environment.

The company's business restructuring—which had been planned before the pandemic—proved to be a great launching pad for FedEx in this new environment. Before COVID-19 spread across the globe, the company had already moved to a seven-day service model, expanded capacity for larger packages, introduced new routing software, and began pushing more Express packages into its lower-cost Ground network.

Those changes helped FedEx increase profit on a flood of residential packages while its more lucrative business delivery service suffered during the US lockdown. Going forward, the big challenge for the company is to contain its costs in an environment where inflation and worker shortages are hurting many businesses.

Long-Term Appeal Remains Intact

FedEx told investors in June that its capital spending will rise more than 20% during its fiscal 2022. Still, many analysts believe that FedEx is a long-term buy due to the continuing expansion of online shopping. UBS, while cutting its earnings estimate for FedEx, said in a note to clients on Friday that labor market issues are likely hurting the company’s profitability.

According to the note, carried by CNBC.com:

“Visibility to the path forward on margin performance is limited at the present time as it is not clear how much of the 1Q issues will remain as a headwind looking forward.”

UBS cut its price target on FedEx to $380 per share from $397, but kept its buy rating on the stock. UBS added the start-up costs for a new hub in California are temporary, but it was unclear when earnings would recover.

JPMorgan, while maintaining its overweight rating on the stock, said in a recent note that FedEX is a multiyear growth story in the transportation sector, with the company’s Ground division leading the gains. The note added:

“After a string of earnings disappointments, the fundamental momentum in each segment combined with well-timed strategic initiatives creates the most attractive multi-year growth story in transports.”

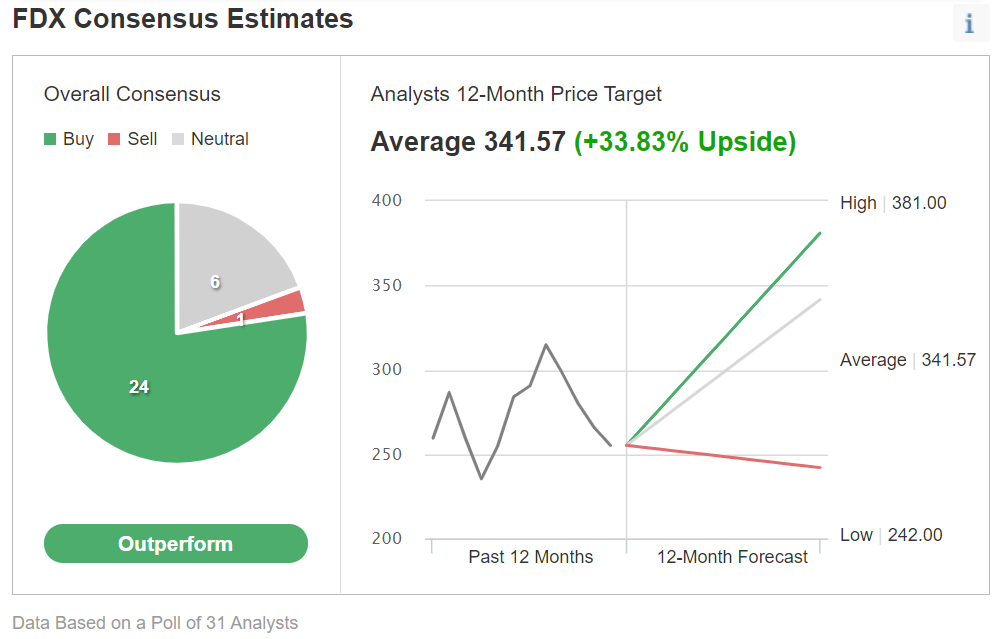

Of 31 analysts covering the stock for Investing.com, 24 have given it an “Outperform” rating.

Chart: Investing.com

The consensus price estimate among analysts polled is $341.57—a 33% upside potential target from Friday's closing price.

Bottom Line

FedEx is facing temporary cost escalations as the delivery giant expands to cater to growing e-commerce demand. But the macro trends are in favor of the business, making its stock a long-term buy after the current spell of weakness.

Tuesday’s earnings report will likely prove that point.