Top U.S. Defense Stocks to Watch According to Jefferies Analysis

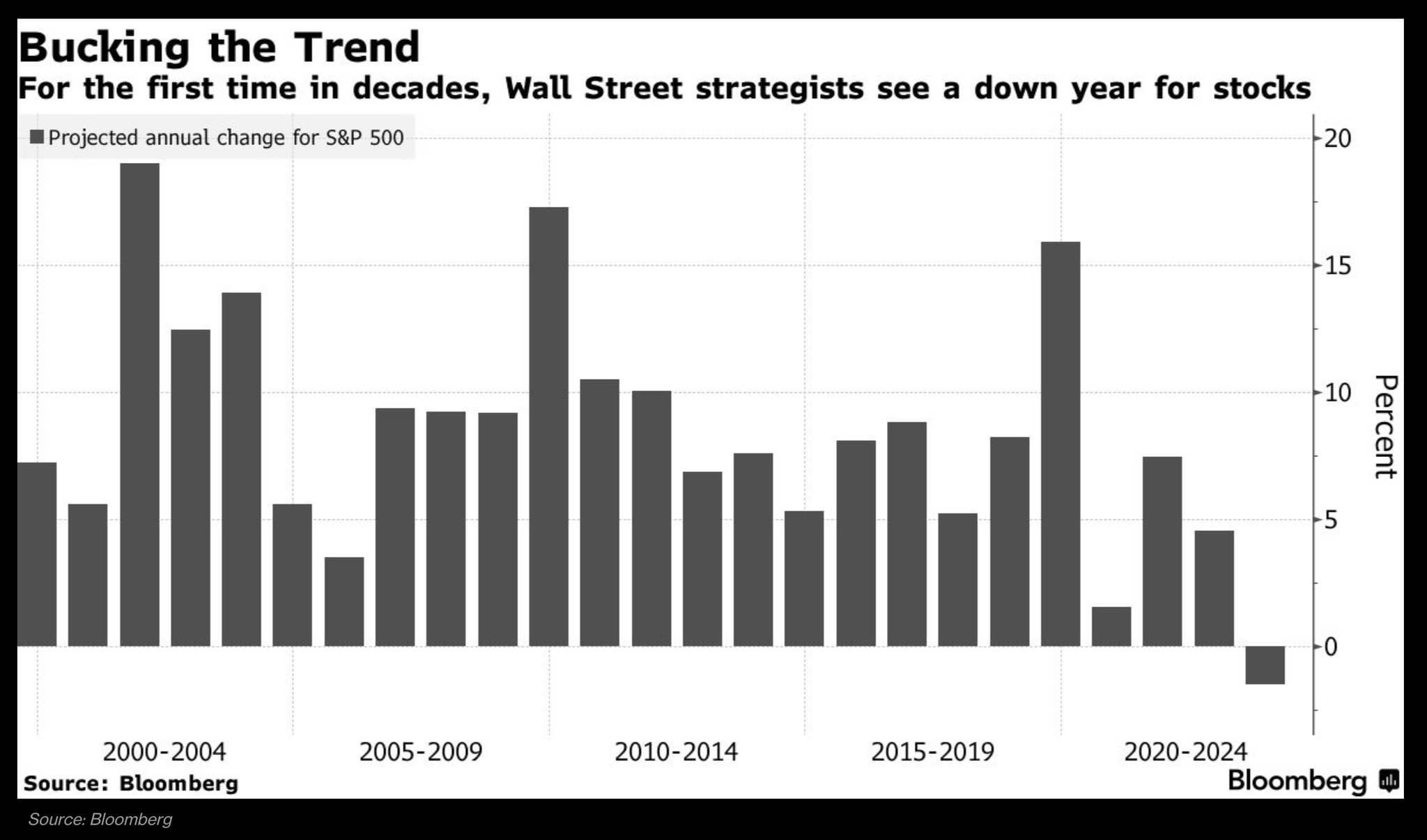

- Professional strategists have issued their 2023 S&P 500 year-end targets, and the consensus is dour

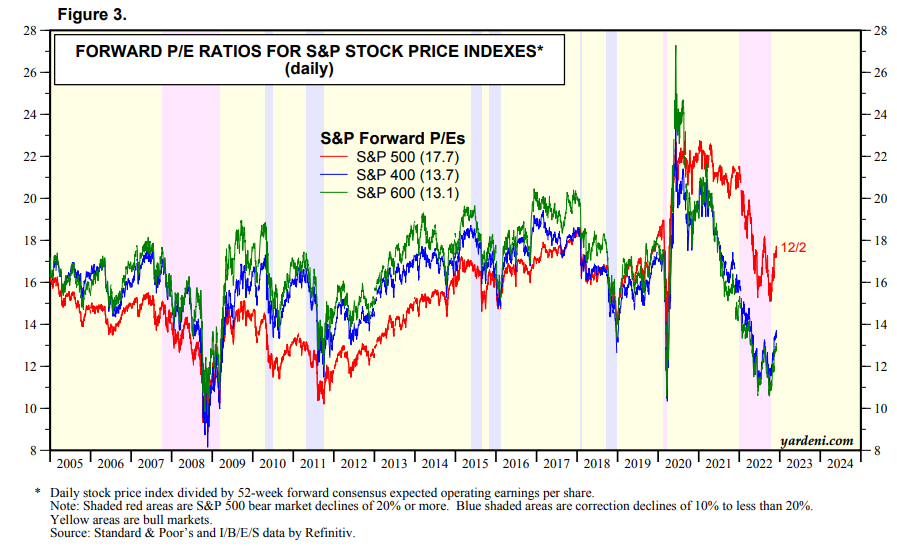

- With the SPX trading near 18-time next year’s EPS forecast, it is hard to call U.S. large caps a bargain

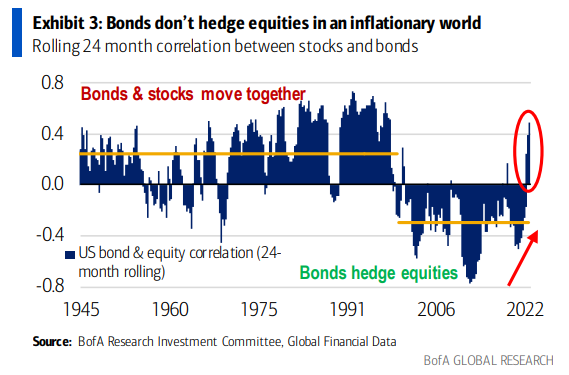

- Bonds, while positively correlated with stocks, could still help weather equity volatility ahead

It’s that time of year on Wall Street. All of the sell-side macro outlooks are arriving in our inboxes. Various sector-weight recommendations and year-end S&P 500 price targets are worth their weight in coal (in my cynical opinion). While I find sell-side research very valuable for charts and identifying important risks, my guess is as good as theirs in terms of where markets will venture in the coming months.

What’s unusual about this go-around, though, is that for the first time since at least 1999, the average strategist’s S&P 500 forecast for the end of the upcoming year is negative. We usually don’t see that much pessimism on the street. The obvious response is to figure out why the smartest folks in the industry see lower prices ahead and not the standard fare annual returns of 8% to 10%.

A Gloomy Crowd Calling for Lower Stocks in 2023

Source: Bloomberg

To me, with the S&P 500 now trading about 18 times 2023 forecast earnings per share and a possible first-half economic contraction, that valuation is steep. To be fair, back at the October 13 low in stocks, a 16-forward multiple might have seemed more reasonable.

Large Caps Are Pricey, SMIDs Still Look Cheap

Source: Yardeni Research

Even then, though, with high-grade corporate bonds yielding above 5.8%, up more than 350 basis points from a year earlier, a 16 P/E did not seem all that cheap either. It’s important to understand that the discount rate applied to future corporate profits is often a weighted-average cost of capital that includes debt, equity, and (to a lesser extent) the yield of preferred shares.

The yield on investment-grade corporate bonds is a good proxy of the debt piece in many instances. So, by basic math, when discounting future cash flows, an 18 P/E on U.S. large caps with intermediate-term corporate debt rates still above 5%, the S&P 500 does not appear to be a big bargain in my eye.

Also concerning on the investment front, as we head into 2023, is the reality that bonds are not hedging stocks anymore. For about 25 years, when stocks zigged, bonds zagged, helping to reduce the overall volatility of a classic 60/40 stock/bond portfolio. In the last several quarters, however, the correlation has flipped positive.

Here’s where I have some good news when assessing yields today; even though equities and Treasuries might be positively correlated, that doesn’t mean you should dismiss bonds. Think of it like this: If your stock allocation is down 20% in the next year, but your fixed-income sleeve is down 1%, the two are technically positively correlated, but bonds indeed helped you weather the equity storm. With positive real yields across the term structure of Treasuries, I assert they still have a place for risk-conscious investors.

Stocks & Bonds Moving Together in 2022

Source: Bank of America Global Research

The Bottom Line

While not any more valuable than your guess, I happen to agree with Wall Street forecasters’ somewhat bleak view of where the S&P 500 will be at the end of 2023. There’s still opportunity, though. Bonds should offer better real returns and if we see the usual earnings recovery in 2024, the next 12 months should feature some very attractive long-term entry points for equity investors.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.