Gold prices hover near 6-week high amid softer dollar, Fed rate cut bets

This article was written exclusively for Investing.com

- Copper digesting and consolidating its move to an all-time high last May

- Long-term trend remains bullish

- Fundamentals and technicals agree

- FCX: leading global copper producer

- Lots of room for FCX to rally

According to analysts at Goldman Sachs, copper is the new crude oil, the commodity that will power the world over the coming years. The red metal, a building block of the worldwide infrastructure, is a critical component in alternative and renewable energy initiatives, opening a new demand vertical for the base metal.

As well, copper is the leader of the nonferrous metal sector. As such, the prices of aluminum, nickel, lead, zinc, and tin follow the red metal higher and lower. Most other base metals are also critical inputs for a greener path to energy production and consumption.

Many market participants refer to the nonferrous metal as Doctor Copper since it has a history of 'diagnosing' the global economy’s health and wellbeing. The state of emerging demand for the red metal raises copper’s profile as a barometer for global growth or contraction.

Freeport-McMoran Copper & Gold (NYSE:FCX) is one of the world’s leading copper-producing companies. FCX shares reached a bottom during March 2020 as the shares traded to a low of $4.82 when the global pandemic caused selling across all asset classes.

At around $42.45 per share as of Monday's close, FCX was nearly nine times higher, with lots of upside potential in the coming years.

Copper digesting and consolidating its move to an all-time high last May

Before 2021, the all-time high in copper occurred in 2011 when the price of nearby COMEX futures peaked at $4.6495 per pound eclipsing the 2008 $4.2160 high. Before 2005, COMEX copper futures never traded above the $1.61 level.

Source: CQG

The weekly chart highlights the pattern of lower highs and higher lows since copper futures traded to a new all-time peak of $4.8985 per pound in May 2021. Since then, the price has corrected and has been consolidating. Aside from a one-day move in August 2021, where the nonferrous metal probed below the $4 per pound level, the price has remained above that round number.

The weekly chart reflects the development of a wedge pattern since August 2021, suggesting that a breakout to the up- or down-side is on the horizon as the range of prices narrows. Wedge patterns are like tightly coiled springs in markets—they often give way to substantial price moves.

Long-term trend remains bullish

Copper futures have been on a bullish path since 2001.

Source: CQG

The quarterly chart highlights that copper futures reached a bottom in 2001 at 60.50 cents per pound. The pattern of higher lows and higher highs remains intact as of February 2022, with the first level of critical technical support at the March 2020 low at $2.0595 per pound, less than half the current price.

Fundamentals and technicals agree

While the technical picture remains bullish, supply and demand fundamentals suggest that copper’s path of least resistance continues to be higher, with new all-time peaks on the horizon over the coming months and years.

The most significant fundamental factors supporting copper are:

- Copper is a critical metal for decarbonization as EVs, wind turbines and other green energy initiatives require increasing amounts of the metal.

- It takes eight to ten years to bring new copper production online. As the demand rises, supplies will struggle to keep pace.

- Rising inflationary pressures are causing fiat currencies to lose value, which is bullish for all commodity prices, and copper is no exception.

- Copper is a critical industrial metal and an infrastructure building block. The US infrastructure rebuilding program and Chinese growth will increase the requirements for red metal supply.

When fundamental and technical factors align, it creates a potent bullish cocktail for a commodity. Bull markets tend to take prices to levels that defy logic, reason, even rational analysis. The world’s leading copper producers are positioned to profit from higher prices over the coming years.

FCX: leading global copper producer

Freeport-McMoRan is one of the top mining companies in the world.

Source: Visual Capitalist

The chart shows FCX was the sixth leading mining company by market cap as of August 2021.

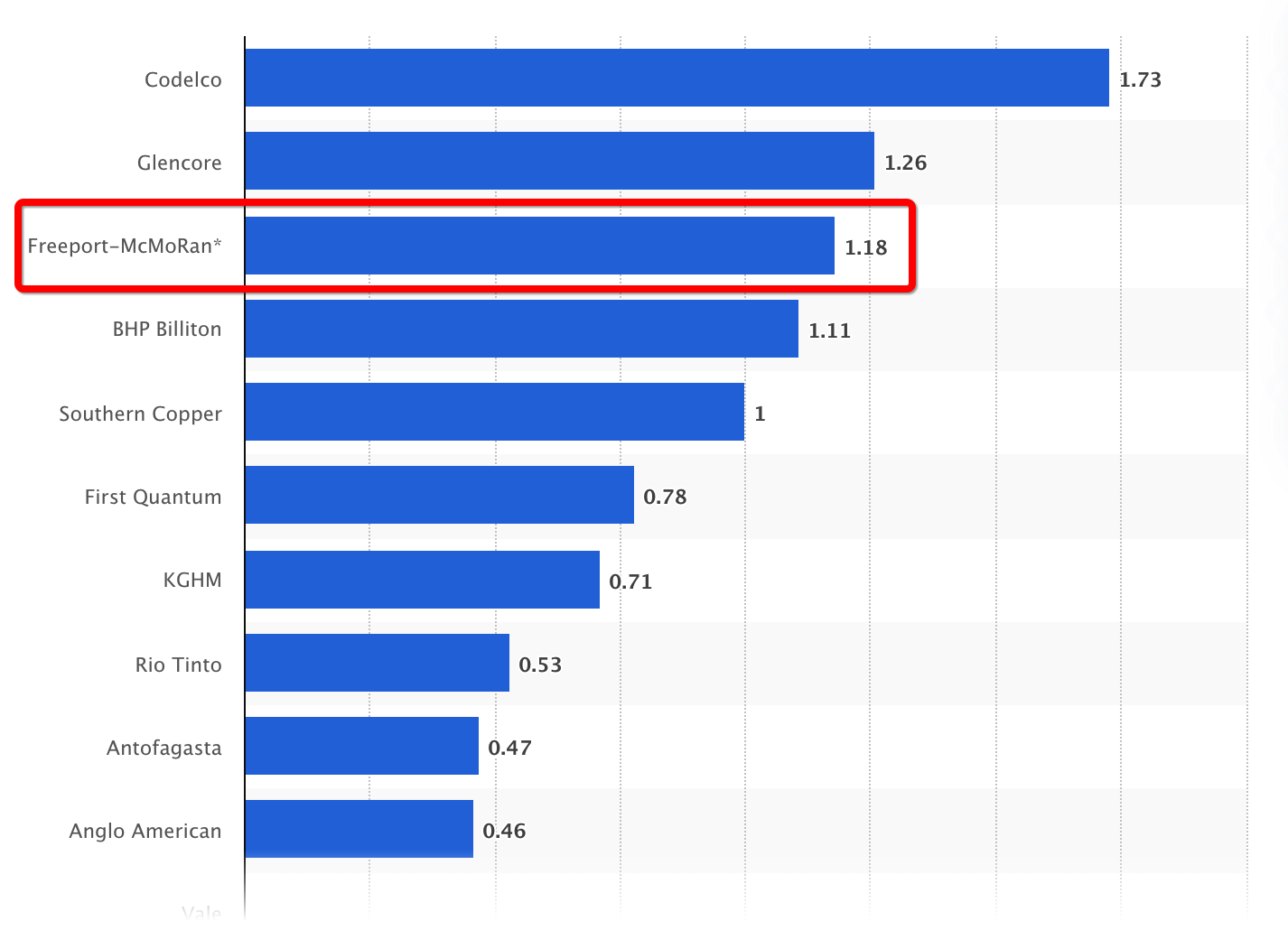

Source: Statista

In 2020, FCX was the world’s third leading copper producer, behind state-owned Chilean copper mining giant Codelco and Glencore (OTC:GLNCY). FCX produced more copper than BHP Billiton (NYSE:BHP), Southern Copper (NYSE:SCCO), and Rio Tinto (NYSE:RIO).

FCX’s mining properties include the Grasberg district in Indonesia and significant mining properties in North and South America.

Lots of room for FCX to rally

While FCX shares soared from the March 2020 $4.82 low to $42.45 on Feb. 14, there remains lots of upside for the stock.

Source: Barchart

The monthly chart, above, created before the close on Feb. 14, illustrates the next technical target for Freeport-McMoRan, which stands at $61.34, the January 2011 high. Above there, the 2008 all-time peak was at $63.62, 49% above the current price level.

Copper prices continue to trend higher, which is bullish for FCX and other copper-producing companies.

For investors looking to hedge against inflationary pressures and take advantage of the greener energy path over the coming years, FCX is a good core portfolio holding. Those market participants who believe copper is heading higher should embrace FCX, a global leader in red metal production.