Gold prices dip as December rate cut bets wane; economic data in focus

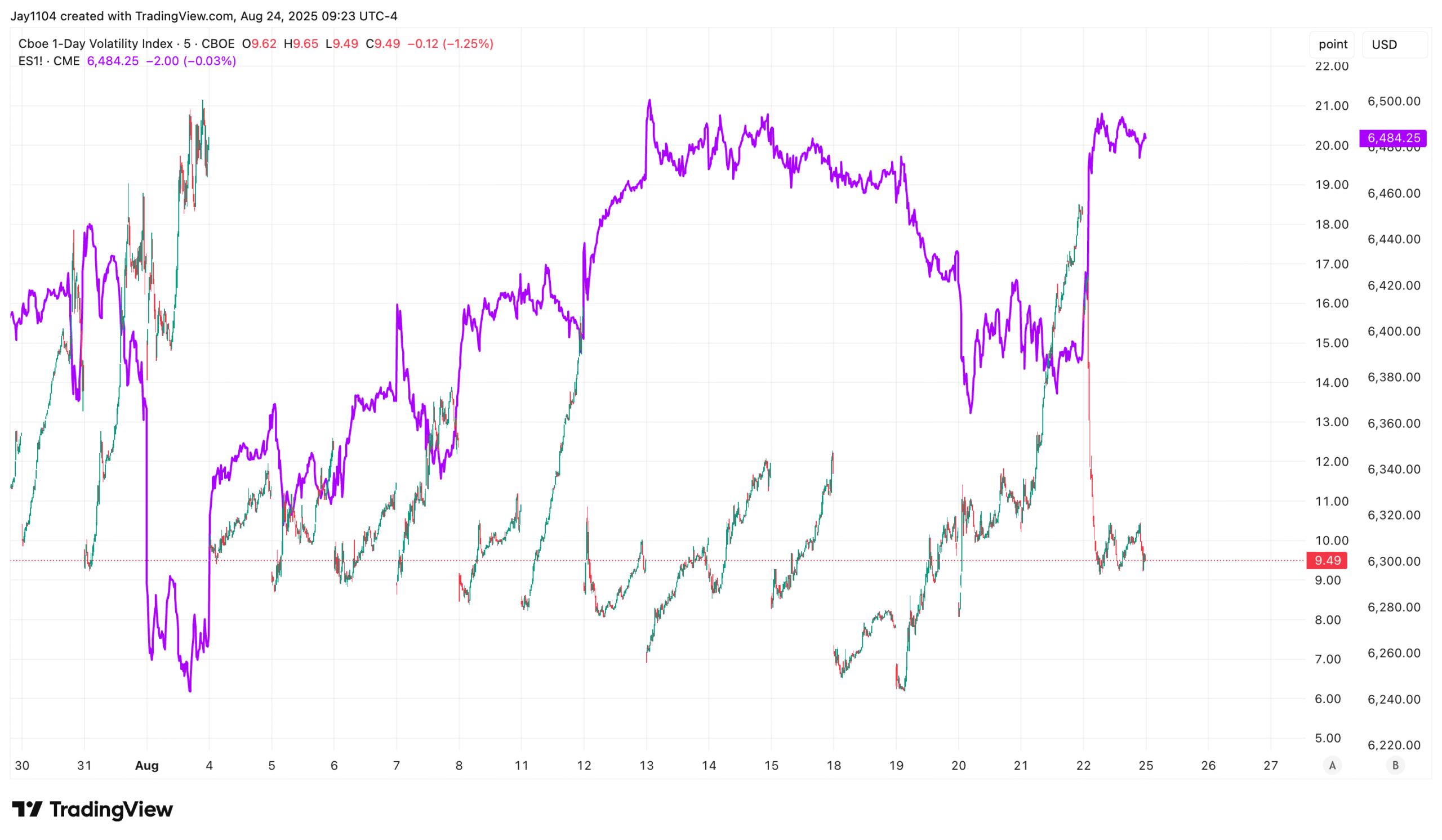

I think it’s important to remember that stocks, bonds, and FX all have a volatility component, and they behave in a similar way. When volatility crashes, as it did on Friday, prices go higher. For the stock market, the VIX 1-Day is probably the best gauge to use on an event-by-event basis. The higher the VIX 1-Day climbs, the more likely it is that the S&P 500 will rally once the event has passed.

For example, on Thursday, the VIX 1-Day closed at around 18. That wasn’t especially high, but relative to the prior day, it was elevated enough that, once Jay Powell cleared his throat for the first time, volatility collapsed and pushed the S&P 500 higher.

In the end, it didn’t really matter what Powell said; the event risk had passed. Once volatility returned to its prior range, the rally was over, and the stock market went nowhere.

It was the same story with the CPI report last week, which is why the gains from that report were gone just a few days later. There is a very good chance the same thing will happen this week following Jackson Hole.

No different for bonds—the VXTLT does a good enough job for us. Notice how it also rose into Jackson Hole and then crashed, sending TLT higher and pushing rates lower.

So why did stocks rise and bond yields tank? Most likely because hedges were unwound, or simply because the risk of the event had passed. Whatever the reason, I highly doubt it had much to do with anything Jay Powell actually said. It certainly wasn’t because the Fed abandoned its 2% inflation target. That was probably the most ridiculous thing circulating on social media over the last couple of days.

The 2% average inflation target that everyone on social media was discussing referred to the framework introduced in 2020, where the Fed allowed for overshoots in inflation when it had been running below 2%. That has clearly not been the issue for some time, so the framework was removed. If you’re following someone who claims the Fed scrapped its 2% inflation target, I suggest you unfollow them quickly.

Take the 5 minutes to read the actual statement.

The Fed remains highly data-dependent, and I don’t think Powell’s speech deviated significantly from the tone of the minutes. The only difference was that he left the door open for a September rate cut—only because he had to, given that no one knows how the August jobs data will come in. If it’s a disaster like July, with big downward revisions, the Fed will have no choice but to cut—and that won’t be good news for any risk asset. But I think that was fairly obvious.

In fact, the odds of a September rate cut hardly changed by day’s end. Overnight index swaps showed the implied Fed rate falling only slightly, from 4.14% to 4.13%. So the market doesn’t seem to think the odds of a cut increased by much at all.

One thing that rose on Friday was CPI swaps, with the 1-year rate climbing to 3.35% and the 5-year rate rising to 2.62%.

The 5-year swap is the problem child because it’s approaching the breaking point of its range, and if it does, it’s likely to push long-end Treasury rates out of their trading range as well.

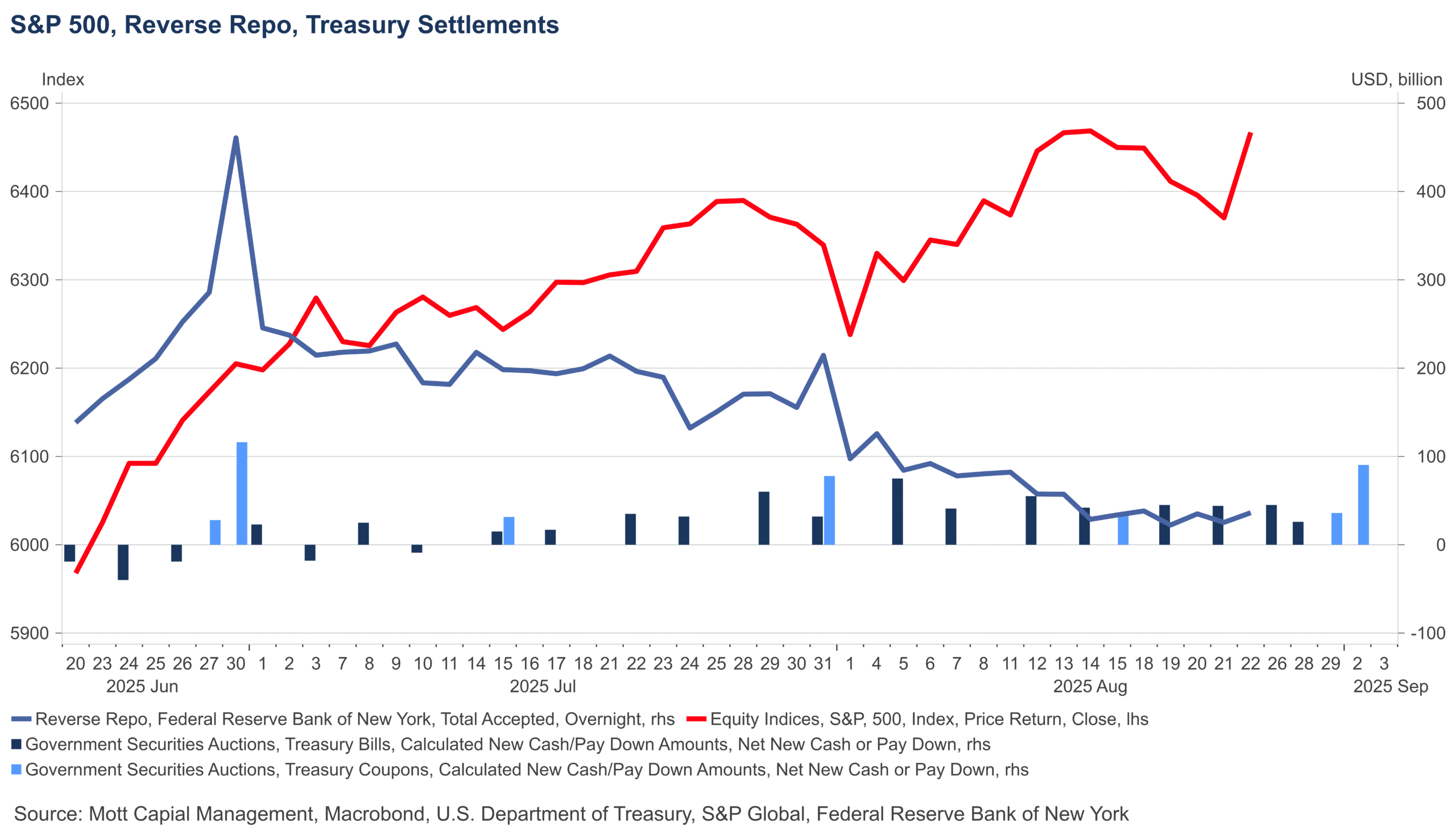

Finally, we have three settlement dates next week: $45 billion on August 26, $26 billion on August 28, and $36 billion on August 29. Then, right after the nice, long Labor Day weekend, we’re greeted with a $90 billion settlement on September 2.