Stellantis Expands EV Charging Access with Tesla Supercharger Network Integration

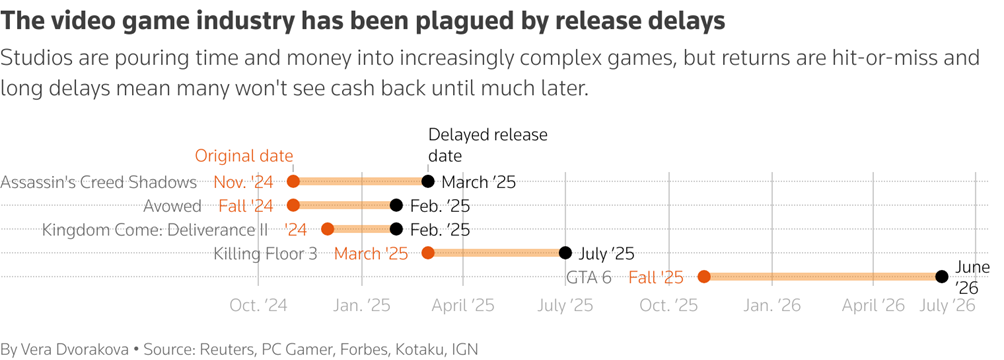

With over eight years in development and an estimated $2 billion budget, GTA VI may be the most ambitious cultural product ever made, and for Take-Two Interactive (NASDAQ:TTWO), the parent company of the game’s publisher, Rockstar Games, the investment seems justified. However, news that the game won’t hit shelves until 26 May 2026 sent Take-Two’s shares tumbling.

Did you know that in 2024, over 3.3 billion people played video games? That’s roughly one in three people on the planet—and the average player is no longer a teenager—but a 36-year-old adult. Gaming has evolved from a kids’ hobby to a multibillion-dollar industry that involves cutting-edge technology.

In fact, the video game sector ($187 billion in 2024 revenues) brings in more money than both the film ($33.9 billion) and music ($28.6 billion) industries combined. Beyond entertainment, it has also become a key driver of technological innovation, with virtual reality, augmented reality, 3D modelling, and motion capture all finding applications in other sectors like healthcare, retail, and education.

Yet, the industry is facing challenges. The gamers’ return to classrooms and offices post-pandemic, project delays, mass layoffs, and studios’ closures, have become increasingly common.

Evergreen Games

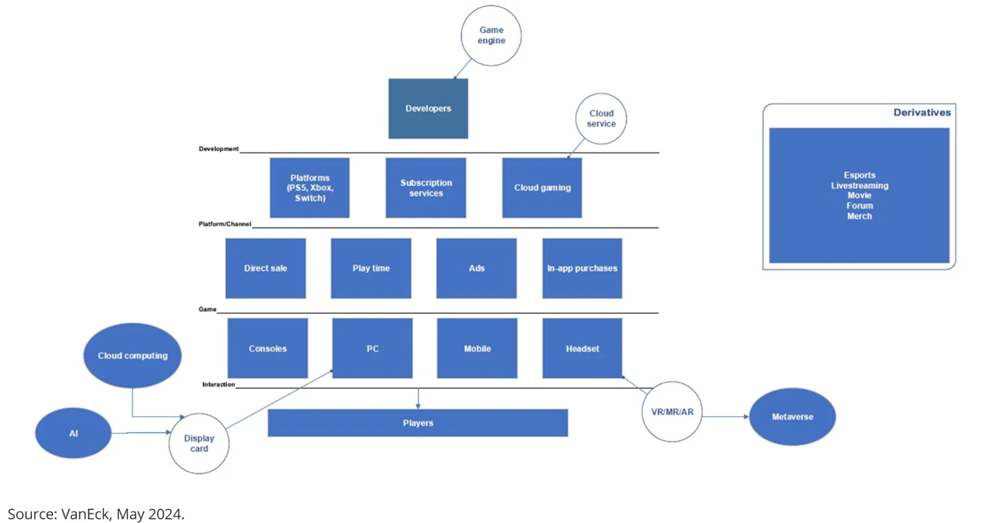

The video gaming industry operates on diverse revenue models that have shifted from traditional one-time purchases to engagement-driven ecosystems. In 2024, the global gaming market generated approximately $187 billion in revenue. Mobile gaming dominates with a 49% market share, primarily through free-to-play models supported by in-app purchases and advertising.

Console gaming generated $51 billion revenue (28% market share) while PC gaming contributed $43 billion (23% market share). On PC platforms, microtransactions have become the dominant revenue source, accounting for 58% of all PC gaming revenue with games like Call of Duty: Black Ops 6, Roblox (NYSE:RBLX), and Fortnite leading this growth.

Traditional premium game sales, while still significant, are declining. Gaming subscription services like Xbox Game Pass and PlayStation Plus, which offer players access to large game libraries for a monthly fee, have shown stagnant growth, suggesting the "Netflix (NASDAQ:NFLX) of gaming" model may not be the industry’s future.

Cloud gaming, which streams games directly to devices without requiring powerful hardware, represents a smaller but rapidly growing segment projected to reach $10.46 billion in 2025 with an expected annual growth rate of 25%.

Over the past decade, the industry has pivoted toward “evergreen” games, designed as “living ecosystems” that evolve continuously through regular content updates, and seasonal events. Success is no longer measured by units sold but by active user metrics, session duration, and long-term participation rates. User-generated content becomes central to this strategy.

Platforms like Grand Theft Auto (GTA), Roblox, Fortnite Creative, and Dreams have turned players from passive consumers into content creators, who design levels, characters, and entire game experiences. Epic Games exemplifies this transformation through Fortnite.

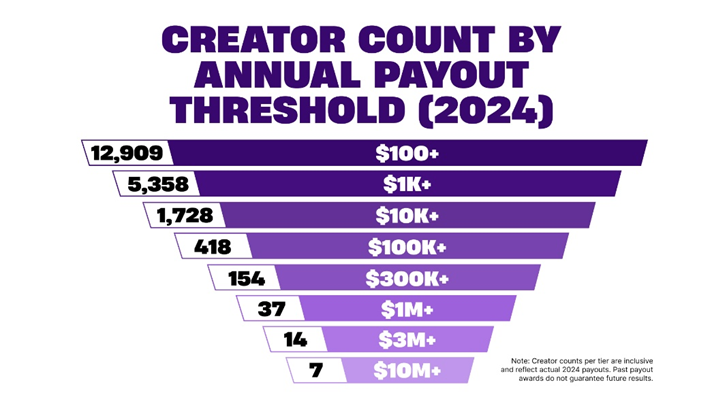

The company paid $352 million to 70,000 creators on Fortnite in 2024. Epic allocates 40% of Fortnite’s monthly net revenue from item shop purchases to eligible creators based on player engagement metrics. 58 creators earned over $1 million.

Source: Fortnite

Virtual concerts, brand partnerships, film premieres, and live streaming sessions have become routine features within these "metaverse-lite" environments. The success has attracted major brands and entertainment figures seeking engagement opportunities.

High-profile collaborations range from luxury fashion partnerships, such as Balenciaga’s in-game collections, to franchises like LEGO providing official assets for creators, to massive entertainment events like Travis Scott’s virtual Fortnite concert, which drew 27 million concurrent viewers.

Source: VanEck

The industry’s confidence in this model is perhaps best illustrated by the upcoming Rockstar Games’ GTA VI, which has garnered unprecedented investment and expectations. With over eight years in development and an estimated $2 billion budget, GTA VI represents the most ambitious and expensive entertainment product ever created. However, investor sentiment took a hit when Rockstar Games announced a delay of the game’s release from fall 2025 to May 2026.

During the recent earnings call, Take-Two CEO Strauss Zelnick emphasised that "affording Rockstar additional time for such a groundbreaking project is a worthy investment", and expressed confidence that there would be "no need for further delays." He maintains that Take-Two expects "to deliver a multi-year period of growth" and "enhanced value" for shareholders.

A report by the Financial Times estimates that GTA VI will generate $3.2 billion in total revenue within its first year post-launch.

Ubisoft (EPA:UBIP), one of the biggest players in the gaming world, launched a new subsidiary in 2025 dedicated solely to three of its flagship franchises: Assassin’s Creed, Far Cry, and Tom Clancy’s Rainbow Six. Backed by Tencent (HK:0700), the new entity is valued at $4.3 billion. This isn’t just a corporate restructuring—it marks a strategic shift toward building these franchises as evergreen platforms, designed for continuous development and long-term player engagement.

Virtual Reality (VR) and Augmented Reality (AR)

Virtual reality (VR) creates fully immersive digital environments where players interact with simulated 3D worlds that closely replicate real-world experiences.

Major technology firms including Meta (NASDAQ:META), Valve, PlayStation, Samsung, and Apple (NASDAQ:AAPL) have made substantial investments in VR development over recent years, recognising its potential across multiple industries. While VR adoption is growing across healthcare, retail, and automotive sectors, gaming has emerged as the primary driver of VR hardware advancement.

VR gaming faces persistent challenges, including expensive hardware, ergonomic discomfort, and limited content libraries.

These obstacles have spurred intensive innovation efforts from gaming companies focused on developing more comfortable, affordable hardware solutions, pushing innovations in controllers, displays, headsets, audio systems, and processing units that enhance user experiences. These gaming-focused improvements ultimately benefit other industries adopting VR technologies.

Augmented reality (AR) gaming presents a different experience, overlaying digital content onto real-world environments through smartphones or specialised eyewear. The technology gained mainstream recognition in 2016 with Pokémon Go, which transformed public spaces into gaming arenas by placing virtual creatures within players’ actual surroundings viewed through mobile devices.

The game generated over $8 billion in player spending. AR holds a faster adoption compared to VR reflecting consumer preference for digitally enhanced reality rather than complete immersion. While mobile devices currently dominate AR gaming, companies like Meta and Magic Leap are developing dedicated AR glasses for both enterprise applications and consumer gaming.

The combined VR and AR market remains relatively modest at $11.5 billion in 2024, though industry projections anticipate significant growth to $370 billion by 2034.

AI in Gaming

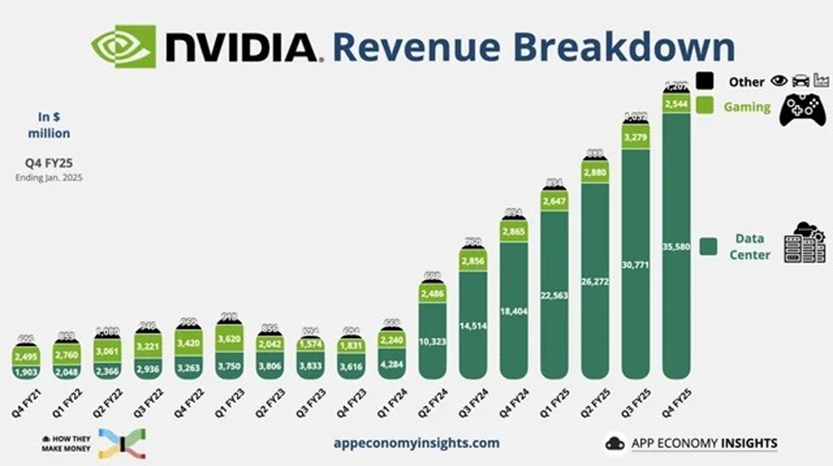

The rise of generative AI tools like ChatGPT owes much to the gaming industry’s demand for realism and immersion. For years, Nvidia (NASDAQ:NVDA) was best known for its powerful GPUs, which were originally designed to handle high-speed, high-quality gaming visuals.

Unlike traditional CPUs that excel at solving complex tasks one at a time, GPUs can perform thousands of smaller tasks simultaneously, a structure that turned out to be ideal for training and running AI models. Today, Nvidia’s AI chips are the industry’s standard for AI data centres globally. Once a niche chipmaker focused on gaming, Nvidia became one of the most valuable companies in the world.

Source: App Economy Insights

The relationship between gaming and AI is now mutual. AI isn’t just powered by gaming; it is also reshaping how games are developed and played. Developers use AI to generate environments, animate characters, test code, and even write branching storylines that evolve based on a player’s decisions.

Smaller design studios can now prototype games faster and produce content that were once exclusive to major developers and required years of development. Many companies harness AI to personalise user experiences, adjust difficulty in real time or alter narratives based on player behaviour. Procedural content generation has become standard industry practice, using AI to automatically create game assets like trees. This allows designers to focus on creative direction instead of repetitive tasks.

Beyond environments, AI is also being used to tailor game experiences to individual players by enabling non-playable characters (NPCs) to respond with intelligent, adaptive behaviours. A technique known as experience-driven procedural content generation allows AI to learn from each player’s in-game behaviour and preferences to create custom gameplay experiences.

For instance, in EA SPORTS FC 25, AI algorithms govern how virtual footballers move, make decisions, and react based on contextual variables like momentum and position. This means that if a player consistently relies on wing attacks, the AI will adjust the opponent’s defensive formation to counter that strategy and create a more dynamic and personalised match.

Over time, the game adapts to individual playing styles, making each session more engaging, unpredictable, and realistic, much like how a real coach would adapt to an opponent’s tactics during a match.

AI-generated art and design tools are advancing quickly. Some developers are already building complete prototypes, and even full games, in a matter of days using AI. However, it’s not yet replacing human designers as AI still lacks the consistency and nuance of a full development team.

Challenges

The gaming industry is certainly not dying, but it is currently undergoing significant challenges. The industry faced record layoffs in 2024, with nearly 15,000 known job losses in 2024 alone. Major players like Sony, Unity, and Embracer Group downsizing or shutting down entire teams. Multiple studios were permanently closed, including Arkane Austin, Ready at Dawn, Volition, London Studio, and Firewalk Studios.

Source: Reuters

At the beginning, many blamed the industry’s troubles on COVID-19 disruptions and post-lockdown adjustments, as gamers returned to classrooms, offices, and outdoor activities.

Gaming spending and time trail their all-time highs set in 2021. Industry revenue growth slowed dramatically from 13% annually between 2017 and 2021, to merely 1% between 2021 and 2023. Development costs continue rising at an unsustainable pace, with AAA game budgets growing at 6% annually from 2017 and 2022 and projected to accelerate to 8% through 2028.

Furthermore, gaming stocks are inherently volatile due to their business model structure. Studio revenues are highly sensitive to release timing, with many AAA titles sell most copies within the first weeks of launch. When release dates shift between quarters, it disrupts investor forecasts and can trigger steep share price selloffs. A game’s long-term value remains similar regardless of launch timing.

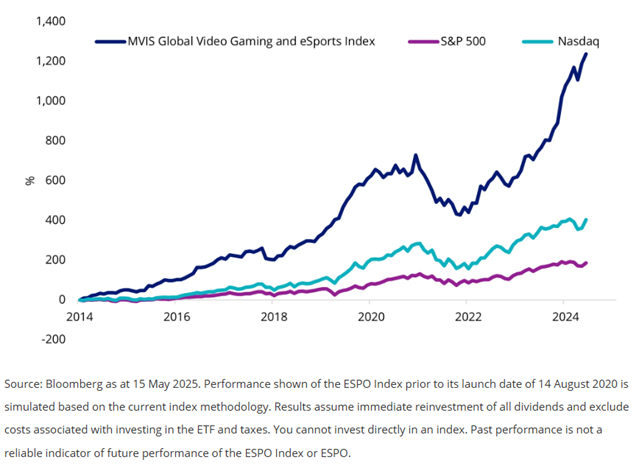

However, the timing makes a difference to the P&L and Cash Flow in the fiscal year, which creates market volatility. Despite this volatility, gaming stocks have delivered strong performance over the long term.

Source: VanEck

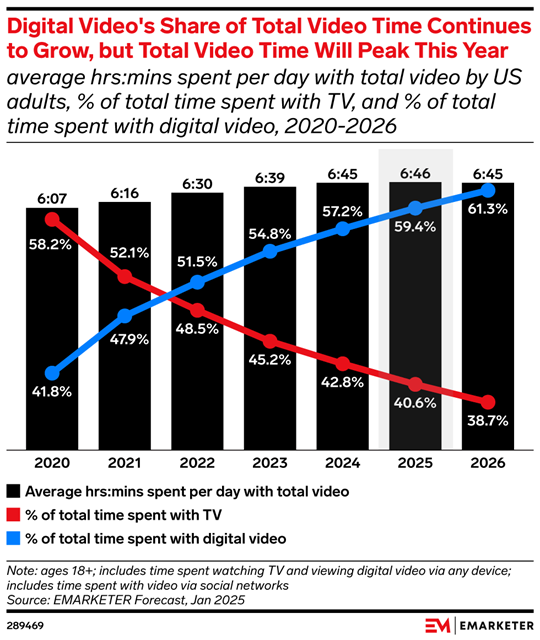

There are growing signs of market saturation. The rapid growth of mobile gaming slowed as smartphone adoption plateaued, and competition from social media platforms like TikTok emerged. Mobile gaming, once the industry’s growth engine, declined 6% in downloads during 2024, and Apple’s IDFA privacy changes reduced mobile ad effectiveness and increased user acquisition costs.

Emerging Technologies like VR, cloud gaming, and blockchain gaming have largely failed to deliver the transformative growth the industry anticipated, with adoption remaining limited despite significant investments.

Source: EMARKETER

Conclusion

The shift from traditional game sales to evergreen platforms like Fortnite and GTA VI has not only created new revenue models, but also new pressures. Post-pandemic adjustments hit hard as players returned to normal life, and development budgets continue spiralling upward. GTA VI’s unprecedented $2 billion budget will test whether massive investments in blockbuster games still deliver on expectations.