Adaptimmune stock plunges after announcing Nasdaq delisting plans

It started the year quite promisingly, even hitting record highs above $3,000 an ounce at one point.

But the global supply chain snarl in automotive chips has done palladium in, pushing the catalyst and emissions-purifier for gasoline-powered cars to the bottom of the commodities heap, where the precious metal now sits with a year-to-date loss of almost 32%.

Platinum, the catalyst and emissions-purifier for diesel cars, isn’t doing much better, with a 2021 loss of more than 14%.

“With some of the latest data it does seem like the worst may be over for auto production,” Hebba Alternative Investments said in a blog posted on Monday.

The investment manager noted that while the situation in the two so-called Platinum Group Metals, or PGMs, was not back to normal, it was still “not as bad as Q3.”

Thus, Hebba was surprised, it said, to see a large speculative short continuing in palladium despite improving auto production across the world.

“We’ve been tracking auto manufacturers and their outlook, and it seems like most have said the third quarter was the toughest and production is starting to pick up,” Hebba said, noting that Toyota Motors (NYSE:TM), for instance, expected its December production to be on schedule for the first time in seven months. The investment manager added:

“We also know that as production increases, automakers have A LOT of ground to make up to get inventory back to more normal levels – which also is extremely bullish for anything auto-related including platinum and palladium.,”

At under $1,685 in Tuesday’s futures trade, palladium was at “a very attractive price-point,” Hebba said.

As such, it posits that next year might be a bumper year for palladium prices.

“Large speculative short position makes dramatic reversal possible,” Hebba said, adding:

“2022 may be a historic year for auto production as auto-inventory rebuild commences from decade low levels. Any price rise in palladium may be further exacerbated as auto-purchase managers buy in advance of 2022 production increases.”

Just as witnessed with this year’s price collapse, Hebba adds that “we could see the reverse as auto-manufacturers restock their inventory in a potentially historic production run for vehicles.”

“There may be a rush to purchase as much PGMs as possible by these companies’ purchase managers especially if the price starts to rise (they were paying 30% more for palladium in 2019),” it noted.

September 2021 imports of palladium in particular were strong, with 213,000 ounces of palladium imported versus 178,000 in September 2020 and 241,000 in September 2019.

Additionally, net imports (imports minus exports) of palladium were higher than in 2019, with a net of 151,000 versus 140,000 in 2019 (and only 9,000 in 2020). For the record, September 2019 was a normal year for auto production.

But Palladium, Platinum Technicals Both Weak

All technical charts courtesy skcharting.com

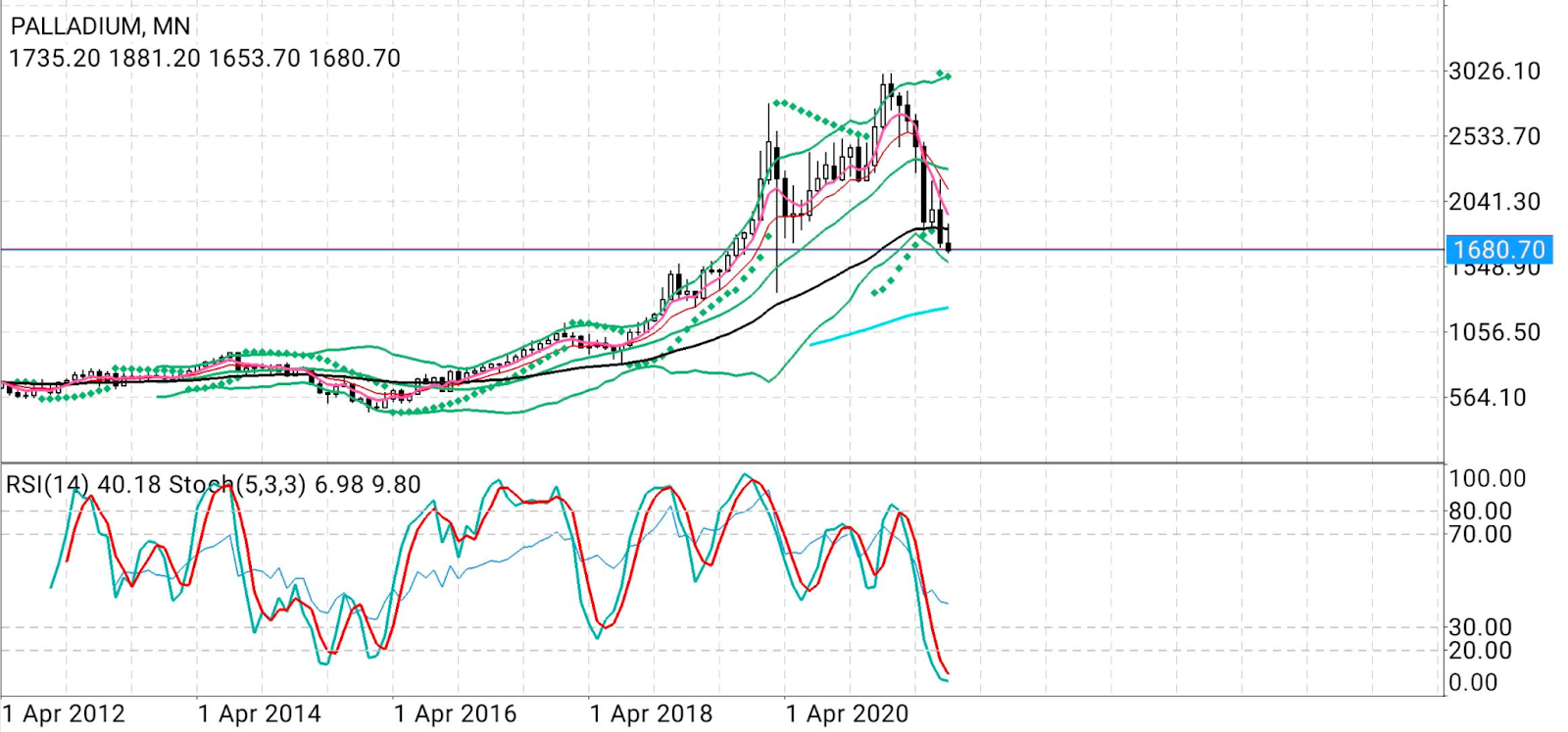

Palladium’s long-term monthly chart shows continued weakness, trading well below the previous month's low, says Sunil Kumar Dixit, chief technical strategist at skcharting.com.

“After falling straight like a hot potato for seven months out of eight, palladium is not just oversold, it is extremely oversold and the auto catalyst doesn't seem to have bottomed out yet,” noted Dixit.

As the 2021 calendar comes to a close, Dixit said he expected the spot price of palladium to extend its bearish move to test $1,585 and bounce back to the 50-month Exponential Moving Average of $1,835 by the year-end.

The extremely oversold stochastic reading of 6.96/9.79 indicates possibilities of a reversal in the early months of the year 2022.

“If the 50-month EMA of $1,835 rejects the metal, the coming year would witness an even worse scenario with prices breaking below $1,500 and exposing $1,350,” Dixit said.

“However, short-covering and re-entry of palladium bulls requires strong resolve above the critical 50-month EMA of $1,585 with $2,280 as the first major station.”

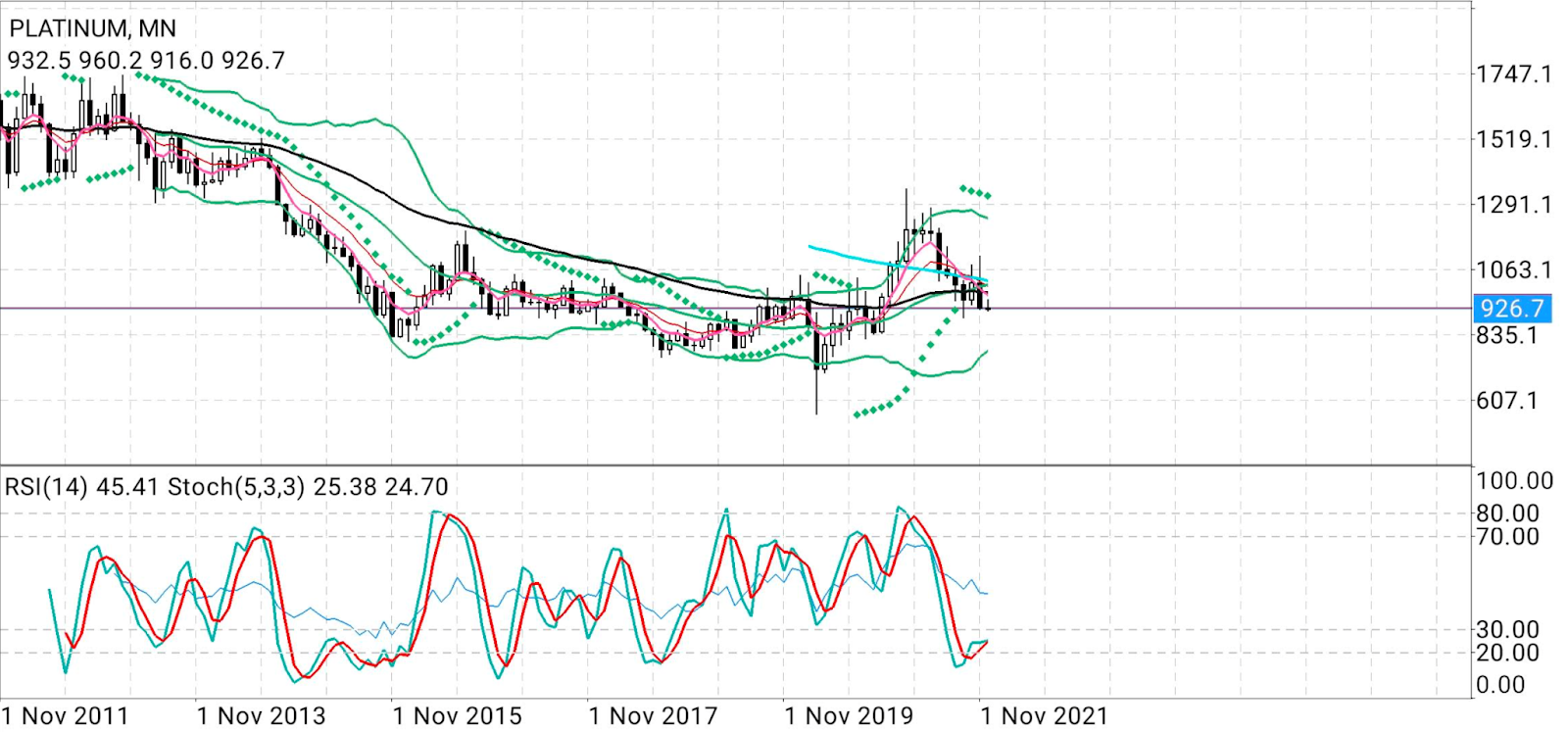

The outlook for platinum was also bearish, though its spot price was trading above the September low of $893, Dixit said.

Oversold stochastic on the short-to-mid term charts may cause platinum to experience some short covering above the 5-month EMA of $973 and the 10- month EMA of $1,004, retesting the middle Bollinger® Band of $1,010 and the 100-month Simple Moving Average of $1,025. Dixit noted:

“Platinum traders will be careful about the September low of $893. Breaking this level will extend platinum’s decline to $778.”

“Alternatively, strong price action above the 100-month SMA of $1,025 can extend platinum’s upside to $1,240 over an extended period of time.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.