Bitcoin extends losses after Trump threatens fresh tariffs and export curbs

Following today's impactful economic data announcement, gold bears gained renewed strength, keeping gold below the crucial support level at $2004. Signals from both building permits and initial jobless claims have further solidified the diminishing expectations for a rate cut.

This economic data resulted in renewed strength in the US dollar index once again in today's session, which is likely to extend selling pressure in the yellow metal even before the upcoming meeting of the Federal Reserve.

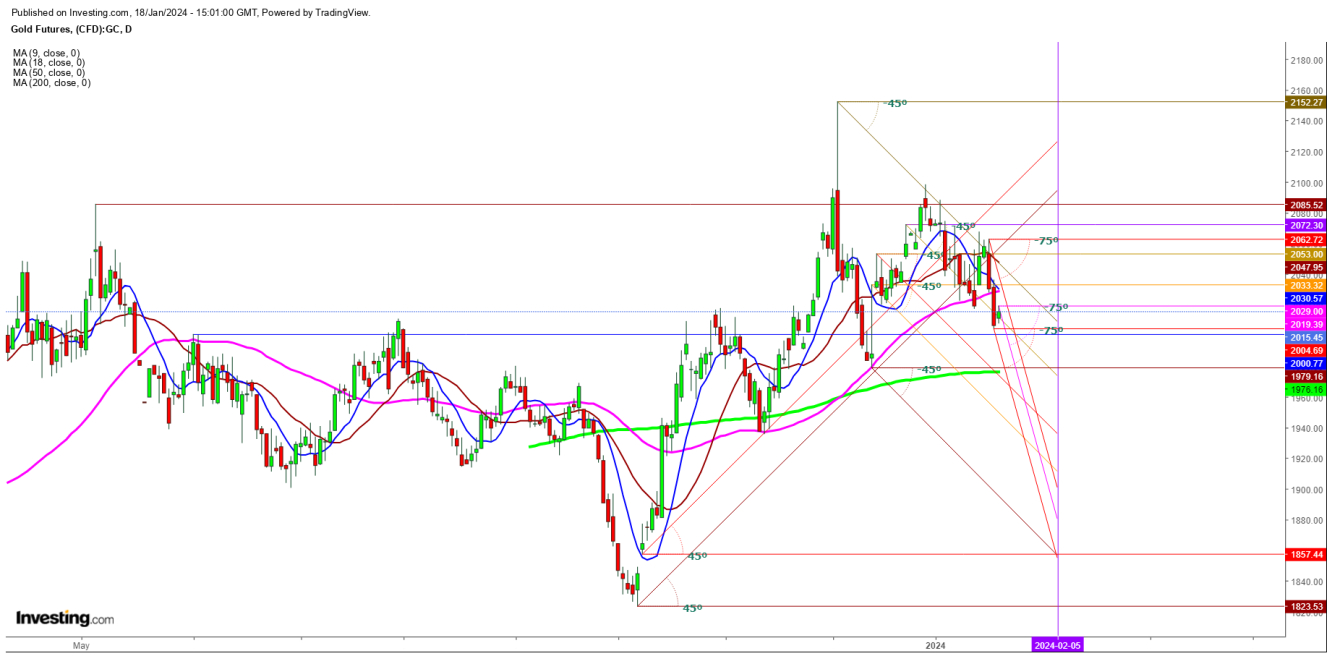

Gold is maintaining its pronounced downward trajectory, as outlined in my recent analysis. Prices could hit the next support at $1979 before this weekly closing.

There could be some reversal as there is significant support at 200 DMA at $1976 in the daily chart. There is a likelihood of bulls getting trapped within the range of $2013 to $2002 during this week.

But the tilting positing of the 9 DMA and 18 DMA below the 50 DMA indicates the current exhaustion is likely to turn steeper if both the moving averages form one more 'bearish crossover' in the daily chart during the upcoming week. A move below the 200 DMA will continue to keep the downtrend intact during the next few weeks.

Watch my attached video, which I uploaded on Jan. 15, 2024.

***

Disclaimer: The author of this analysis may or may not have any position in the Gold futures. Readers can take any long or short trading position at their own risk.