Bitcoin price today: dips to $92k as Fed cut doubts spark risk-off mood

Gold’s recent plunge has left investors reeling. Futures tumbled over 6.5% in a single session, catching bullish traders completely off guard. As I flagged in my last analysis, a perfect storm of easing geopolitical tensions, unexpected U.S. commentary on the China trade conflict and Washington’s renewed push for a Russia-Ukraine ceasefire triggered a wave of panic selling. In the blink of an eye, what seemed like a stable market became a dramatic test of nerves for those betting on gold’s resilience.

Undoubtedly, gold has become the focal point in a story of uncertainty, risk, and opportunity. However, this steep fall yesterday has created a new setup. It tends to eclipse speculative mania that recently sent gold into an exceedingly overbought territory. Gold futures could remain under extensive selling pressure, despite some short-lived up moves due to adverse news flow.

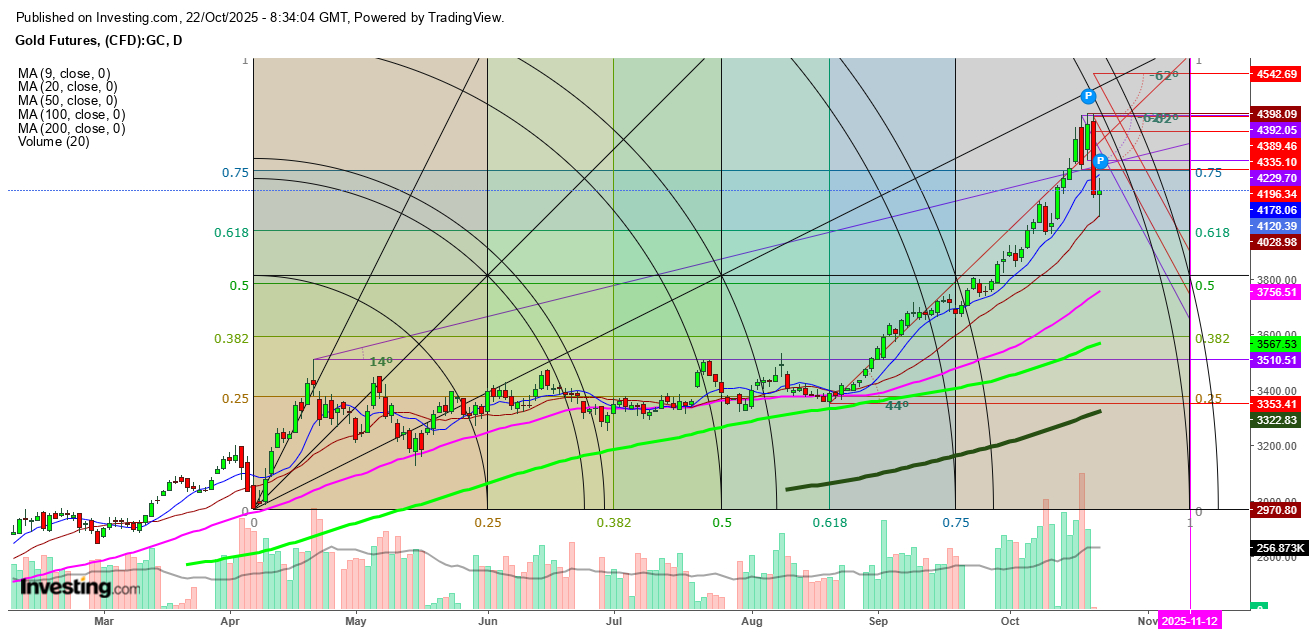

On Wednesday, gold futures found a bounce back after testing a significant support at the 20 DMA at $4021.91, exactly the same as I defined yesterday while explaining the support and resistance levels for the gold futures in a daily chart.

Undoubtedly, this reversal is a resultant of Russian missile and drone attacks throughout the night and this morning, could be short-lived if the gold futures don’t sustain above the immediate resistance at the 9 DMA at $4181.62 while a flip below the 20 DMA could push the futures to test the next support at $3978 where a sustainable move below this support could push the futures to test the next significant support at the 50 DMA at $3757 before the end of this week.

Undoubtedly, Washington’s attempts to broker a Russia-Ukraine ceasefire could accelerate this week as Tuesday’s attack on Ukraine killed four and left hundreds of thousands without power and many without water in what Kyiv said was Moscow’s latest salvo in a campaign to break its neighbor’s energy system ahead of winter.

Technical Levels to Watch

In a daily chart, gold futures are showing exhaustion as after testing the day’s high at $4163.79 due to surging bearish pressure that could push the futures back to the pavilion from were today’s bounce back started today, at the significant support at the 20 DMA at $4029, where a breakdown could push the futures to test the next support at the 50 DMA.

In a 1-Hr. chart, gold futures are sustaining below the significant support at the 200 DMA since yesterday due to the formations of bearish crossovers as the 9 DMA, 20 DMA and 50 DMA have come below the 100 DMA and 200 DMA while the gold futures are sustaining even below the 9 DMA which indicate an extensive pressure could keep the gold futures under pressure for a longer period that expected.

Disclaimer: Readers are advised to take any position in gold at their own risk, as this analysis is based only on observations.