SoftBank Group Q2 profit blows past expectations; sells Nvidia stake for $5.8 bln

For more than a century, New York City has stood as the beating heart of global capitalism. That’s why this month’s election of Zohran Mamdani, a self-described Democratic Socialist, as the city’s next mayor has sent shockwaves through America’s business and investing community.

Mamdani, 34, will be the youngest NYC mayor in over a century and the first Muslim to hold the office. Despite having virtually no name recognition as recently as the beginning of the year, he handily defeated none other than former New York governor Andrew Cuomo, a member of the Cuomo political dynasty who was endorsed by President Donald Trump (though one can argue this hurt him more than helped him).

Tapping Into the Youth Vote

Populism has long been associated with the right—think the Trump/MAGA movement in the U.S. and Brexit in the U.K.

But now, a different kind of populism appears to be cropping up from the left. Mamdani’s progressive messaging—rent freezes, small-business support, a $30 minimum wage—clearly resonated with young, working-class voters. According to exit polls, an unbelievable 78% of New Yorkers under 30 pulled the lever for him, compared to only 18% for Cuomo.

Kevin O’Leary, aka Mr. Wonderful, places a lot of the glory (or blame, depending on your point of view) at the altar of the almighty algorithm, writing on LinkedIn that the mayor-elect “did a fantastic job of understanding social media.”

I couldn’t agree more. Older voters may roll their eyes at memes and “viral” TikTok videos, but in today’s attention economy, the algorithm has steadily grown in importance to become the be-all and end-all. That’s precisely what compelled Elon Musk to buy Twitter in October 2022, a strategy that I believe helped Trump get reelected.

Many young people have voiced mistrust in institutions, which has prompted them to seek not only candidates who are outside the norm but also decentralized assets such as Bitcoin and stablecoins.

Progressive Policies Weigh on Business

On the surface, much of Mamdani’s policy agenda sounds like a wish list for Main Street. He’s promised to cut city fines and fees for small businesses in half, including the $1,000 registration cost, and to streamline permits and digitize applications.

It’s his more progressive pledges—A $30-an-hour minimum wage by 2030! Free buses and childcare!—that have many corporations and taxpayers worried. Payroll is already the largest expense for most small businesses, typically costing them between 15% and 30% of gross revenue.

Freezing rents and nationalizing utilities might play well on social media, but these policies, while well-meaning, could have a chilling effect on private investment, construction and more.

As BCA Research put it, “Mamdani will struggle to run NYC and implement his agenda of free stuff.”

Escape from New York

Large employers are starting to get nervous. JPMorgan Chase, Goldman Sachs and Citigroup have already moved thousands of workers out of New York to Texas and Florida, where taxes are lower and regulations lighter. I suspect we’ll see more of this as Mamdani’s policies take effect.

Due mainly to taxpayers fleeing high-tax states, the Lone Star State and Sunshine State have gained a combined $250 billion in net adjusted gross income (AGI) in the past decade alone; over the same period, the Empire State has lost $111 billion, according to the National Taxpayers Union Foundation (NTUF).

Meanwhile, the Tax Foundation’s 2026 State Competitiveness Index ranks New York dead last for business taxes. With top marginal income tax rates approaching 15% when city taxes are included, high earners and corporations have yet another incentive to move elsewhere.

If the trend continues, Mamdani may preside over a smaller, poorer tax base even as he promises more spending. The top 1% of New Yorkers pay roughly 40% of the city’s income taxes, meaning even if a fraction of them leave, the fiscal consequences could be severe.

Capitalism in Decline?

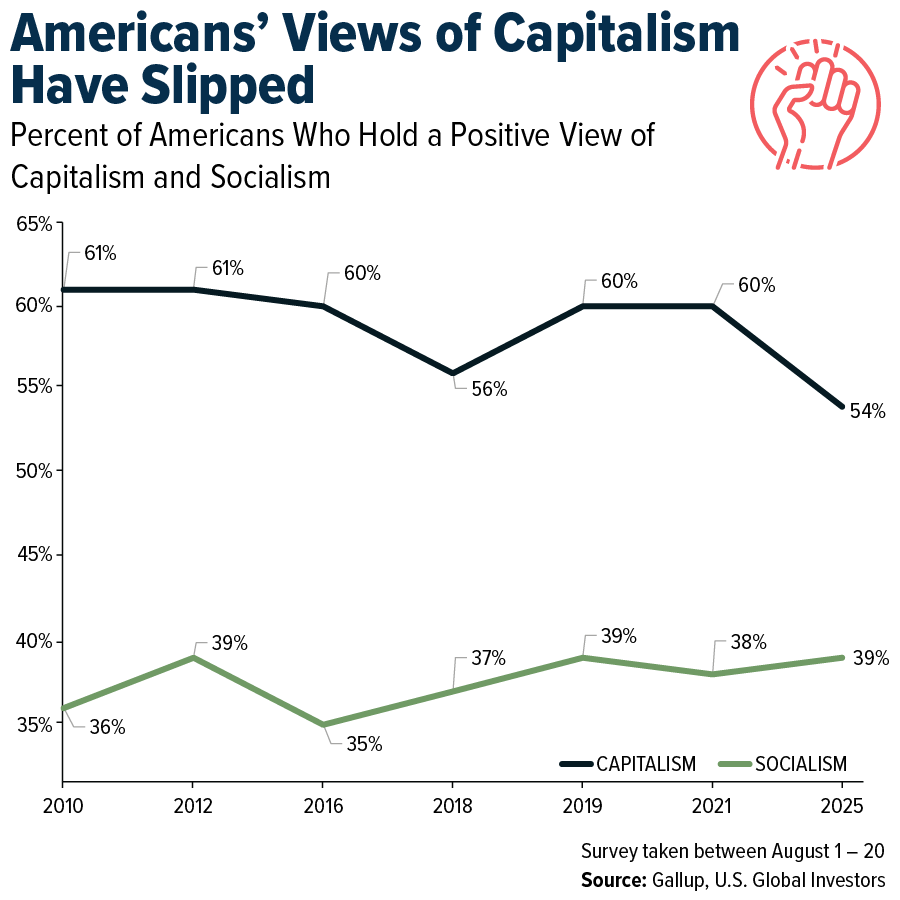

To understand Mamdani’s rise, it’s important to look at young people’s changing views of capitalism and socialism.

A recent Gallup poll found that only 54% of Americans view capitalism favorably, down from 60% a few years ago. Among Democrats, the numbers flip entirely, with more holding a positive view of socialism than capitalism, by 24 points.

That probably sounds shocking to many readers, but venture capitalist Peter Thiel put it all into context in a 2020 email that resurfaced after Mamdani’s victory: “When one has too much student debt or if housing is too unaffordable, then one will have negative capital for a long time… and if one has no stake in the capitalist system, then one may well turn against it.”

A Red-Letter Quarter for Gold Funds

For investors, I believe it’s important to keep in mind that government policy is a precursor to change. If businesses and capital continue migrating to low-tax, pro-growth states like Florida, Texas and Tennessee, investors may find opportunities in real estate, infrastructure and municipal bonds.

At the same time, sectors aligned with Mamdani’s Democratic Socialist policies—green energy, affordable housing, public transit—could see new funding streams, even if the broader business climate cools.

I’m confident that markets will adapt. In the meantime, I think it’s particularly prudent to maintain exposure to hard assets such as gold and silver, which investors have historically sought in uncertain times.

Today, that’s no exception. According to Lipper data, gold mining funds in the U.S. saw remarkable flows in the third quarter, collecting some $5.4 billion. That’s the most in a single quarter since December 2009.

***

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the links above, you will be directed to a third-party website. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.