U.S. stocks surge; investors buoyed by progress towards ending government shutdown

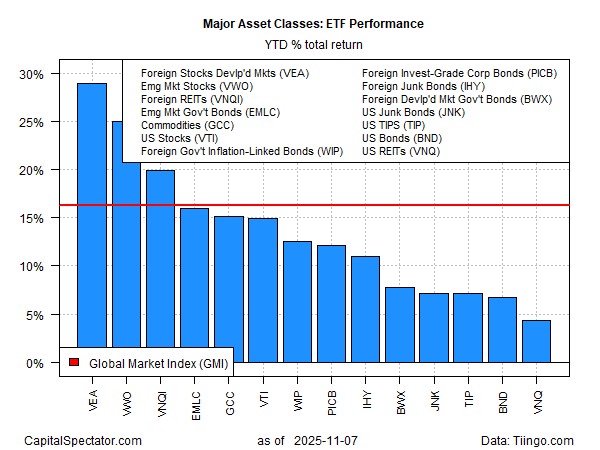

With less than two months to go, widespread gains continue to dominate the performance ledger for global markets. A lot can happen between now and the New Year’s celebrations – and probably will — but for the moment, the appetite for risk is leaning toward a win-win for portfolio strategies in 2025, based on a set of ETFs through Friday’s close (Nov. 7).

Echoing the profile in recent months, foreign stocks are leading the winners by a wide margin, led by shares in developed markets ex-US. The Vanguard FTSE Developed Markets ETF (NYSE:VEA) is clocking in with a sizzling 29.0% total return so far this year. The second-best performer: equities in emerging markets (VWO) via a 25.0% rise.

US stocks (VTI) are posting solid but relatively middling results vs. the alternatives via SPDR S&P 500 ETF (SPY) with a 15.5% total return this year.

In a sign of the times, the Global Market Index (GMI) is higher by more than 16% this year, or well above its long-term performance. Not too shabby for a know-nothing, forecast-free portfolio: GMI is an unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights via the ETFs above and represents a competitive benchmark for globally diversified multi-asset-class portfolio strategies.

The ”losers” this year are asset classes posting relatively modest returns. The softest year-to-date gain: US real estate investment trusts, based on the Vanguard Real Estate ETF (NYSE:VNQ), which is higher by a modest 4.3%.

The overall results are strong enough to invite the question: Is it timely to cash in one’s chips, declare victory, and start anew come January? Tempting, perhaps, but wildly impractical for most investors, given that dramatic swings in risk exposure usually end in tears.

Still, it’s an intriguing academic question for a year that has gone right for most globally diversified investment strategies, courtesy of a strong beta tailwind. Reversion to the mean will eventually kick in, as it always does. The main mystery: When? For the moment, the crowd is betting that it’s later rather than sooner – a view that’s proven to be a winner in 2025, despite some dark moments.

As we write, a new bullish catalyst appears to be brewing for the trading week ahead: Signs that the US government shutdown may be ending after the Senate approved a plan to fund the government, if only through Jan. 30. A thin reed, perhaps, but enough to reanimate animal spirits, or so it appears based on rallies in global markets on Monday ahead of the open for US trading.

“I think all news is good news,” said Jason Paltrowitz, executive vice president at OTC Markets. “I think the market needs to see we’re moving past this. I think investors want some surety both for the economy and for their own investment.”

Hope still springs eternal for the everything rally of 2025.