TSX jumps amid Fed rate cut hopes, ongoing U.S. government shutdown

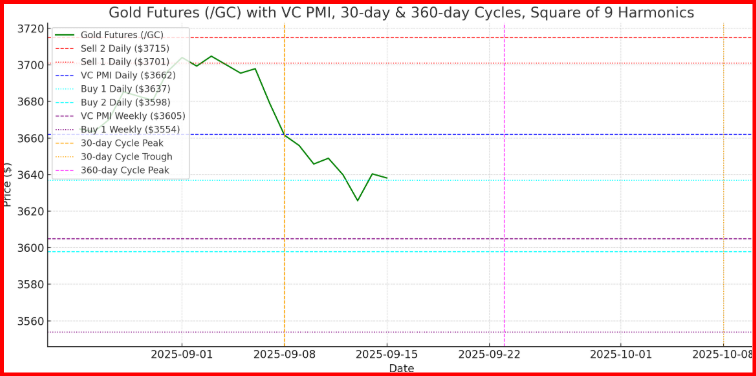

Gold futures are currently trading at $3,668.6, after testing a recent high of $3,715.2. This price action has brought the market directly into the Sell 1 Daily ($3,701) and Sell 2 Daily ($3,715) resistance zone, a region of heightened probability for mean reversion according to the VC PMI model. The daily pivot at $3,662 is now the fulcrum, defining the immediate directional bias. A sustained close above this level keeps the bullish short-term bias intact, while failure to hold opens the door for a pullback into $3,637 (Buy 1 Daily) and $3,598 (Buy 2 Daily).

On a weekly timeframe, the structure aligns with these signals: Sell 1 Weekly at $3,704 overlaps the daily resistance cluster, underscoring the importance of this zone. On the downside, VC PMI Weekly support rests at $3,605, with deeper structure at $3,554 (Buy 1 Weekly). This confluence suggests that the $3,704–$3,715 band represents a critical inflection point for gold.

From a cycle perspective, the 30-day Gann cycle, anchored from the August 9 low near $3,462, projected a crest into the September 7–9 window. The current rally aligns precisely with this forecast, suggesting that gold is entering a time/price convergence zone that often produces reversals or sharp corrective phases. Looking further, the 360-day cycle, anchored from the September 28, 2024 pivot low, identifies this September window as part of a broader annual topping structure, reinforcing the probability of resistance.

Overlaying the Square of 9 geometry, the $3,715 high resonates with harmonic angles tied to the $3,540 base, where prior support was confirmed last week. This geometric alignment strengthens the probability that the $3,701–$3,715 region is a natural resistance cluster, where price and time converge. Failure to sustain closes above $3,715 could trigger a mean-reversion retracement toward $3,605–$3,554, which would realign price with both weekly support and cycle timing.

Momentum indicators support this cautionary stance. The MACD (14,3,3 exponential) has turned positive (12.1 vs 8.8), reflecting bullish pressure, yet the recent flattening of histogram bars suggests waning momentum as price presses into resistance. This divergence often precedes pullbacks.

Conclusion

Gold futures have rallied sharply into a time/price resistance band defined by VC PMI, Gann 30-day cycle projections, and Square of 9 harmonics. While short-term momentum remains bullish, probabilities favor mean reversion toward $3,637–$3,598, unless the market can decisively close above $3,715. The current structure argues for caution on new longs and tactical profit-taking at resistance, with opportunities emerging on the pullback cycle into mid-September.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.