Bitcoin price today: tumbles below $90k as Fed cut doubts spark risk-off mood

Gold prices hovered around $3960 on Tuesday, holding steady after a strong rebound in the previous sessions. The metal continues to trade within a well-defined technical range as investors weigh U.S. economic data, Treasury yields, and shifting expectations for Federal Reserve policy.

4-Hour Structure: Range-Bound Within a Premium Zone

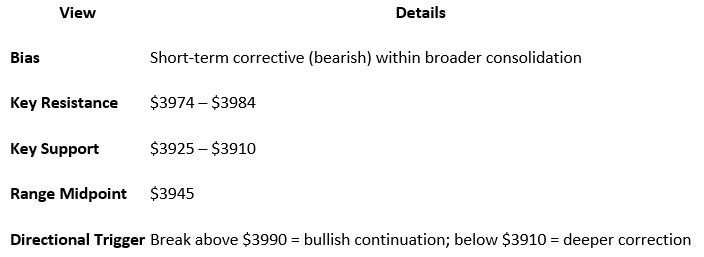

On the 4-hour chart, gold remains confined between $3890 and $4000, a range that has governed price action for several sessions. The midpoint near $3945 represents the current equilibrium level.

Price is now trading slightly above this midpoint, placing it in the premium zone of the range—historically an area where short-term selling pressure tends to re-emerge.

The structure shows a series of lower highs and lower lows, confirming a mild retracement phase within the broader uptrend. The latest break below $3938 confirmed a bearish break of structure, suggesting sellers are defending the upper boundary for now.

Key Technical Zones to Watch

Resistance Cluster ($3974 – $3984):

A confluence of a bearish order block and an unfilled fair-value gap sits around this band. It also aligns with the 61.8–78.6% Fibonacci retracement window of the latest impulse leg, making it an important technical pivot.

If price retests this zone during the London or New York sessions, traders may watch for reaction patterns to gauge whether liquidity above $3970 is being absorbed or rejected.

Support Band ($3925 – $3910):

On the downside, this area represents the discount side of the current range, where prior demand emerged last week. It also coincides with previous sell-side liquidity pools that may attract institutional bids if price dips further.

A deeper sweep toward $3895 – $3880 would mark a test of the broader 4H swing low and could invite stronger buying interest if accompanied by volume expansion.

Market Context: Data, Dollar, and Yield Dynamics

The near-term direction of gold continues to hinge on US dollar strength and bond-yield behavior.

Recent softness in Treasury yields has offered relief to bullion, but with US inflation readings and employment data scheduled later this week, traders remain cautious.

Analysts note that gold’s ability to hold above $3940 will be key to maintaining its medium-term bullish narrative, while a decisive close above $3990–$4000 could reopen the path toward $4040 and beyond.

Technical Outlook Summary

Bottom Line

Gold’s current structure suggests a controlled retracement phase, with liquidity concentrated near the $3980 handle on the upside and $3920 on the downside.

Unless a strong macro catalyst emerges, traders can expect range-bound volatility dominated by short-term liquidity sweeps rather than sustained directional moves.

The next directional breakout will likely depend on U.S. macro data and DXY momentum, making the upcoming sessions critical for confirming whether the $3980 area acts as a ceiling—or a springboard—for the next major leg in gold’s trajectory.