Palantir shares slip premarket despite posting record revenue in third quarter

As we noted in a recent article entitled The High Beta Melt Up: Echoes of 1999, there has been a notable change in investor preferences since the April lows. To wit:

"What we do know is that, starting from the April lows, the market’s attitude toward riskier, more speculative activities has become much more intense."

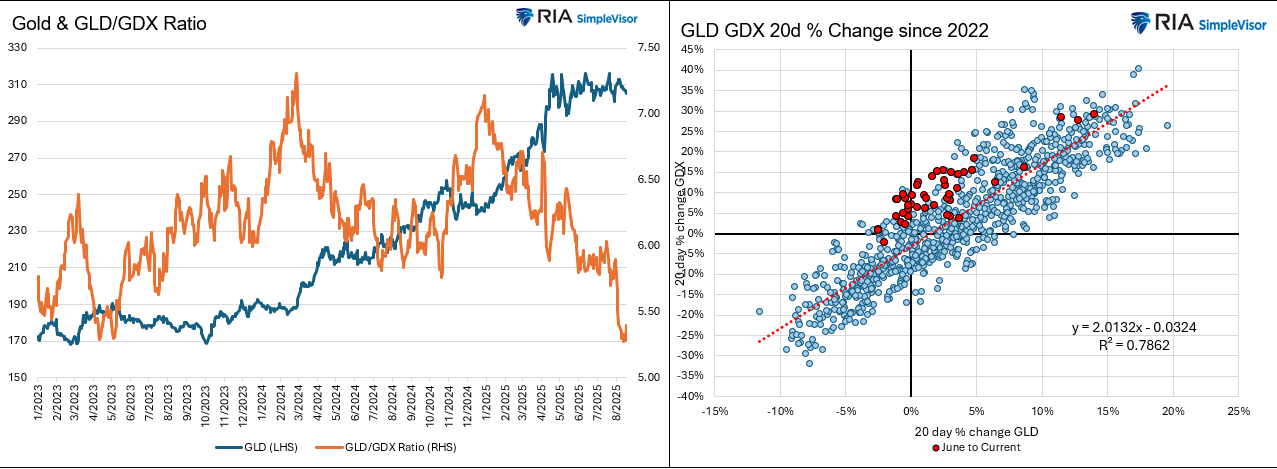

Gold miners are among the groups benefiting from the speculative activity. Since April 8, GDX, the gold miners ETF, is up 36%, three times the 11% increase for gold. The following graphs add context to the relationship between gold and gold miners.

The top graph on the left shows that the GLD to GDX price ratio has fallen from over 7.0% to nearly 5.25% since the start of the year. Since April, GLD has been relatively range-bound while gold miners continue progressing. The scatter plot shows the strong 3+ year correlation between 20-day changes in GLD and GDX (R-squared = .7862).

Furthermore, the regression formula shows that GDX has a beta of about two versus gold prices. The red dots highlight the 20-day periods starting in June. Almost all of them are decently above the regression line. This signals that gold miners are outperforming gold more than normal.

Suppose you are an investor who rotates between gold and gold miners. In that case, this data can help appreciate that when this speculative environment ends, the likelihood of gold outperforming gold miners will increase significantly. For additional guidance, see the second graphic.

The GDX/GLD ratio analysis shows that our proprietary momentum gauge, MACD, and stochastics are overbought and nearing a sell signal. In other words, GDX is due for a pullback compared to GLD.

Breadth Improves, But Conditions Remain Overbought

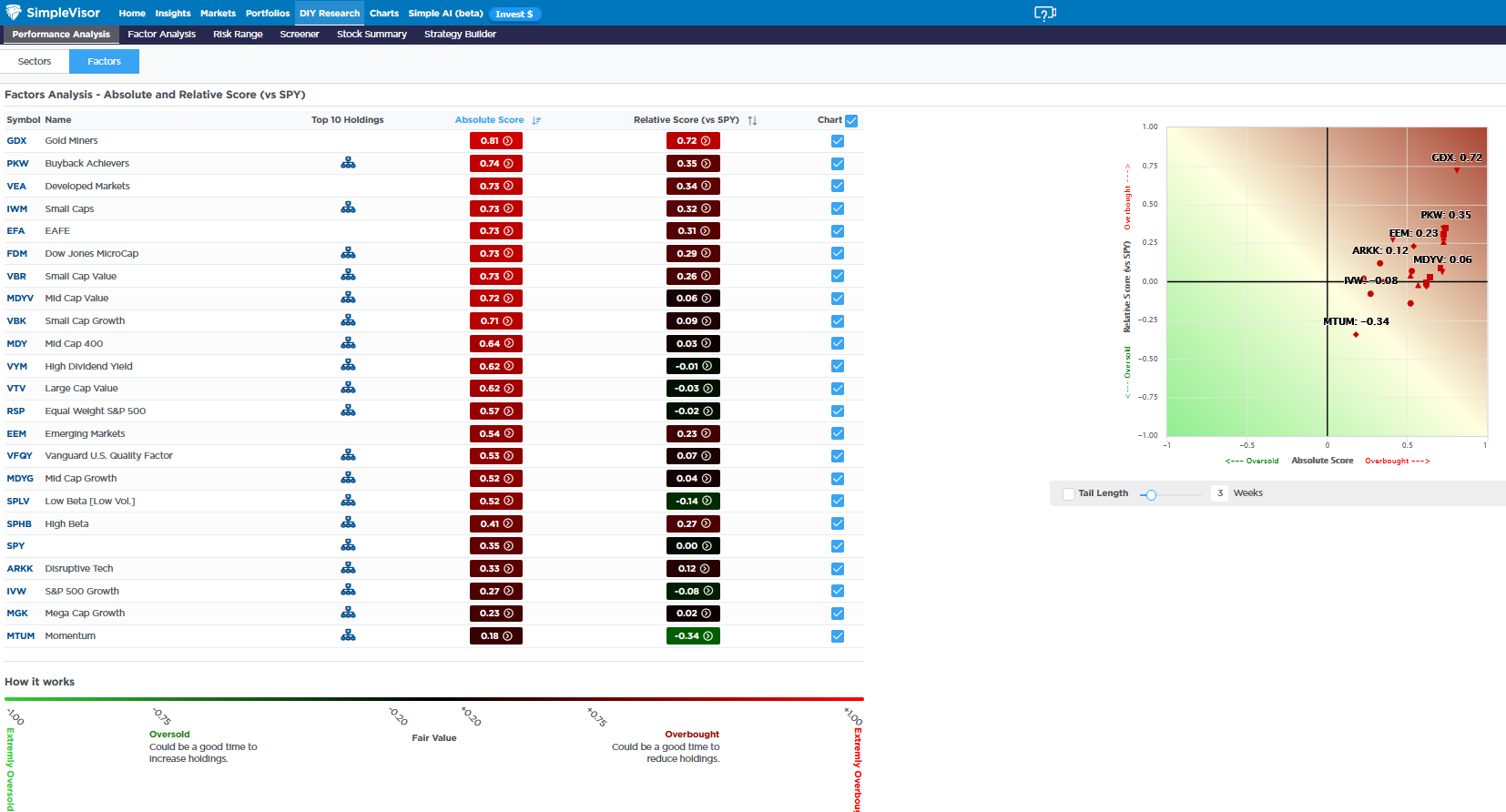

The Absolute and Relative scores provide valuable insights about current market conditions. For starters, the graph on the right shows that the majority of factors are bunched up near each other. Compare that to a few weeks ago, when they were scattered from the top right to the bottom left. This is a clear signal that breadth has improved.

However, while breadth may be better, the absolute scores, many of which are above 50, and over a third are above 70, tell us that a vast majority of factors are overbought.

So while we can relax in the market’s breadth, which has become more stable and a better foundation for a bull market, we need to be concerned that large pockets of the market are decently overbought. It’s worth adding that Bitcoin and cryptocurrencies have been leading the speculative charge since April.

However, since peaking at 125k on August 14th, Bitcoin has fallen over 10% to 111k. Might Bitcoin be an omen of things to come for other speculative assets?

Tweet of the Day