IonQ CRO Alameddine Rima sells $4.6m in shares

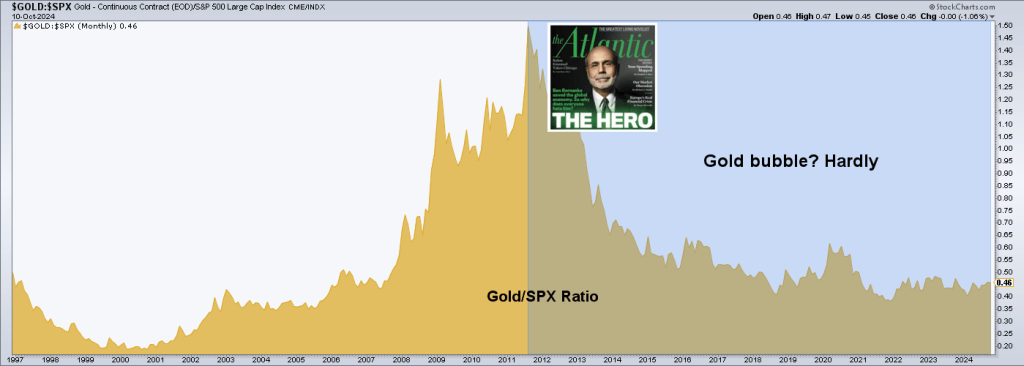

Gold’s current bull market phase has been somewhat muted, compared to much of the 2000-2011 phase, when it was loud indeed. Much of that can be attributed to the fact that gold is still flatlining in relation to the S&P 500 and other major stock indexes (it has been rising since 2021 in relation to lesser and broader measures, like Small Caps and the Value Line Geometric Index), whereas gold boomed vs. SPX from 2000 to 2011.

Gold is now in the dumps in comparison to the great bull market in stocks, as instigated, nurtured and sustained by a decades-long bubble in inflationary policymaking; especially monetary (Fed and other central banks), but also fiscal (government) policymaking.

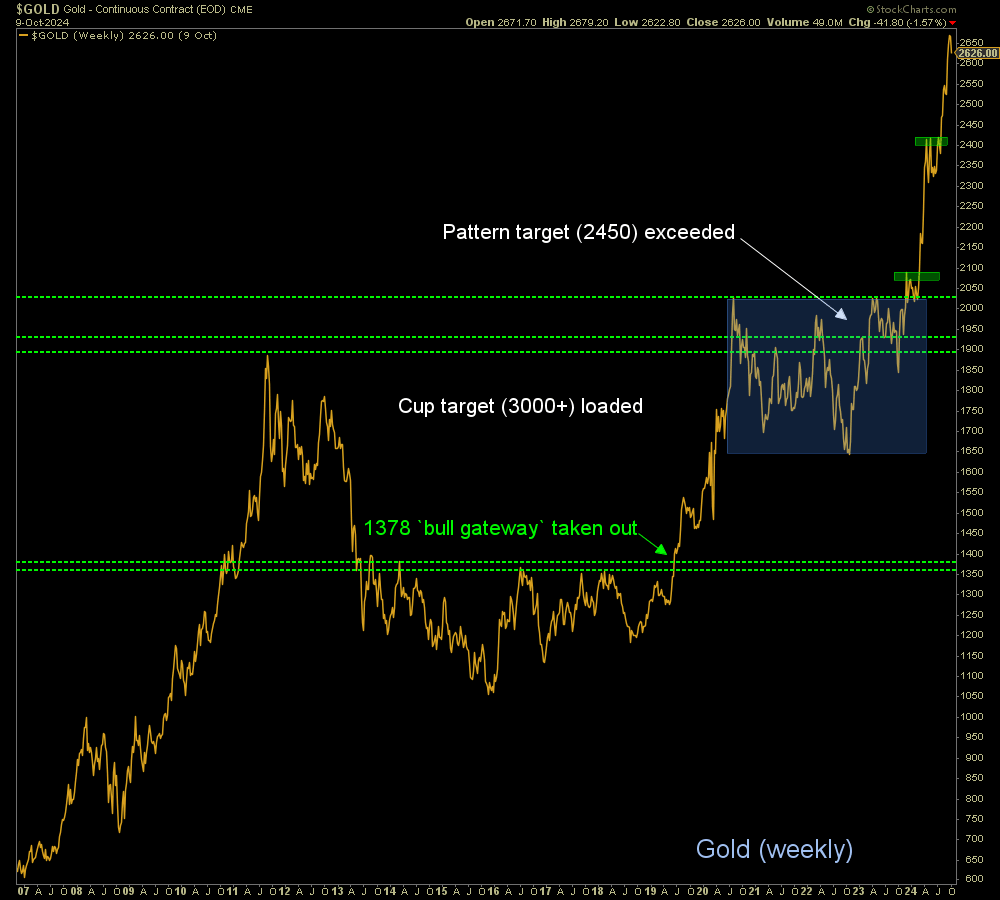

It seems outlandish to state that THIS is quiet…

…but that goes to show how far into nose bleed territory the stock market has gone with the policy bubble as its silent partner.

The fact is, with reference to the first chart above, gold is nowhere vs. the S&P 500. The policy bubble was kicked off by Greenspan’s Fed, but back in those more innocent days gold was the first mover against the monetary chicanery. Later came the Bernanke Fed and all manner of new and ingenious monetary evil cooked up in order to further manipulate bond markets to the will of Wall Street and the asset-owner class in general. Then came the ingenious MMT (Modern Monetary Theory), also known around these parts as TMM (Total Market Manipulation), and the system was subject to an ever tighter grip by policy that had no room for an asset that merely sits there representing honest value over time. Evil had won.

Paraphrasing Steven King, investors had “forgotten the face of their fathers”. Dorothy would say “we’re not in Kansas anymore”. The main character of my service’s Wonderland imagery would find herself down a rabbit hole where it seems anything is possible. And it has been possible, for decades.

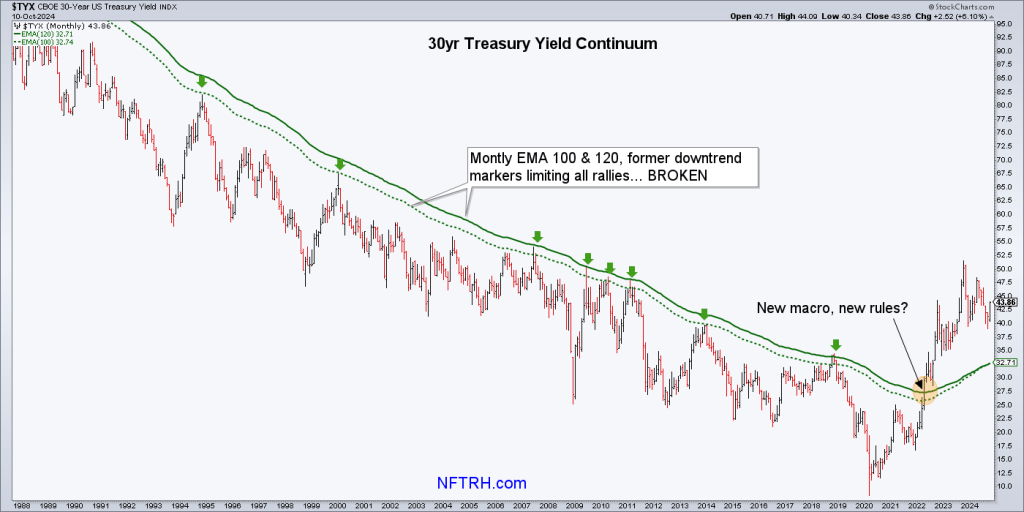

The elegant “Continuum” (below) represents what WAS (a decades-long decline in long-term Treasury yields indicating another King quote: “nope, nuthin’ wrong here”, as disinflationary signaling allowed for inflationary action by Fed and government whenever it was perceived needed)… and now, since 2022, it represents what IS (a broken trend into a new phase of macro inflationary signaling). That break, almost by definition, means that outcomes from policymakers’ bond market manipulation going forward will not be what they were, pre-2022.

As a side note, the current decline from the highs in yields was fully anticipated in NFTRH and is expected to be an “interim” move – a final gasp for Goldilocks – before the next rise in yields and future inflation problem, which is likely to be worse than the one we’ve been easing out of in “Goldilocks” 2024, conveniently, an election year.

That is the preferred view due to the expectation that Fed and government will conduct business as usual, damn the torpedoes. But the biggest picture could also include a deflationary collapse at the hands of a bond market that has simply had enough, goes completely off script, and will no longer play ball at all to policymakers’ desires.

The main point of the above can be summed up thusly: the power held by entities previously in total control of the macro…

…no longer exists. If they try to control markets and the economy to positive ends (bubbles, though they were) in similar fashion to decades past, we should see dysfunction at best, and flat out failure at worst.

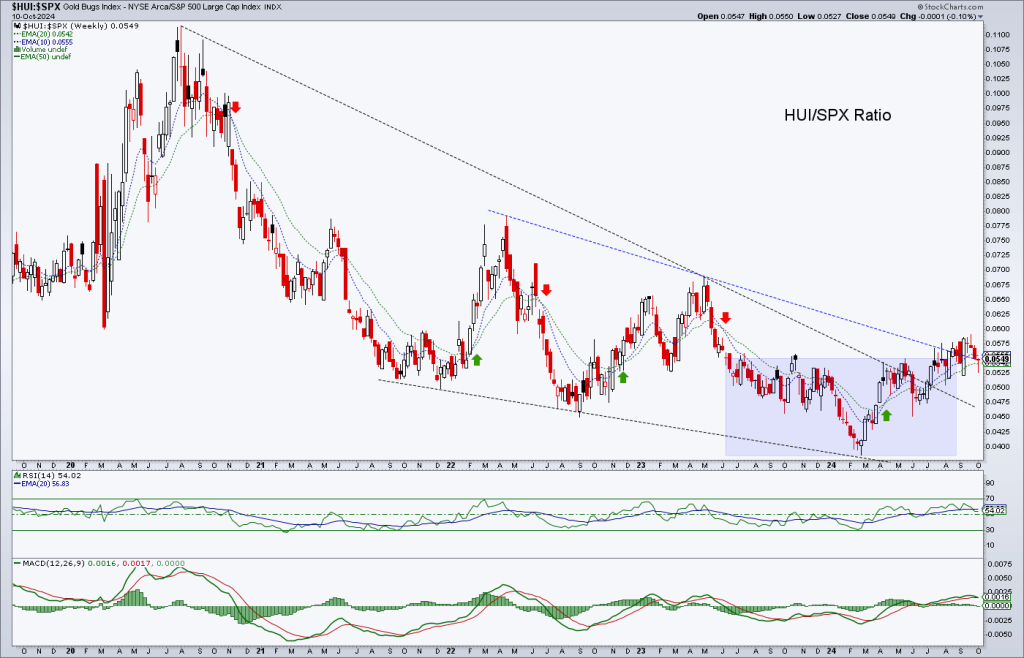

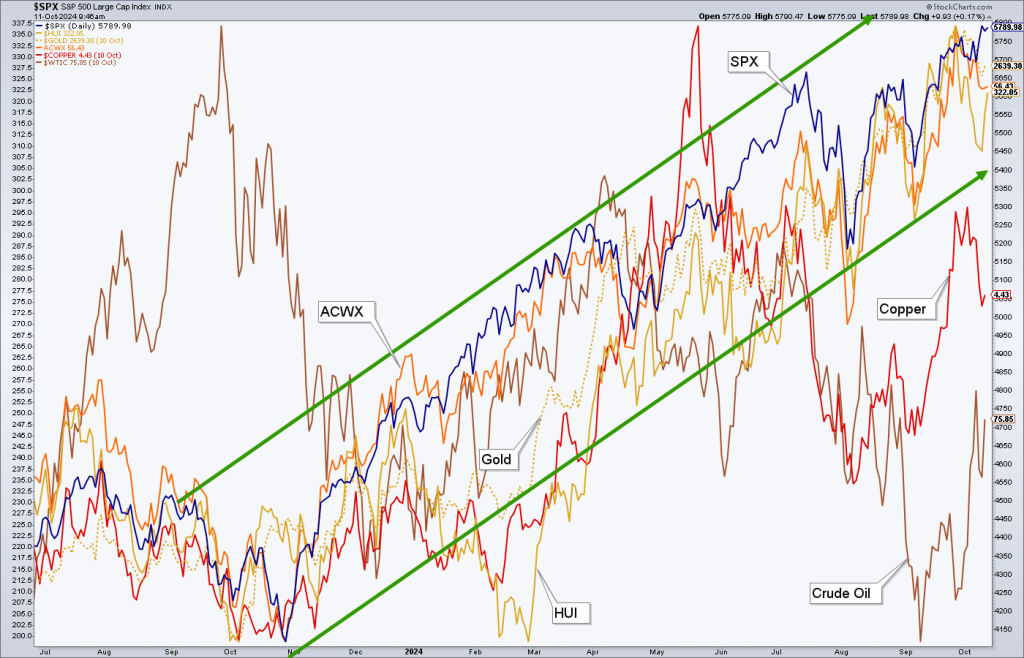

The interim problem for the price of gold (as opposed to the enduring value of gold) will be its current positive alignment with stocks (see the final chart below) and other aspects of the broad asset rally that several of our indicators (beyond the scope of this article, but all over the recent history of nftrh.com’s public posts) signal to be doomed, with only the timing at issue.

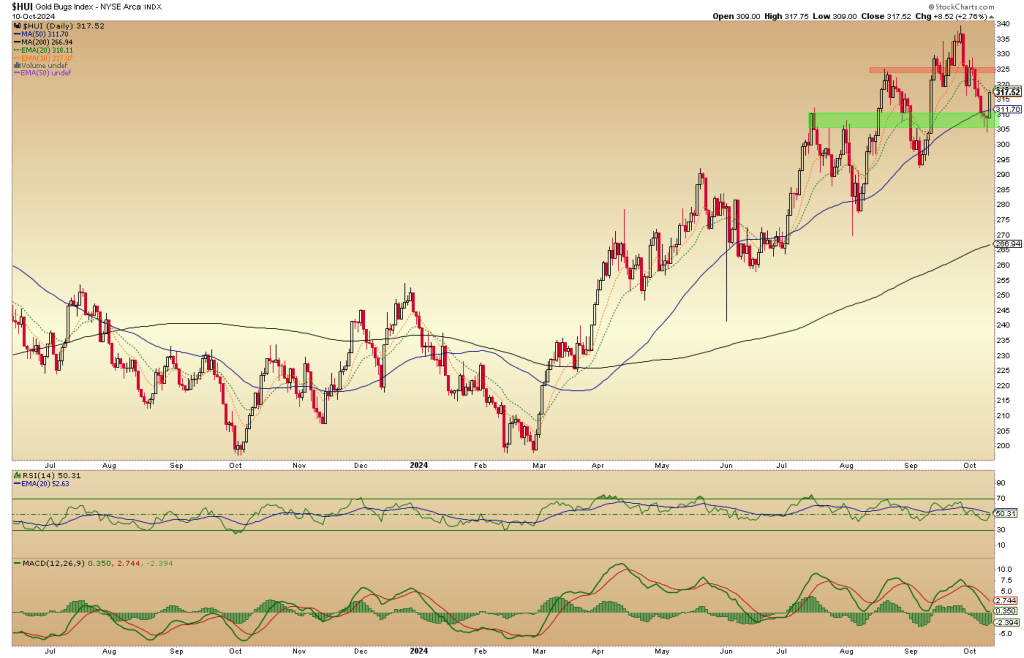

On to the miners, they too are in alignment with the broad rally and like gold, have been among its leaders since March. As you can see, ARCA Gold BUGS' leadership to SPX has bent, but not broken recently.

Nominally, HUI (daily) continues to stair-step the rally we’ve been managing since March. NFTRH subscribers were advised on September 29 (NFTRH 829) that a pullback within the uptrend could test the 50 day average, which it has now done, thus far successfully. From #829:

Nominal HUI (daily) got bonked on Friday, to no technical damage. It could continue to pull back to the 50 day average (308) and associated lateral support, and still be fully intact to the rally.

Thursday’s move up is a strong hint that the rally could now resume. HUI may have been in decline since September 27, but it was within an orderly stair-step up along the SMA 50. Imagine that, the words “HUI” (gold stocks) and “orderly” appearing in the same sentence. Well, it is a new macro after all.

If you have read me over the course of 2024, you know that we have upside targets in play, the next of which (375+) could be registered on the next leg up. Beyond that, we leave 500 +/- for future management because of the currently aligned state of the precious metals complex (watch silver, which is not a feature of this article, but which is anticipated to be a leader off its bullish structures on weekly and monthly charts) with the broad election year global rally.

Apologies in advance about what this chart does to your eyes, but its point is that for year now gold and the miners (HUI) have been in the same rally as the stock market, SPX (US) and ACWX (global, ex-US). This is due to the disinflationary winds now blowing… blowing away the hawkish Fed and blowing in the doves. Copper and oil are also on script as they are traditional cyclical inflation trades and with inflation dissipating and the economy lamely intact, they have under-performed. But there is a scenario we are tracking where commodities can bottom and play some catch-up before the whole broad mess wheezes and rolls over. Meanwhile, our “to or through the election” call continues to look more than viable.

Bottom Line

Although we have not included the stunningly beautiful longer-term weekly and monthly charts of HUI and silver, they are and have been bullish for much of the year and especially of late (HUI, for example, busted its 4+ year long corrective channel in August, signaling the next bull leg up). But the correlation to stock markets paints the precious metals as vulnerable to the coming top in stocks, per multiple indicators flashing……CODE RED.

But that is the future. Today we are managing a bull market in gold that has been in play since 2000 and a bull market in gold stocks (HUI) in play since 2016. We are managing the next leg of that gold stock bull market with some very nice upside targets. But part of that management must include the macro situation of asset market uniformity.

In other words, while I expect the gold mining industry to leverage gold’s place within a post-bubble macro to the upside (and to the surprise of many), the miners are no yet unique in the macro. Hence, they will be vulnerable to the broad top our indicators say is out ahead. Could be weeks, more likely it’ll be months, potentially well into 2025. But it’s coming and that will be the end of the first phase of the precious metals bull market within the new macro (reference the 30yr yield “Continuum” chart above).

After whatever disturbance visits the sector when the broad markets top out for good, the precious metals will then be set free as a unique asset class with the contrary sentiment benefit of the masses’ disregard for gold and especially, gold stocks. Won’t they be surprised when the miners rise from the ashes of the next possibly vicious correction and lead gold in a secular bull phase as the bubble makers fade to the dustbin of history?

The above represents my personal financial market Utopia. To see if it comes true, we may have to wait a few years. But the macro has changed, and there are going to be some consequences, unexpected by a vast majority still tethered to the old rules and ways of doing things.