After-hours movers: Broadcom, lululemon, Costco and more

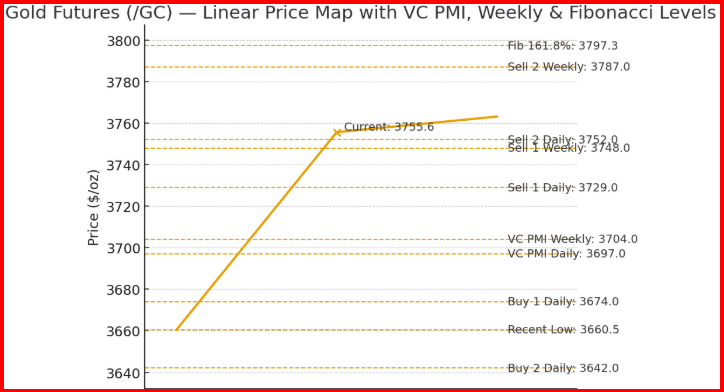

The gold futures market has entered a decisive phase of its short-term and intermediate-term structure. At the core of today’s action lies the Variable Changing Price Momentum Indicator (VC PMI), which defines the immediate trading map. With gold trading near 3755, the market is testing the convergence of daily and weekly resistance levels that align with both Fibonacci retracements and Gann cycle harmonics.

From a short-term perspective, the market staged a sharp recovery from Thursday’s low of 3660.5, which coincided with the Buy 2 Daily level of 3642 and the Buy 2 Weekly level of 3621. This low activated a strong mean-reversion setup, propelling prices back toward the daily and weekly pivot zones of 3697–3704. The breakout above these pivots confirmed bullish momentum and set the stage for testing the overhead supply at the Sell 1 Daily (3729) and Sell 2 Daily (3752) levels. As of this writing, the market is pressing directly into this critical band, which also includes the Sell 1 Weekly (3748). This alignment represents a significant resistance cluster.

From a 30-day Gann cycle perspective, gold appears to have transitioned from a mid-cycle low toward an advancing phase that will extend into the next cycle high projected around October 17, 2025. This 30-day window suggests continued upward pressure, provided that support holds above the daily pivot (3697). The immediate objective within this cycle expansion is the Sell 2 Weekly at 3787, while the 161.8% Fibonacci extension at 3797 marks the outer boundary of this rally phase.

Overlaying the 360-day cycle, which is dominant in setting long-term price direction, we are approaching a structural inversion point. The previous cycle pivot low occurred in late September 2024, establishing the foundation for a year-long bullish phase. With the 360-day cycle window maturing into late September 2025, the market is now in the process of either validating a long-term continuation breakout or exhausting into a distribution top. The 3797 extension aligns closely with Square of 9 harmonic resistance, suggesting that price could meet geometric resistance precisely as the cycle matures.

In conclusion, the convergence of VC PMI resistance (3748–3752), the 30-day advancing cycle, and the 360-day maturity phase creates a critical inflection point. Sustaining momentum above 3752 opens the path to 3787–3797, but failure to hold this breakout could invite sharp mean-reversion back toward 3700. Traders should monitor this resistance band as a key determinant of whether the short-term escape velocity translates into a long-term breakout—or exhausts into a cyclical inversion.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.