After-hours movers: Broadcom, lululemon, Costco and more

On analysis of the movements of the gold futures in different time charts, since Fed’s cautious tone, however, prompted some investors to take profits after bullion’s surge to highs as the markets are facing an “unusual” economic situation as the Federal Reserve embarks on a potential series of interest rate reductions on Wednesday while the Japan left the interest rates unchanged as expected on Friday amid increased uncertainty over the country’s political futures and the effects of U.S. trade tariffs on the economy.

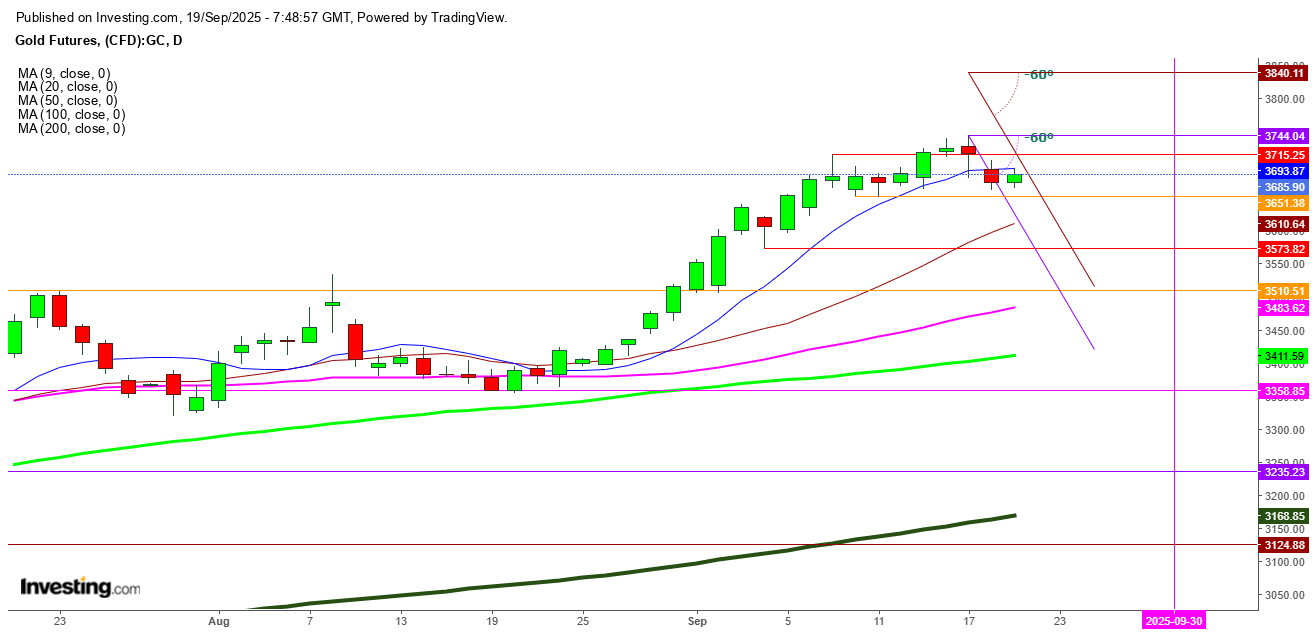

Gold prices traded in tight ranges on Thursday, slipping from record highs in the wake of the Federal Reserve lowering interest rates and signaling a measured approach to future policy easing, but gold futures are facing stiff resistance at the 9 DMA despite finding some support at $3664 on Friday.

In a daily chart, gold futures look ready to move downward due to surging bearish pressure at the current prices, and a breakdown below the immediate support at $3664 could accelerate the selling spree to test the next support at the 20 DMA at $3610 on Friday.

Undoubtedly, if the gold futures find a sustainable move below the second support at the 20 DMA, the next target for the gold bears could be at the 50 DMA at $3483, from where some bounce back could be there, but exhaustion is likely to follow if the futures find a breakdown below this significant support on Friday or next Monday.

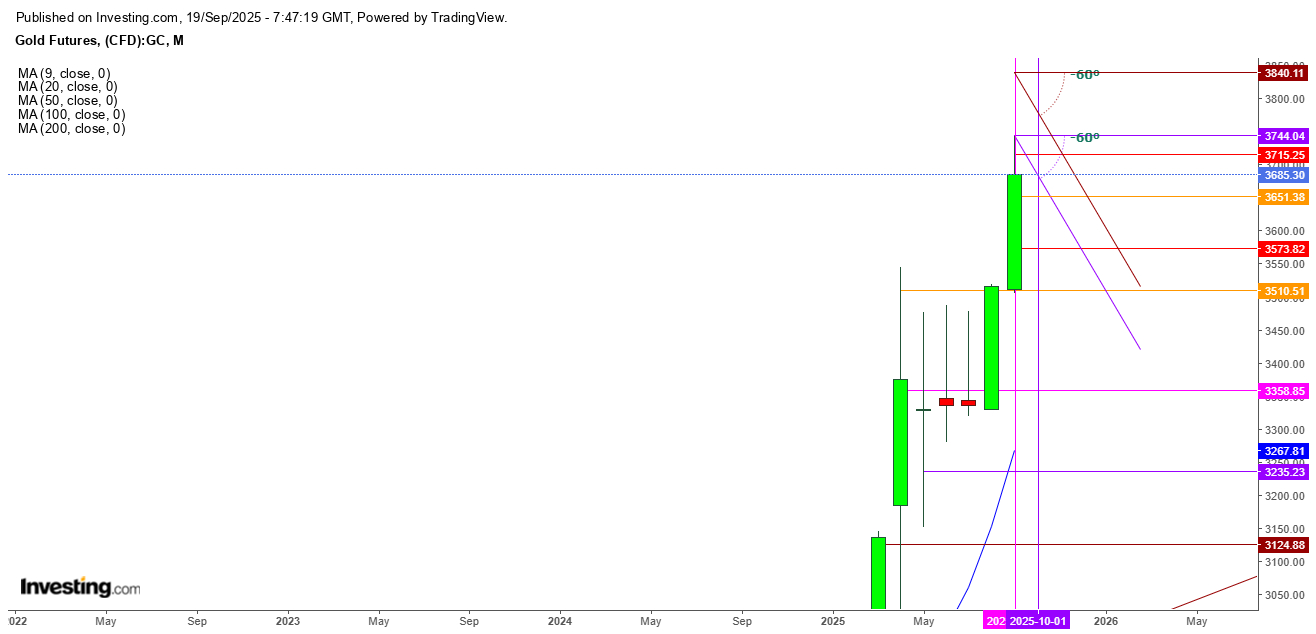

In a weekly chart, gold futures have formed a bearish hammer this week, which looks evident enough to keep the selling spree during the next week, as the next week could experience the formation of a confirmatory bearish candle to confirm the further directional trend of the yellow metal.

In a monthly chart, extensive pressure at the current level looks evident enough, as after testing a record high at $3744, exhaustion has pushed the futures up to $3685, which ensures more exhaustion is likely to continue to push the futures below the immediate support at $3651 and the next support at $3573.

Undoubtedly, next ten trading sessions could be decisive for the gold futures as the upcoming news flow till the end of this month will definitely result in volatile move but if the gold futures close this month below the significant support at $3573 could confirm the quantum of bearish pressure during the October despite the announcement of two more interest rate cuts by the Federal Reserve in its next two meetings.

Disclaimer: Readers are advised to take any position in gold futures at their own risk, as this analysis is based only on observations.