Bill Gross warns on gold momentum as regional bank stocks tumble

In examining the gold weekly continuation chart, a clear vibrational pattern emerges around the September window. By anchoring both the 30-day short-term trading cycle and the 360-day long-term cycle to September 28, we uncover a repeating rhythm of corrective lows that shape the trajectory of the market. This confluence of time and price geometry has historically provided traders with high-probability opportunities to identify pivot points and position ahead of significant trends.

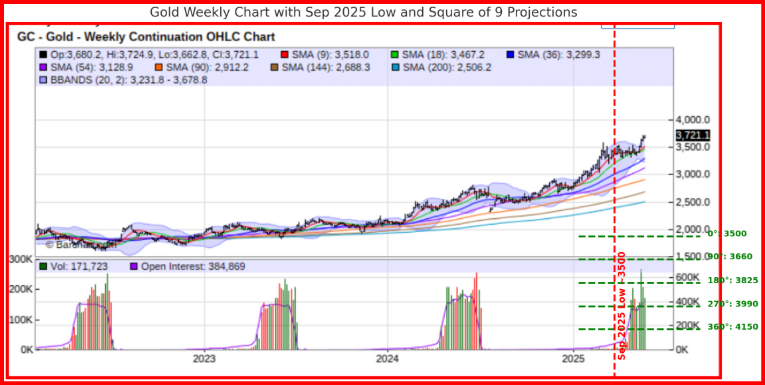

I’ve overlaid the Square of 9 resistance projections onto your gold chart, anchored from the Sep 2025 low (~3500):

- Sep 2025 Low (red dashed vertical line) → pivot anchor at ~3500.

- Green dashed horizontal lines → projected Square of 9 resistance levels:

- 0°: 3500 (anchor)

- 90°: ~3660

- 180°: ~3825

- 270°: ~3990

- 360°: ~4150

- 0°: 3500 (anchor)

The cycle structure shows that each September low has unfolded progressively higher, confirming the long-term bullish momentum embedded in this market. The September 2022 low anchored near 2400, establishing a major base of support after a period of consolidation. The following year, the September 2023 cycle low printed near 2500, again respecting the rising trajectory of gold’s secular uptrend. By September 2024, the cycle low had advanced to 3000, and in September 2025 the current pivot has emerged in the 3500 zone, underscoring the steady climb in both time and price dimensions.

This alignment of higher lows across consecutive September windows reveals the interaction of mean reversion with cyclical time forces. The 30-day cycle, while shorter in vibration, often identifies minor corrective lows within the broader annual structure. The 360-day cycle, by contrast, carries the weight of long-term accumulation, reflecting the deeper forces of monetary policy, global liquidity, and macroeconomic uncertainty. When both cycles synchronize into a September inflection, as they consistently have over the past four years, the resulting pivot becomes a structural foundation for the next advance.

As we approach the current September 2025 window, the implications are twofold. First, the established rhythm suggests a strong probability that the recent low in the 3500 zone will hold as the dominant support. This reinforces the bullish bias, as the market continues to climb along its rising time-and-price spiral. Second, the cyclical law of vibration suggests that the following months could usher in renewed upside momentum, as reversion from the cycle low projects a test of higher resistance levels.

For traders, the lesson is clear: the September lows serve as an anchor of both time and price, offering a reliable framework to align short-term trades with long-term positioning. By respecting the geometry of the 30- and 360-day cycles, one can better navigate volatility and capture the enduring trend that gold continues to reflect in this historic moment.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.