Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

Gold futures have been trading with strong volatility this past week, carving out a technical structure that highlights both short-term accumulation and the potential for a broader continuation rally. The market reached a weekly low of 3660.5, which coincided almost exactly with the Buy 2 Daily level at 3642 and the Buy 2 Weekly level at 3621.

This confluence created a powerful support base and validated demand at the lower boundary of the VC PMI mean reversion framework. The rally from this zone quickly regained the Buy 1 Daily pivot at 3674 and extended through the VC PMI Weekly pivot at 3704, signaling that momentum had shifted back toward the bullish side.

On the upside, gold tested the Sell 1 Daily level at 3729 and the intraday high at 3744, just shy of the Sell 1 Weekly level at 3748. This alignment reinforces the VC PMI principle that supply pressure emerges within the upper fractals of distribution. The 15-minute chart shows price rejecting slightly from these resistance bands, with the Sell 2 Daily at 3752 and the Sell 2 Weekly at 3787 as the next potential targets if momentum persists.

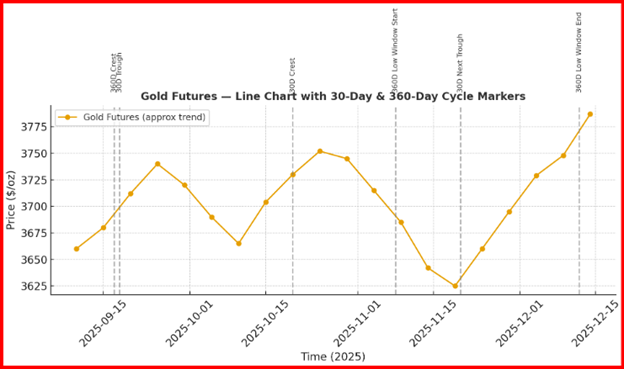

Overlaying this immediate structure, the 30-day Gann cycle appears to have pivoted higher from the recent trough, giving the rally "escape velocity" into the next phase of distribution. The cycle suggests continuation strength toward late September, which may align with testing the Sell 2 zones.

At the same time, the broader 360-day cycle remains in play, with its influence pointing to a long-term accumulation phase that still supports higher prices into year-end. The convergence of these cycles indicates that pullbacks toward the 3665–3642 support band may offer opportunities to re-enter long positions within the mean reversion strategy.

Time Cycles for Gold Futures

30-Day Trading Cycle

This short-term cycle often defines near-term swing highs and lows within the VC PMI framework:

- Aug 20, 2025 – Last 30-day cycle trough (aligned with Buy 2 zone validation)

- Sep 19, 2025 – Current 30-day pivot date, marking a cycle low at 3660.5 and rally toward 3744

- Oct 19–21, 2025 – Next expected 30-day turning point (likely distribution window into Sell 2 Weekly range 3752–3787)

- Nov 18–20, 2025 – Following 30-day cycle low/high window

(±2 days variance around cycle dates should be allowed for market action.)

360-Day Gann Cycle

This super-cycle frames the macro turning points for gold, often converging with Square of 9 harmonics and VC PMI long-term pivots:

- Nov 14, 2024 – Major low at 2541 (cycle anchor)

- Sep 17, 2025 – Current cycle high at 3744 (aligning with Sell 1 Weekly 3748)

- Sep 28, 2025 – Cycle pivot closing date (reference 3700 close for calculation)

- Nov 2025 – Jan 2026 – Anticipated long-term distribution window

- Nov 2026 – Next projected cycle low (completion of 360-day harmonic sequence)

Cycle Convergence

- The 30-day cycle (Oct 19–21) aligns with the distribution phase of the 360-day cycle, suggesting a high-probability turning point into resistance (Sell 2 Daily 3752 / Sell 2 Weekly 3787).

- The 360-day cycle implies that these shorter cycles are unfolding inside a larger bullish arc that began in Nov 2024, still projecting higher price harmonics (Square of 9: 3797, 3888) before the next long-term correction window in late 2025–early 2026.

Interpretation:

The convergence of the 30-day and 360-day cycles suggests gold is in an accumulation-to-distribution transition, where pullbacks toward 3665–3642 should be seen as tactical buying opportunities, while 3748–3787 remains a profit-taking zone until momentum confirms breakout into the 3797–3888 Square of 9 band.

Square‑of‑Nine Harmonics

By anchoring the Square‑of‑Nine wheel at 3712 (Daily Pivot), harmonic spokes align directly with VC PMI levels:

- +45° ≈ 3729 → Sell 1 Daily

- +90° ≈ 3752 → Sell 2 Daily

- −45° ≈ 3674 → Buy 1 Daily

- −90° ≈ 3642 → Buy 2 Daily

The weekly pivots also fall within this lattice: 3665, 3704, 3748, 3787, with 3797 emerging as a Fibonacci 161.8% extension confluence. These harmonic alignments reinforce the probability of reversals or accelerations at each spoke.

Conclusion

Gold futures are at a pivotal juncture where short-term momentum and long-term cycles are converging. The 30-day cycle that pivoted on Sep 19 at 3660.5 has launched a rally into the Sell 1 Weekly band at 3748, setting the stage for a test of the Sell 2 levels at 3752–3787 into the next cycle window (Oct 19–21, 2025).

At the same time, the 360-day Gann cycle that began at the Nov 14, 2024 low (2541) continues to project upward harmonics, reinforcing the bullish framework into year-end. The alignment of these cycles with the Square of 9 resistances (3797, 3888) highlights both the opportunity and the risk: rallies into these zones may attract profit-taking, while pullbacks into 3665–3642 should be seen as tactical re-entry levels within the mean reversion strategy.

In essence, gold remains in an accumulation-to-distribution transition: the short-term cycles are fueling momentum higher, while the longer-term super-cycle suggests that higher price harmonics remain in play before the next major corrective phase develops in late 2025 to early 2026.

Traders should remain flexible, executing around VC PMI levels with cycle timing in mind—accumulating on pullbacks, distributing into resistance, and preparing for a potential breakout beyond the 3797–3888 Square of 9 band.

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.