Navitas stock soars as company advances 800V tech for NVIDIA AI platforms

After reviewing the movements of gold futures in different time frames, I find that the US Dollar maintains its recovery path following the United States and the European Union’s framework agreement on Sunday, which reduces the threat of higher tariffs.

Undoubtedly, this development added one more leg to easing concerns over the reciprocal tariffs by the trading partners of the U.S., after the U.S.-Japan trade deal but still some skepticism remains on the trade relations between the U.S. and China since as China’s use of petroyuan for buying Oil from Saudi Arabia and some other gulf countries which accept local currencies to sell their oil.

I find that U.S. President Donald Trump’s preferred goal is to keep the US dollar stronger. At the same time, he will deal with the Middle East, China, and Russia before the trade tariff deadline of August 1, or if he doesn’t complete some more deals within this time limit, this deadline will have to be extended for some other dates, and this will raise skepticism among the investors.

No doubt, such a dilemma still prevails in the markets, which could end only with a clear-cut indication of Trump’s next move on the trade front. If he steps back this time, markets could react overly as the surging strength of the US dollar and weakening demand for gold, picking up the directional momentum.

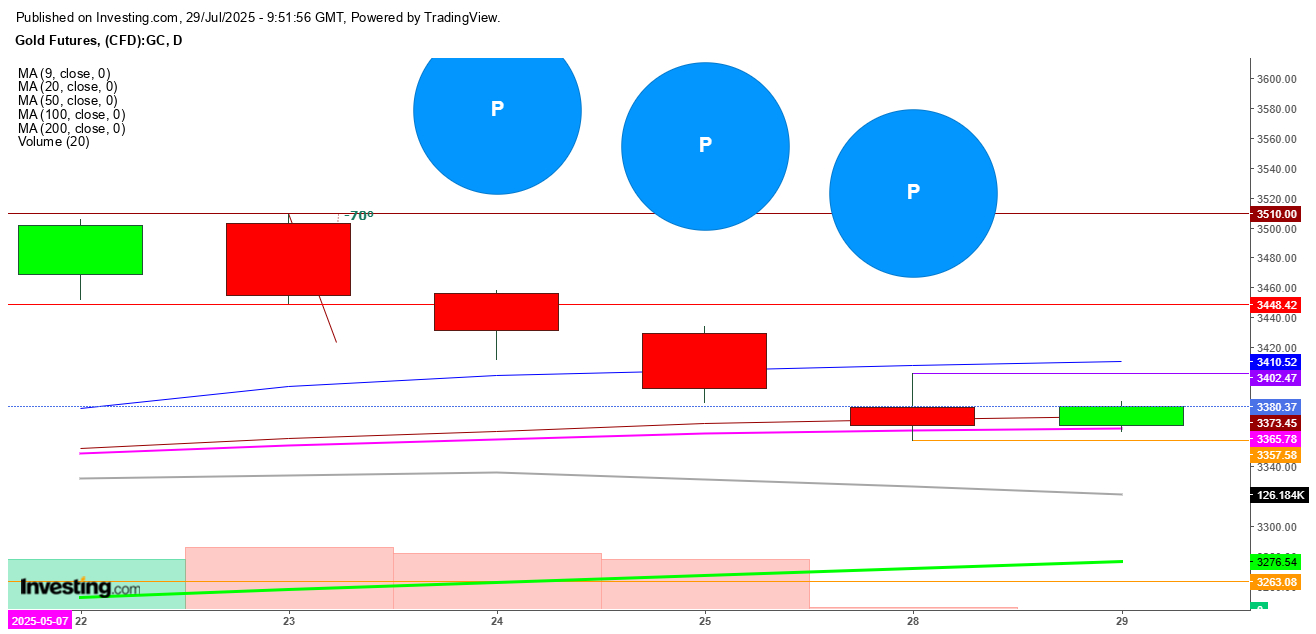

Despite some reversal on Tuesday, after a 4-days fall, gold futures are only trying to defend the immediate support at the 50 DMA at $3365 where a breakdown is expected today as the US dollar Index remained in positive territory after jumping more than 1% on Monday and this surge in dollar strength look evident enough to push the gold futures below this immediate support.

Undoubtedly, a stronger dollar makes gold more expensive for overseas buyers and tends to weigh on demand for the yellow metal, as this non-yield asset attracts bears while it has already lost its safe-haven potential due to higher prices.

Technical Levels to Watch

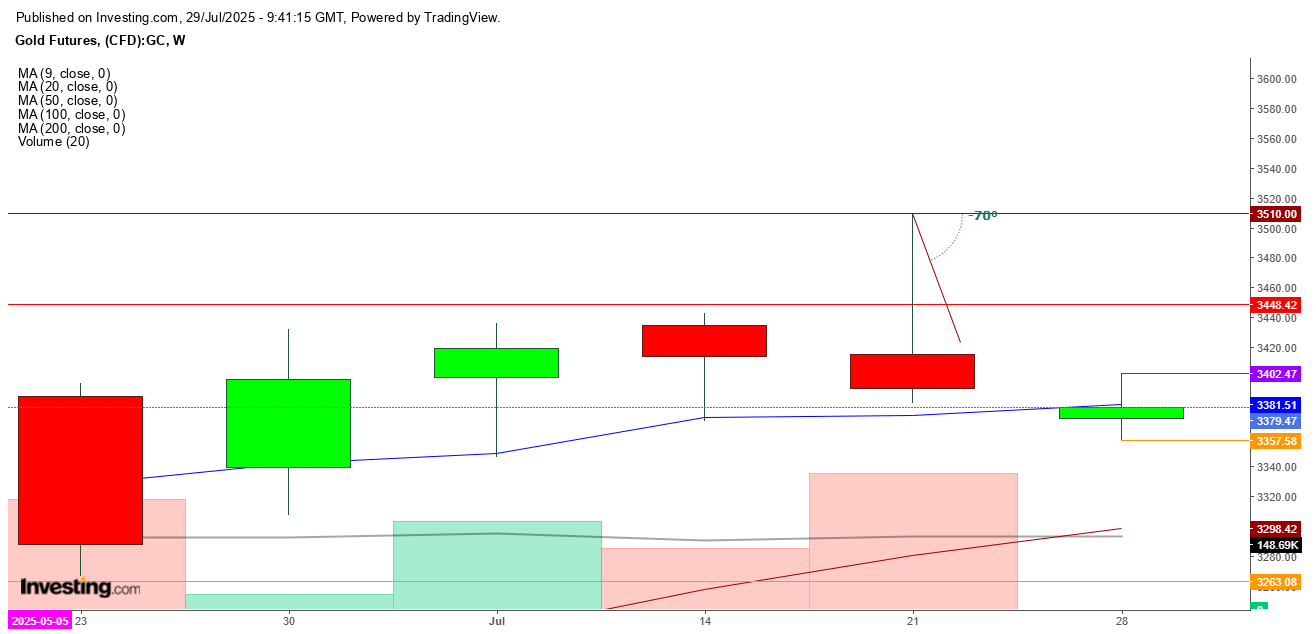

In the weekly chart, gold futures found sharp sell off after testing a high at $3508 last week before closing the week at $3391, resulted in the formation of an exhaustive hammer while this week’s candle looks evident enough to remain under bearish pressure where a breakdown below the immediate support at $3357 will confirm the advent of a selling spree this week.

Inversely, any upward move in gold futures above the immediate resistance at $3402 will attract sellers to remain on top as the gold futures are still trading above the significant resistance at the 9 DMA at $3381.

In the daily chart, gold futures are just trying to hold the immediate support at the 50 DMA at $3365, where a breakdown could push the futures to test the next support at the 100 DMA at $3276.

Inversely, any upward move will face stiff resistance at the 9 DMA at $3410, as the formation of ‘three black crows’ shows the continuation of a bearish reversal this week.

Disclaimer: Readers are advised to take any position in gold at their own risk, as this analysis is only based on observations.