Walmart halts H-1B visa offers amid Trump’s $100,000 fee increase - Bloomberg

“Bring it on,” the long-gold crowd seems to be telling anyone disputing the yellow metal’s ability to act as a hedge against untoward US inflation expected this year.

After benchmark 10-year Treasury yields hit 1.8%—a more than two-year high—over the past 48 hours, and drifted not far from there, gold climbed back above the $1,800 an-ounce support. The yellow metal's resilience has surprised even some long-time observers.

Anyone who has watched the yield-gold correlation long enough will know how toxic a surge in real rates can be to prices of the precious metal.

All charts courtesy of skcharting.com

Tuesday can be considered an exceptional day for both after Federal Reserve Chair Jerome Powell managed to breathe calm into the financial markets by affirming that there will be rate hikes in 2022, without giving any timing or frequency. Powell did repeat the “median expectation of three” hikes cited by the Fed in December, a number that could always change.

Stocks on Wall Street had their first all-round positive day in more than a week after Powell’s charm-offensive, as yields backed off and the dollar dropped, allowing gold to rise 1% on the day.

Despite Tuesday's performance, gold’s actions since the start of the year have been striking as it clung to, lost, then regained its $1,800 footing.

At the time of writing, gold’s most active contract on New York’s COMEX, February, was up 1.7% on the week—recouping point-for-point what it had lost for all of last week (which, incidentally, marked the sharpest weekly slide since November).

While it’s virtually impossible at this juncture to say if the momentum will continue, two things seem clear:

- Gold’s long-only crowd is determined to profit from the runaway inflation headed for the US this year.

- Gold’s standing as an inflation hedge is being propped up ahead of the December reading of the Consumer Price Index, scheduled for release today (8:30 AM ET US; 13:30 GMT, Jan. 12). Today's CPI data essentially flags the start of this year’s inflation watch calendar for the US in 2022.

Expectations are high that the data will show another spike for last month, after the 6.8% jump in the year to November, which already represented the fastest price growth rate in 40 years. Economists tracked by Investing.com are predicting a 7.1% year-on-year growth for December CPI.

Gold has always been touted as an inflation hedge. But it failed to live up to that standing several times last year as yields and the Dollar Index rallied instead on expectations of rate hikes.

“Given that expectations for an interest rate hike from the Fed in March are largely priced-in, there is scope for gold to pick up some additional demand on the back of any bearish corrections in the coming sessions,” precious metals strategist Anil Panchal wrote in a blog that appeared on the FXStreet portal.

“That will mean the US Dollar breaking below the aforementioned support near 95.50 in the coming days.”

“In doing so, the greenback could fall all the way back to test the 95 figure, opening scope for gold to test as high as $1,850.”

“Gold forecasts for the year are all over the place, with most economists/analysts anticipating weaker prices as higher interest rates and fresh record highs for equities might dent demand for the precious metal,” Ed Moya, analyst at online trading platform OANDA, said.

He noted, with wry humor though, that “the longer gold stays above $1,800, the more annoyed the shorts will become.”

Agreeing with the consensus of the majority, Moya said there was no clear reason why gold would outperform this year. But he also said it was unlikely that the back-end of the Treasury yield curve will go significantly higher once the Fed gets past the first couple of US rate hikes. That could work in gold’s favor, he contends. Moya explained:

“While the economy looks very strong this year, possibly headed for a GDP reading above 4%, next year could be a quick return to near 2% growth, which has it vulnerable to a wide range of risks.”

“As the Fed tightens conditions, we will see large pockets of froth struggle and the risks of inverting the curve will grow.”

Fitch Ratings, in a forecast released Tuesday, predicted that the Fed will raise rates twice this year and another four times next year.

News of rate hikes is almost always bad for gold—in 2021 it closed down 3.6% for its first annual dip in three years and the sharpest slump since 2015.

But analysts like FXStreet’s Panchal and OANDA’S Moya think that if the US inflation theme remains strong through 2022, then gold could even retrace 2020’s record highs above $2,100—a peak which, incidentally, came on the back of worries about price pressures as the US began spending trillions of dollars on pandemic relief.

The economy shrank by 3.5% in 2020 due to shutdowns and other disruptions caused by the COVID-19 pandemic. The Fed has projected a 5.5% growth for 2021 and 4% for 2022. The central bank’s problem though is inflation, which is running at four-decade highs as prices of almost everything have soared from the lows of the pandemic due to higher wage demands and supply chain disruptions.

The US will likely have more interest rate hikes over time if inflation continues to exceed forecasts, Powell told the Senate hearing on Tuesday. Adding:

“The economy no longer requires extremely accommodative policy.”

Even so, “we must be humble and nimble” with rate hikes, he said, citing the inconsistent pace of job gains as a worry despite the labor market reaching the Fed’s target of “maximum employment” through the December jobless rate of 3.9%.

Back to gold’s rally prospects: Even leaving aside soaring yields, there seems to be another problem—a wall of resistance for the yellow metal at $1,830.

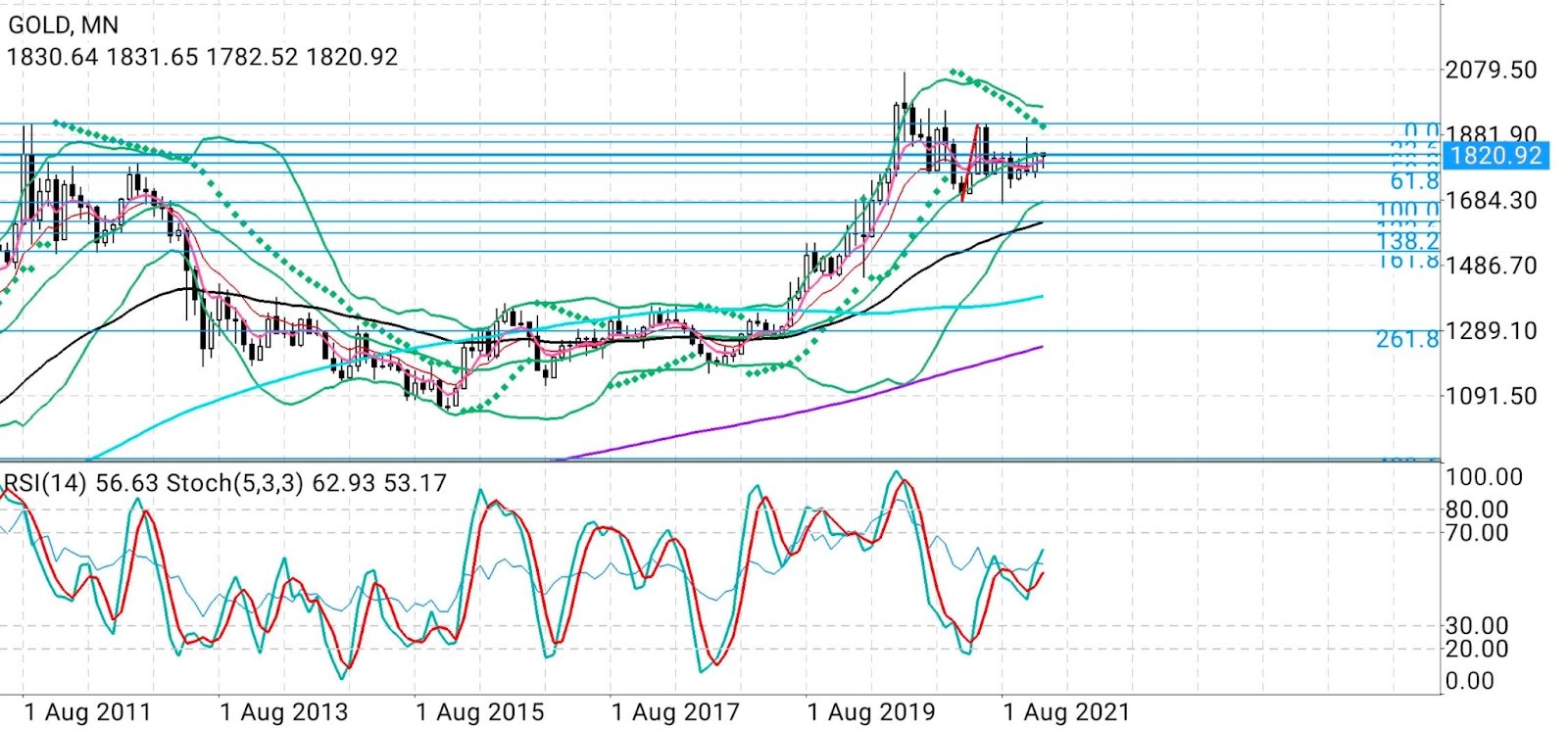

Like in its hedging mission against inflation, gold has also failed that $1,830 resistance test several times over the past few months, noted Sunil Kumar Dixit, chief technical strategist at skcharting.com. He observed that gold suffered concerted attacks from bears when it tested $1,831, tumbling to $1,782, before dip-buying brought it back to Tuesday’s close of above $1,820.

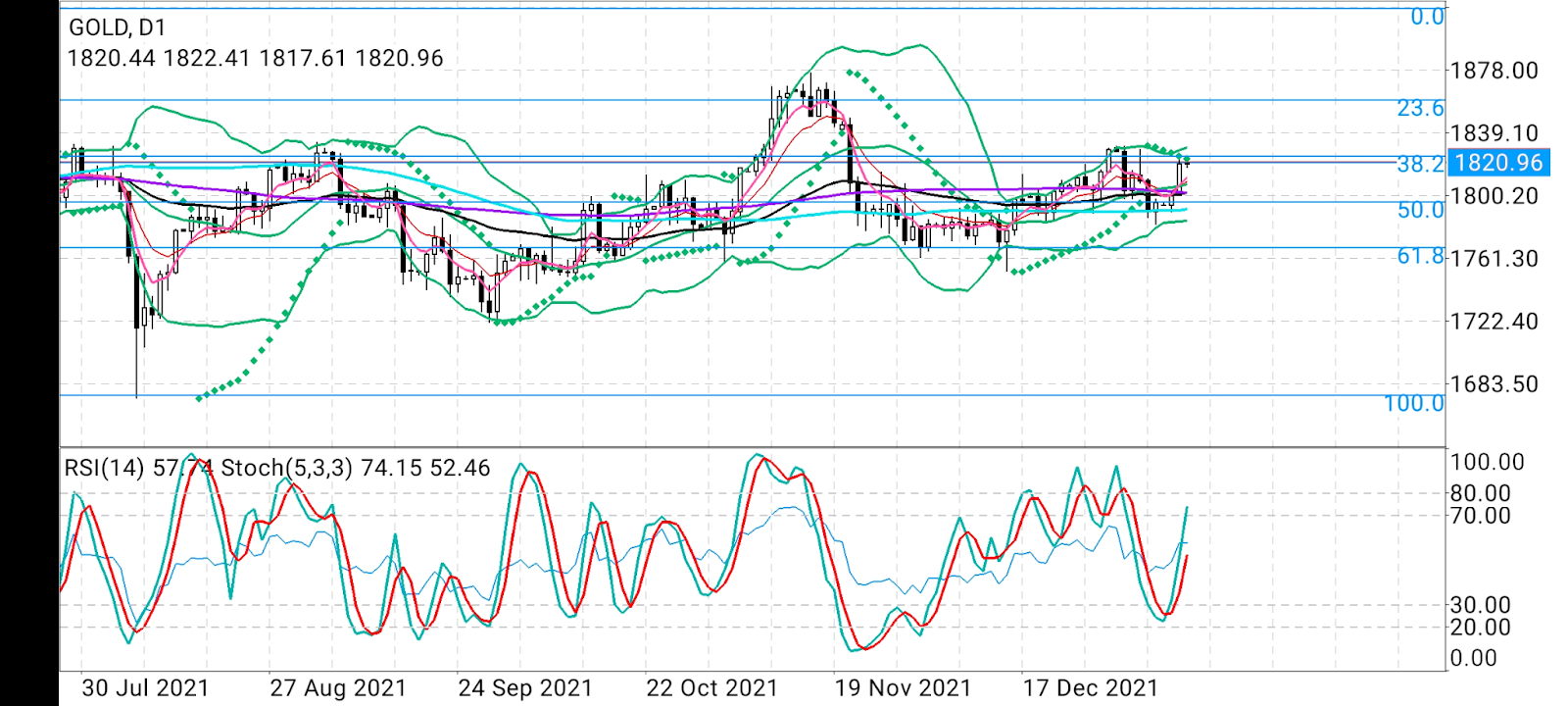

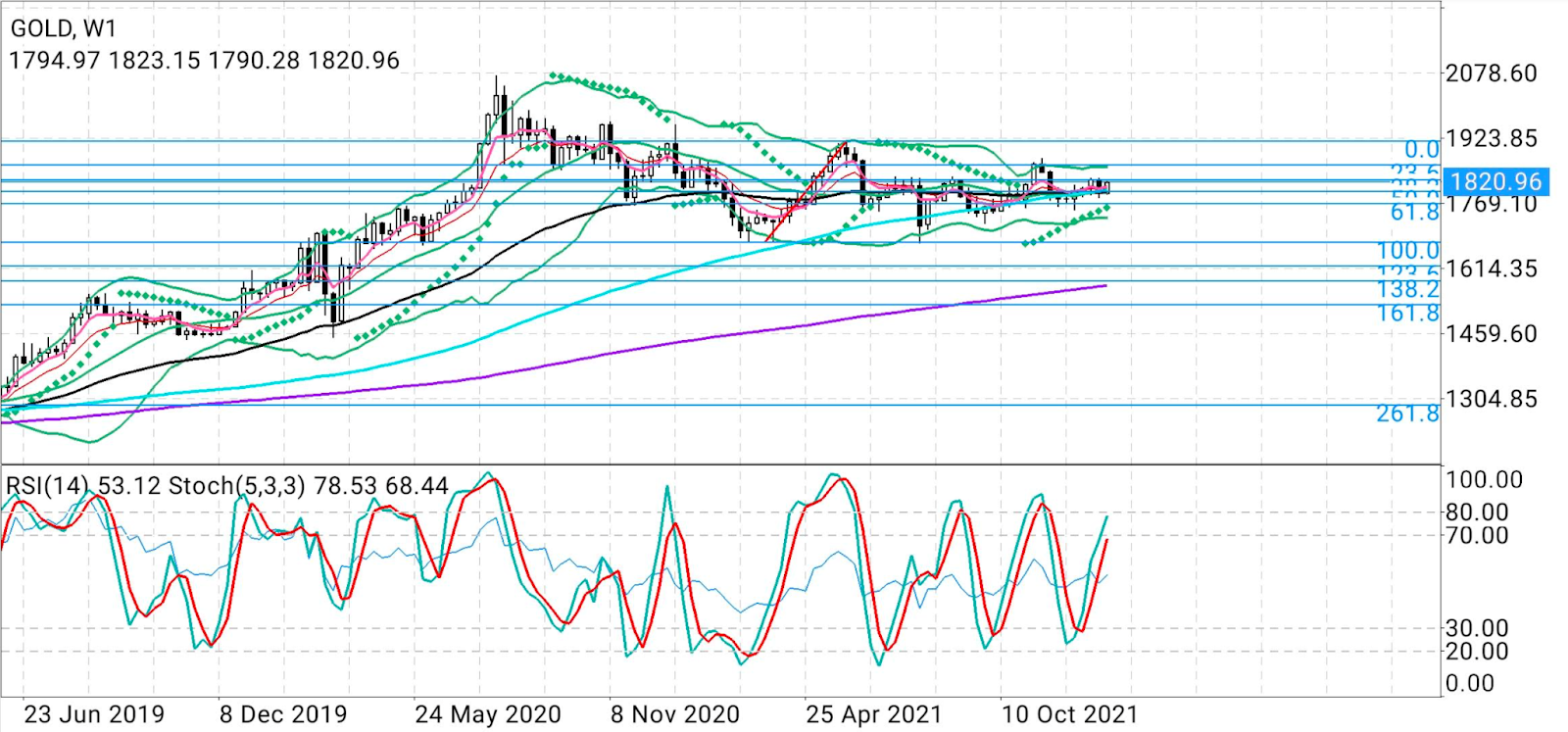

On its way up, gold should aim for $1,825 first, a level that marked a 38.2% Fibonacci retracement measured from the $1,678 low of March 2021 to the $1,916 high of May 2021, Dixit said.

On the heels of that, would come the stubborn resistance zone of $1,830-$1,835.

“Gold needs to clear this $1,830-$1,835 zone in order to maintain its bullish momentum, which targets the next leg higher 23.6% Fibonacci level of $1,860,” Dixit said.

He said the CPI data itself could cause volatility that sparks some sideways action in gold, pushing prices to support areas that include the 5-Day Exponential Moving Average of $1,811, the middle Bollinger Band® of $1,807 and the critically-important confluence of the 200-Day Simple Moving Average and the 50 Day EMA of $1,802.

“Stochastic positivity across the daily, weekly and monthly charts with readings of 72/52, 77/68, 62/53, respectively, and RSI readings of between 52 to 56 are all supportive for gold's upside to $1,860,” Dixit said.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.