Broadcom shares slide 4% as margins, OpenAI concerns overshadow strong earnings

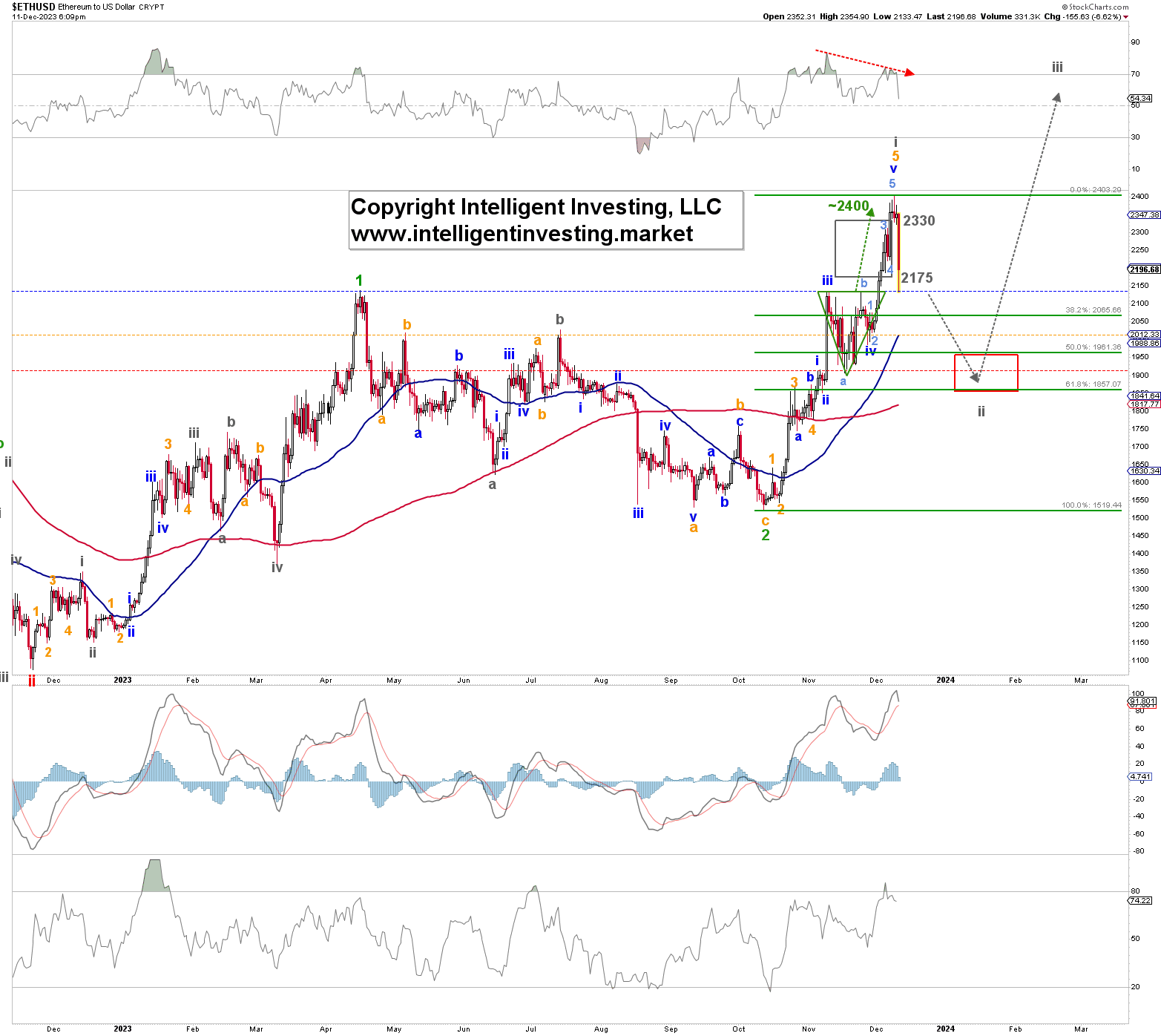

Over the last month, we have been anticipating a local top for ETH/USD at around ideally $2150-2330. On our previous update from two weeks ago, see here, we found by using the Elliott Wave Principle (EWP):

“… our forecast for a local around $2150+/-25 and the anticipated subsequent decline was correct. [But] we still need a daily close below $1910 to confirm this path (a pullback … to ideally around … $1770-1845).”

Fast forward, and ETH/USD did not close below $1910. Instead, Ethereum’s price exceeded the $2136 high we initially labeled as (grey) Wave-i. It then staged another rally, peaking at $2403 yesterday.

Although we already showed our premium members that as long as $1910 would hold, a breakout above $2136 could target $2400 on December 1, our initial assessment was not entirely correct. But, with today’s >7% drop, the largest in one day since the October low, grey W-i most likely completed only 3.1% above the ideal target zone set forth a month ago: still not a bad forecast. See Figure 1 below.

Figure 1. The daily resolution chart of ETH with several technical indicators Since corrections are often complex price patterns with lots of dips and rips (A, B, and C-waves), we must see a move below $2140 (blue-dotted horizontal line) to give further confirmation the local top we anticipate is in place. Moving below $2015 (orange-dotted horizontal line) can then allow for a drop- and full confirmation- to the red-dotted horizontal line at $1910.

Since corrections are often complex price patterns with lots of dips and rips (A, B, and C-waves), we must see a move below $2140 (blue-dotted horizontal line) to give further confirmation the local top we anticipate is in place. Moving below $2015 (orange-dotted horizontal line) can then allow for a drop- and full confirmation- to the red-dotted horizontal line at $1910.

Since ETH/USD reached higher ($2430 vs. $2136), we can also move the grey W-ii ideal target zone to $1900+/-50.

Once attained, Ethereum can launch into its “3rd of a 3rd wave” to new All-Time Highs. In the long term, the cryptocurrency must stay above the June 2022 low ($883), with a severe warning to the Bulls below the October 12 low at $1521, to allow this Bullish path to unfold.