Oil prices hold gains amid stalled Ukraine peace talks, Fed cut hopes

Semiconductor firms and ETFs are more than 50% of my investments in the Information Technology sector right now.

Why do I own such a compelling position in semiconductors? My logic is straightforward:

- We are already living in the Digital Age.

- The digitization, automation and robotization trends will only grow stronger.

- All these trends rely, more and more, on semiconductor chips.

- Because of current shortages, day traders have moved on to other, trendier, areas. Long term investors can accumulate today at eminently fair prices.

The "current" chip shortages mean that "current" sales will likely suffer in the short term. If a company in this industry, because of lower sales, shows lower earnings, most traders (who call themselves investors but are too easily spooked to have earned that designation!) will bolt at the first sign of lower quarterly earnings.

Seriously?

My readers and clients understand that 12 little weeks do not make or break a future for an industry that will only grow in demand. I have been buying, am buying now, and will continue to buy chip stocks. Chips may not become my largest single holding but they will continue to be the largest component of my allocation to tech.

You will likely have ample opportunity to join me in adding chip companies. Unlike many sectors and industries, earnings season for semiconductor manufacturers is spread out from October to at least mid-November.

My largest tech position is the Invesco Dynamic Semiconductors ETF (NYSE:PSI). That's deliberate.

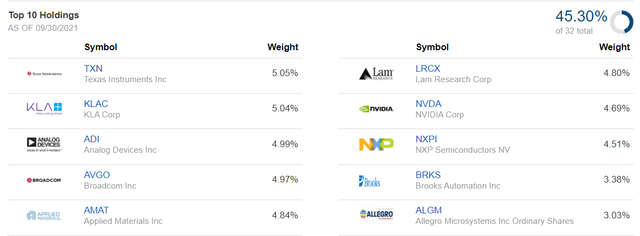

I believe PSI gives the best exposure to the entire industry writ large of any of the ETFs or single equities currently available. Here are the fund's top 10 holdings, which comprise about 45% of the portfolio: Texas Instruments (NASDAQ:TXN), KLA Corporation (NASDAQ:KLAC), Analog Devices (NASDAQ:ADI), Broadcom (NASDAQ:AVGO), Applied Materials (NASDAQ:AMAT), Lam Research (NASDAQ:LRCX), NVIDIA (NASDAQ:NVDA), NXP Semiconductors (NASDAQ:NXPI), Brooks Automation (NASDAQ:BRKS), Allegro Microsystems (NASDAQ:ALGM).

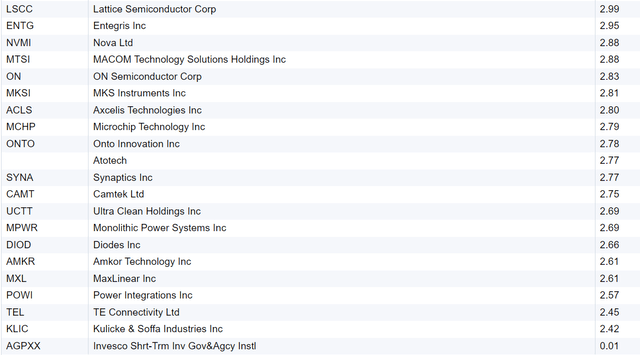

These are some of the best names in the business. The other 22 holdings are equally interesting. They are:

Source above graphs: Fidelity.com

There are some names missing here that I really like. But that's OK. Taiwan Semiconductor (NYSE:TSM) and United Microelectronics (NYSE:UMC) are already in my portfolio.

The nature of capital, capital formation and capitalism is that supply and demand will never reach perfect stasis, but they will always be moving in that direction, sometimes overshooting it, sometimes correcting below it. We are now in a phase where the demand for chips far outweighs the current supply, especially in some critical areas.

Supply will catch up to demand. Look beyond the last 12 weeks or the next 12 weeks and I believe you will agree that this is a steamroller similar to one of my other key themes, raw materials for the battery revolution.

The current need for chips will only grow larger as 5G, then 6G require ever smaller and ever more powerful chips, as networking grows more intense, as cloud computing gains even more, as vehicles demand more and more connectivity and lightning-fast response, and more.

I believe chipmakers are already ramping up production to "come closer" to meeting the ever-increasing demand. The latest month we have figures for, delivered Oct. 5, was for August. As the head of the Semiconductor Industry Association said then:

“Global semiconductor sales remained strong in August, increasing year-to-year across all regional markets and major product categories,” said John Neuffer, SIA president and CEO.

“Chip shipments have reached record totals in recent months as the industry ramps up production to address continuing high demand.”

I especially like that KLA, Applied Materials and Lam Research are among PSI's Top 10 holdings. These three are among the very best of the semiconductor capital equipment makers. They stand to benefit most as semiconductor manufacturers invest heavily in new plants and equipment to meet demand.

Are there risks with this ETF?

Of course there are risks. There are risks with any investment, including the risk of investing all your money underneath your mattress (and watching its value decline year by year.)

Diversification risk is one hazard—while there are 32 different companies in the portfolio, they are all aligned with the continued success of a single industry, semiconductor companies.

If demand increases faster than supply can be provided through the various shipping bottlenecks, there will be short-term disinterest in the industry. But around here, we don't think short term.

The markets themselves are at or near all-time highs. In an extended market sell-off, this ETF would decline as well.

Bonus Round

For those who are currently too underweight semiconductors or whose portfolios are large enough to want a little more, you might consider what I am doing for my own portfolio. I am also buying the VanEck Semiconductor ETF (NASDAQ:SMH).

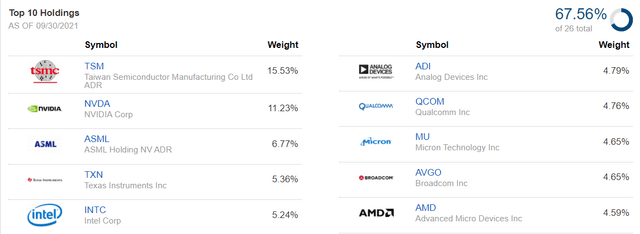

Take a look back a few paragraphs at the top holdings of PSI. Now take a look at the Top 10 holdings of SMH:

Source: Fidelity.com

The good news here is that there is little overlap between the holdings of the two ETFs. The biggest reason is the outsized weighting, based upon capitalization, of the #1 SMH position, Taiwan Semiconductor.

The other difference between the two is that SMH is primarily a large cap fund, with 92% of its holdings fitting that description. PSI is much more balanced between all four market cap categories.

Either way—owning one or if you're using both—I suggest this kind of diversification for your due diligence before you decide to place all your bets on 24 Red (that is, all on one stock). A combination of PSI and SMH will provide you with superb representation across what I believe are the best companies in the business.