Bitcoin price today: falls to 2-week low below $113k ahead of Fed Jackson Hole

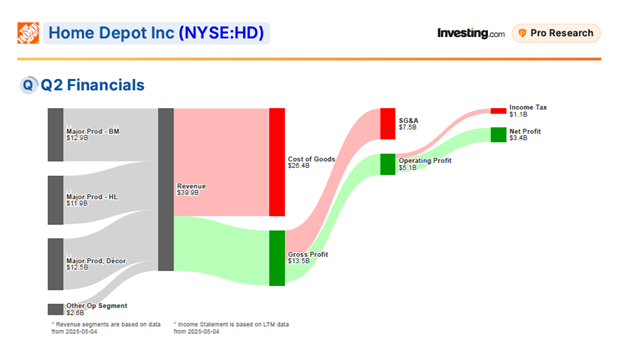

Demand for home-improvement products is closely aligned with housing-market fundamentals. Because many homeowners renovate prior to listing a property or soon after purchase, the current stagnation in the housing market has adversely affected The Home Depot (NYSE:HD). The company’s sales growth has been lackluster for several years, and the second quarter is unlikely to diverge from this trend.

Key Highlights:

- Foot-traffic data from Placer.ai show Home Depot store visits fell 2.2% year over year in the second quarter.

- FactSet consensus estimates same-store sales will rise 1.3% for the quarter—an improvement from a 0.3% decline in the April quarter, but still below the level that would indicate a sustained recovery in home improvement.

- Analysts forecast that Home Depot will report adjusted second-quarter earnings of $4.72 per share on $45.4 billion in sales according to FactSet consensus estimates.

- According to credit card purchase data from Affinity Solutions, Home Depot sales remained approximately flat year-over-year in May and July, while experiencing a 3% decline in June.

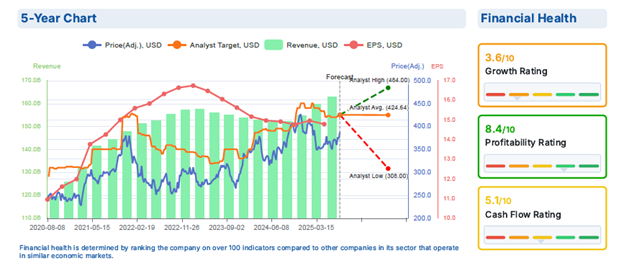

- An analyst from Stifel reaffirmed a ’buy’ rating for Home Depot, raising the price target from $425.00 to $432.00. Prior to this update, Home Depot held 25 buy ratings, 11 hold ratings, and 1 sell rating.

HD Q2 2025 earnings before market at 6:00 AM Tuesday August 19, 2025

|

HD Earnings Statistics since Q2 2012 |

|||

|

EPS |

1W % move post earnings |

2W % move post earnings |

1M % move post earnings |

|

BEATS 47 |

0.38% |

-0.17% |

2.52% |

|

MISSES 3 |

-1.17% |

2.52% |

3.87% |

|

Analyst Ratings |

|||

|

SOURCE |

BUY |

HOLD |

SELL |

|

Refinitiv |

26 |

13 |

1 |

|

TipRanks |

19 |

6 |

0 |

|

Earnings Expectation |

|

|

EPS |

4.72 USD |

|

Revenue |

45.42 B USD |

Technical Analysis Perspective

- Home Depot broke through a declining trend line from 439.37, recorded in November 2024.

- The stock declined to 326.31 in early April 2025, forming a weekly hammer-like candlestick, indicating potential bullish sentiment.

- The candlestick pattern suggests a technical bullish bias.

- The stock rebounded strongly, surpassing 380–390 resistance, reaching a high of 407.82 last week.

- Post-earnings, HD may retrace to 387–386 to test the falling trendline.

- A sustained hold above 387–386 could target a move higher toward 415, with potential to reach 420–425, possibly filling an opening price gap from November 2024 after the US elections.

- Conversely, failure to hold 387–386, followed by a drop below 379, would invalidate the bullish outlook, possibly sending the price lower to support zones around 350–340.

Weekly Candlestick Chart

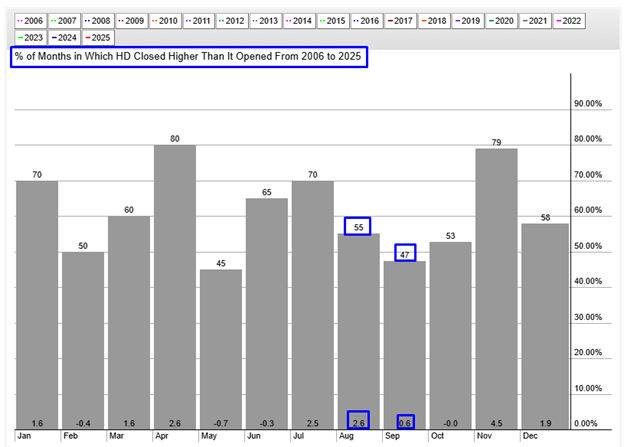

HD Seasonality Chart

Since 2006, Home Depot has experienced an average increase of 2.6% in August, with positive performance in 55% of those years, and an average rise of 0.6% in September, occurring in 47% of years.

***

Be sure to check out all the market-beating features InvestingPro offers.

InvestingPro members can unlock a powerful suite of tools designed to support smarter, faster investing decisions, like the following:

ProPicks AI

Built on 25+ years of financial data, ProPicks AI uses a machine-learning model to spot high-potential stocks using every industry-recognized metric known to the big funds and professional investors. Updated monthly, each pick includes a clear rationale.

Fair Value Score

The InvestingPro Fair Value model gives you a clear, data-backed answer. By combining insights from up to 15 industry-recognized valuation models, it delivers a professional-grade estimate of what any stock is truly worth.

WarrenAI

WarrenAI is our generative AI trained specifically for the financial markets. As a Pro user, you get 500 prompts each month. Free users get 10 prompts.

Financial Health Score

The Financial Health Score is a single, data-driven number that reflects a company’s overall financial strength.

Market’s Top Stock Screener

The advanced stock screener features 167 customized metrics to find precisely what you’re looking for, plus pre-defined screens like Dividend Champions and Blue-Chip Bargains.

Each of these tools is designed to save you time and improve your investing edge.

Not a Pro member yet? Check out our plans here or by clicking on the banner below. InvestingPro is currently available at up to 50% off amid the limited-time summer sale.

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, Fund & Relationship Management, Fintech, and Digitalization. He is a CMT charter holder and an active member of CMT Association, USA, American Association of Professional Technical Analysts, and CMT Association of Canada. He has worked on various roles and organizations in North America and the GCC, such as ABN Amro bank, Thomson Reuters, Refinitiv, MAK Allen & Day Capital Partners (WA:CPAP), and Bridge Information Systems.

He is the founder of TwT Learnings, provides financial market training.

https://twtlearning.com/ (Checkout Testimonials)

https://x.com/twtlearning

https://www.youtube.com/@twtlearning

Email us: admin@twtlearning.com

https://www.investing.com/members/contributors/263388641/opinion