Is this U.S.-China selloff a buy? A top Wall Street voice weighs in

Stocks had a back-and-forth day ahead of today’s CPI report, which could take on some extra weight regarding the outlook for rate cuts.

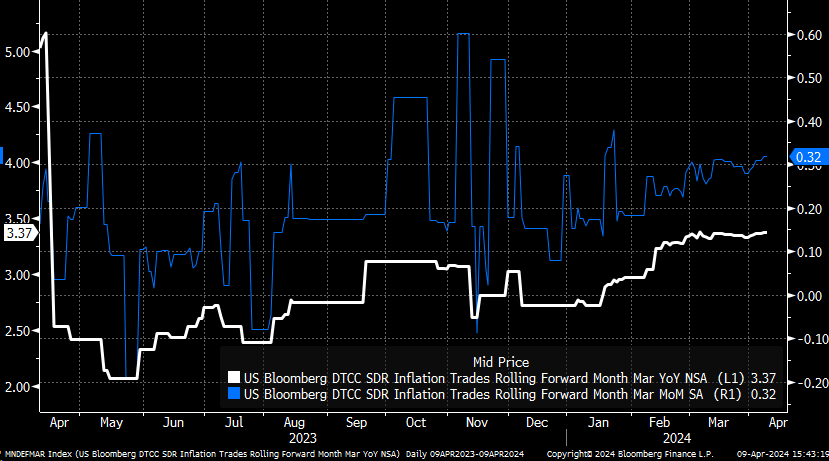

Expectations are for the CPI to rise by 0.3% m/m, down from 0.4% m/m last month, while rising by 3.4%, up from 3.2%. Meanwhile, the core CPI is forecast to rise by 0.3% m/m, down from 0.4% last month, and by 3.7% y/y, down from 3.8%.

The swaps market has been pretty consistent here and still thinks the CPI comes in at 3.4% on the y/y headline number and by 0.3% m/m.

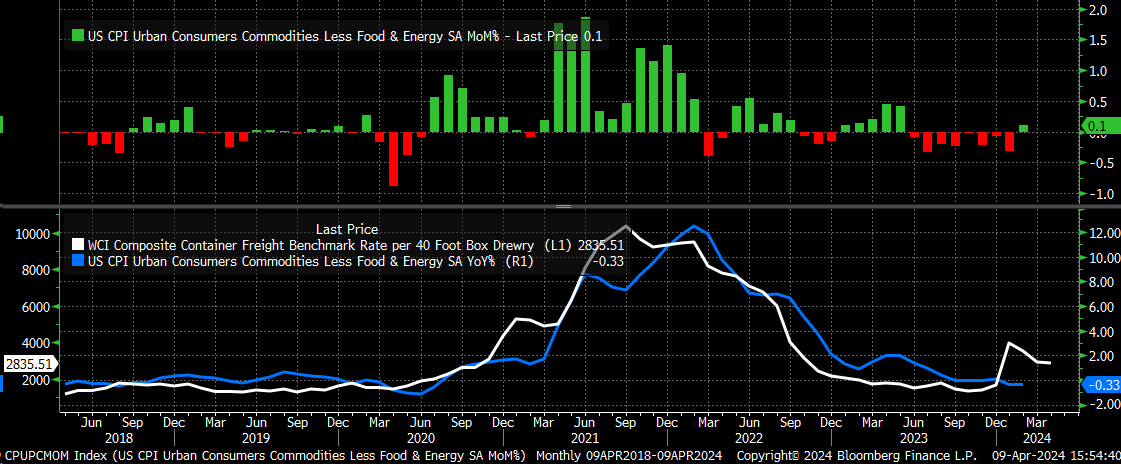

The deciding factor on the headline CPI rate will probably be energy and good prices. Those have been the big disinflation narrative in recent months, and gasoline prices have risen significantly in March.

Additionally, we saw goods inflation come back to life in February, which followed that significant increase in shipping costs. Last month was the first time since May 2023 that there was a positive reading on the CPI commodities, less food and energy.

In the meantime, the S&P 500 was all over the place yesterday, opening higher and dropping sharply midday only to snap back into the close.

I’m not sure what drove the end-of-day part of the day. Bostic was making comments around 3:25 PM ET, but the rally started well before that.

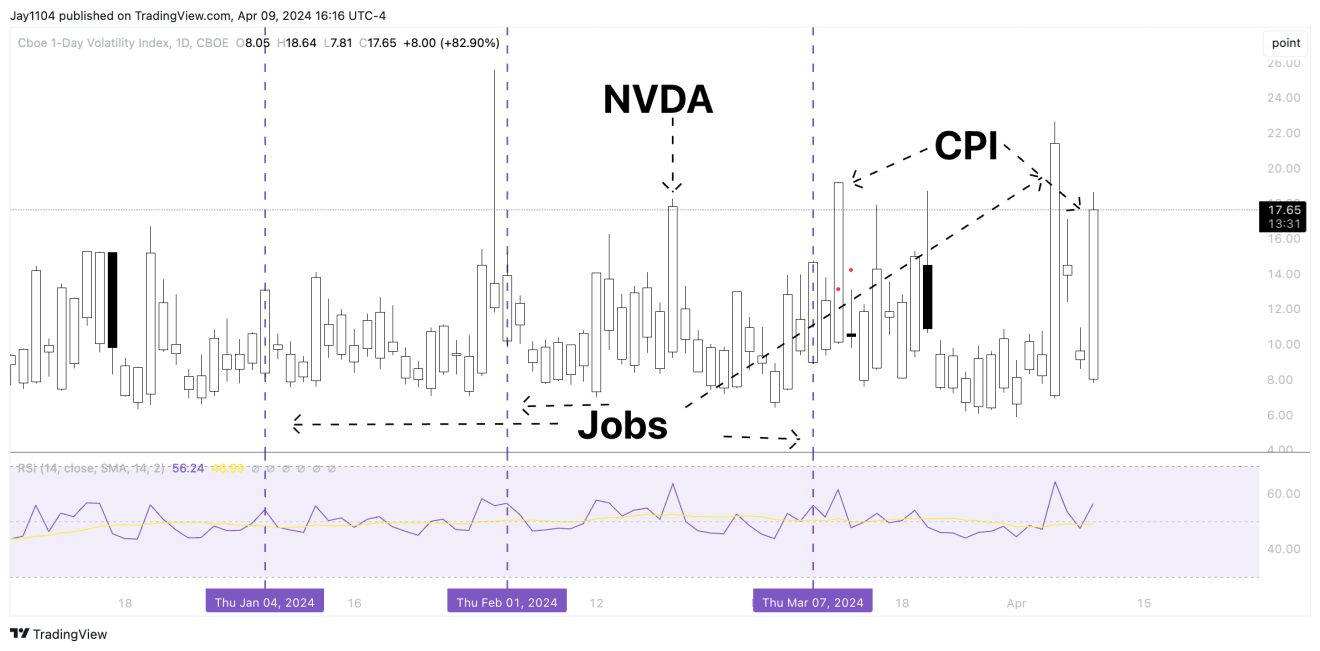

The VIX 1-day finished higher on the day, closing around 18 and up 8 points, so it was a big move. One would expect the VIX 1D value to drop sharply today; how far it drops will likely determine if the equity market rallies.

We saw a rally following the Job report and a rally following last month’s CPI report, so given the VIX 1-day level yesterday, it seems possible to see a rally today, even if the CPI number isn’t favorable, on a volatility reset.

We will have a 10-year auction today at 1 PM, following the CPI report. The 3-year auction wasn’t great yesterday with indirect acceptance coming in low at 60%, and the two bps tail on the high yield rate.

Clearly, with the risk of the CPI report removed from the equation, we could see a better auction today.

The 10-year closed yesterday at 4.36%, so right on support. It seems evident that if the 10-year break support is at 4.35%, it could drop further to around 4.15%, with resistance around 4.5% to 4.55%.

Today, we will also get the Fed minutes, which have been mostly forgotten, it seems. I think the minutes will show that the Fed’s consensus was much closer to 2 rate cuts than the three rate cuts seen in the dot plot. Additionally, it should give us some clues on the pace of the QT slowdown.