European stocks mixed on Friday after volatile week; U.K. economic woes

This article was written exclusively for Investing.com

- Bull market in cryptocurrencies created head-spinning price action

- Supply is a function of demand in all markets

- The speculative frenzy has caused new tokens to 'be fruitful and multiply'

- The trend continued throughout 2021 and over the past years

- There are too many tokens - Most will wind up as dust collectors in computer wallets in cyberspace

There is nothing like a good old-fashioned bull market to attract investors and traders looking for profits. While bullish trends have had a magnetic effect throughout history, there's never been anything quite like the cryptocurrency asset class.

Bitcoin’s rise from five cents in 2010 to nearly $70,000 per token in 2021 has caused thousands of new digital currencies to come to the market. Imitation is, of course, the sincerest form of flattery, and emerging tokens have attracted market participants on the hunt for Bitcoin-like returns.

But potential rewards come with commensurate risks in any market, and cryptocurrencies are no exception. While many market participants are looking for quick profits, some have an ideological devotion to the asset class that provides an alternative to traditional means of exchange, fiat currencies, and even gold.

Acceptance of cryptos moved towards the mainstream in 2021, but speculative activity fueled a lot of the price action and wild price volatility. During 2021, cryptos experienced breathtaking rallies and harrowing price plunges.

However, the only bull market that actually gained traction in the asset class was the escalating number of token choices available. New tokens seemed to debut each day, begging the question, how many tokens are simply too many?

Bull market in cryptocurrencies created head-spinning price action

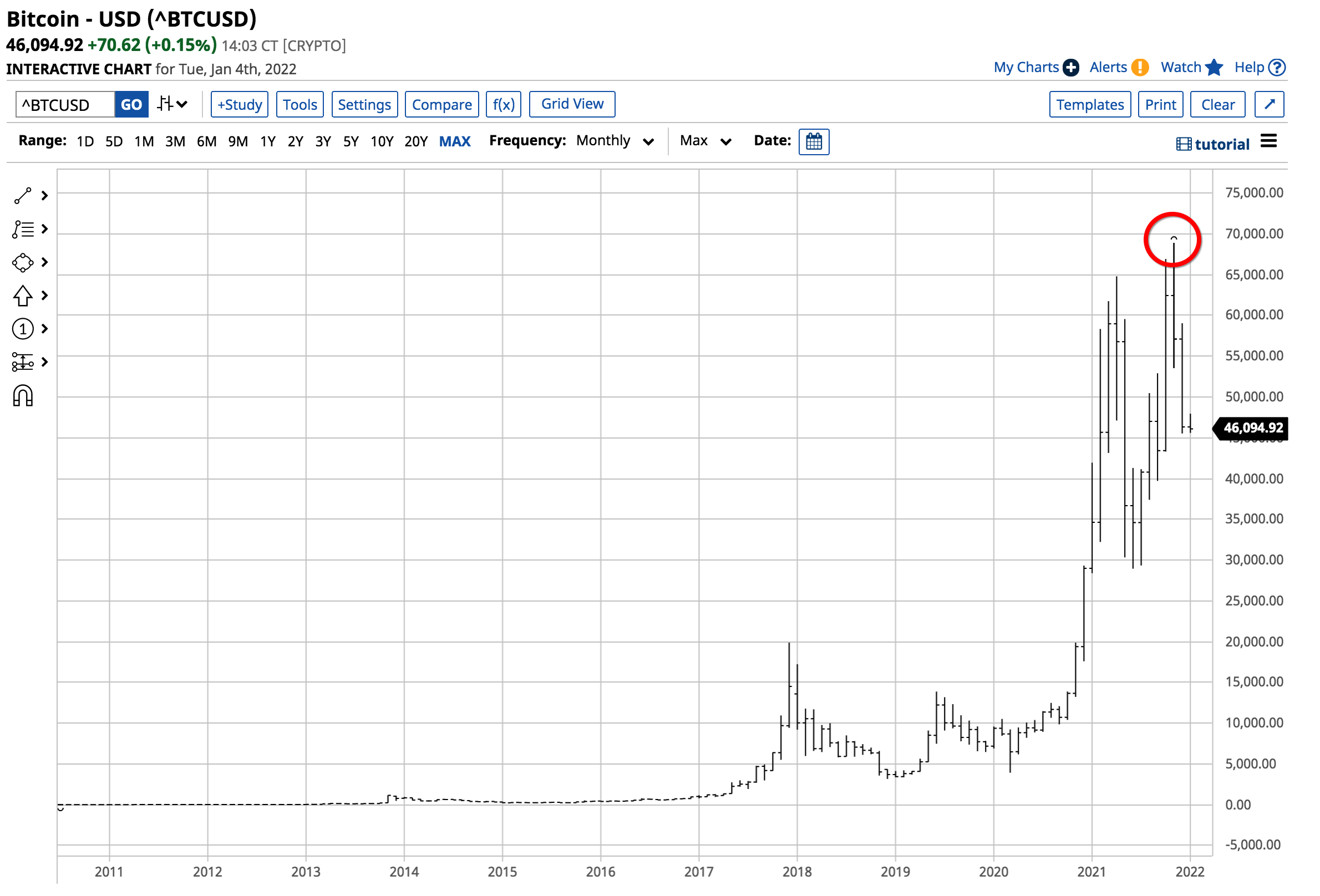

Bitcoin and Ethereum posted gains in 2021, but the volatile price action was not for the faint of heart. As of Dec. 31, 2021, Bitcoin appreciated by 57.8% from its closing level at the end of 2020, with the price at just below the $46,000 per token level.

Ethereum did better as the price gained nearly 392% on a year-on-year basis, with the price at the $3,650 level on Dec. 31, 2021. Meanwhile, both Bitcoin and Ethereum closed the year well off their peaks in 2021. On Nov. 10, the prices of the two leading cryptocurrencies reached record highs.

Source: Barchart

As the chart illustrates, Bitcoin reached a high of $68,906.48 on Nov. 10, 2021, but closed the year over 32.7% below the record peak.

Source: Barchart

Ethereum moved to its highest price in history on Nov. 10 at $4,865.426, declining by around 24% to finish out the year.

The risk of corrections escalated with prices, but the two leading cryptos still posted substantial gains in 2021.

Supply is a function of demand in all markets

Fundamental supply and demand theory teaches that supplies tend to adjust to levels of demand. In the cryptocurrency world, the ascent of Bitcoin and Ethereum has minted many millionaires and more than a few billionaires. Those with the foresight to buy the tokens when prices were low and the asset class was not in the spotlight, and hold them, have made fortunes.

Market participants flock to bull markets to ride the trend higher in order to build out their nest eggs. Success in cryptocurrencies has bred success for many new tokens coming to the market. Over the past year, we have seen the number of crypto offerings soar.

The speculative frenzy has caused new tokens to 'be fruitful and multiply'

Bull markets can create speculative frenzies, influencing market participants willing to pay higher and higher prices, sometimes for more and newer instruments in the same asset class. In 2010, Bitcoin was the only crypto. Like Adam in the Garden of Eden, it was fruitful and multiplied after Eve came onto the scene.

I began keeping track of the number of cryptocurrency offerings at the end of Q1 2019, when there were already 2,136 tokens floating around in cyberspace. Nearly every day, new tokens came to market.

At the end of 2019, the number stood at 4,986, over double the level at the end of Q1. At the end of 2020, it rose to 8,153 different tokens.

The trend continued throughout 2021 and will in future years

On Dec. 31, 2021, there were 16,238 tokens available for investment, as the number rose by 99.2% in 2021. On Tuesday, Jan. 4, the number stood at 16,372, and by the time you read this, it will be higher.

Bitcoin, Ethereum, and the many other cryptocurrency success stories created a fertile environment for new tokens over the past years, and that trend continues in early 2022.

While many, if not most, of the new tokens coming to market will wind up as dust collectors in computer wallets, the ascent of the leading cryptos continues to be a magnet for capital from those searching for the next crypto that will deliver substantial returns.

Too many tokens; ultimately only the strong will survive

The bottom line is that there are far too many cryptocurrencies circulating, but that hasn't stopped new tokens from coming to market each day. Eventually the asset class will face a reckoning where only the strong will survive.

Right now just a small percentage of highly liquid tokens with market caps over $10 billion might be considered 'strong.' But a number of catalysts can also boost tokens—for example, Elon Musk repeatedly extolling Dogecoin—or pressure them, including scandals involving exchange hacks or collapses as well as dodgy tokens that rapidly gain traction, then implode.

Like any flourishing market or product, imitation is the highest form of flattery, but it also creates an environment where scams take advantage of unsuspecting market participants.

Only invest capital in the cryptocurrency asset class that you recognize is 100% at risk. Risk is always a function of reward; in cryptocurrencies, the incredible rewards potential carries commensurate risks.

A day of reckoning will arrive in the asset class when the number of offerings suddenly evaporates, and the asset class quickly shrinks. However, as of Jan. 6, 2022, the number of tokens continues to rise as the demand supports new entrants each day.

Over 16,370 different cryptocurrencies are far too many, but that doesn't mean the number of tokens cannot continue to grow to an even more irrational level in 2022 and beyond.