Truist Securities reiterates Buy rating on Salesforce stock, maintains $380 price target

As we move further into the year, stock market indexes continue to show impressive gains year to date, reflecting a robust uptrend that might suggest a broadly positive market sentiment. The major indexes are reaching new highs and portraying an image of economic health and investor confidence. However, beneath this seemingly strong facade lies a troubling sign for market participants: a significant deterioration in market breadth.

Market breadth is a crucial measure that indicates the overall market's health. It reflects the number of stocks participating in the uptrend. Currently, while major indexes like the S&P 500 and NASDAQ are climbing, most individual stocks within these indexes are underperforming. This divergence suggests that the gains are being driven by a few large-cap stocks, masking the struggles of the majority.

This trend of narrowing market breadth has persisted throughout the year. Such a scenario can sustain an upward trajectory for the indexes in the short term, driven by the performance of a select few. However, it also increases the likelihood of a market pullback, especially as these indexes become overextended.

With the current market advance showing signs of reaching an overbought state, it’s a critical time for investors to exercise caution. The disparity between index performance and individual stock performance serves as a warning that the market's strength may be more fragile than it appears on the surface.

Visualizing the Divergence: A Tale of Two Indexes

In the chart below, we have a clear visual representation of the growing disparity in market performance. The top panel illustrates the capitalization-weighted S&P 500, which, as noted in the introduction, has continued its ascent, reaching new highs and showcasing the robust performance of the largest stocks within the index. The lower panel, however, tells a different story. This panel displays the Equal Weighted S&P 500, where each stock contributes equally to the index, offering a more balanced view of the broader market's health.

From the start of the year until the end of March, both indexes moved in harmony, reflecting a broad-based rally where gains were relatively evenly distributed among the stocks. However, the divergence that began in April is striking. While the capitalization-weighted S&P 500 maintained its upward momentum, driven by a handful of dominant large-cap stocks, the Equal Weighted S&P 500 began to falter, trending downward. This negative divergence highlights that the majority of stocks within the index have not shared in the recent gains, revealing a troubling decline in market breadth.

The significance of this divergence cannot be overstated. It underscores the cautionary message from the introduction: despite the impressive performance of the headline index, underlying market strength is weakening. The few stocks leading the charge higher can mask the broader market's struggles, but this imbalance often precedes corrections or pullbacks, especially when the market becomes overly extended. Investors should be wary of this trend, as it suggests that the apparent resilience of the market may be more fragile and susceptible to reversal than it appears on the surface.

Divergence Deepens: A Closer Look at Market Breadth

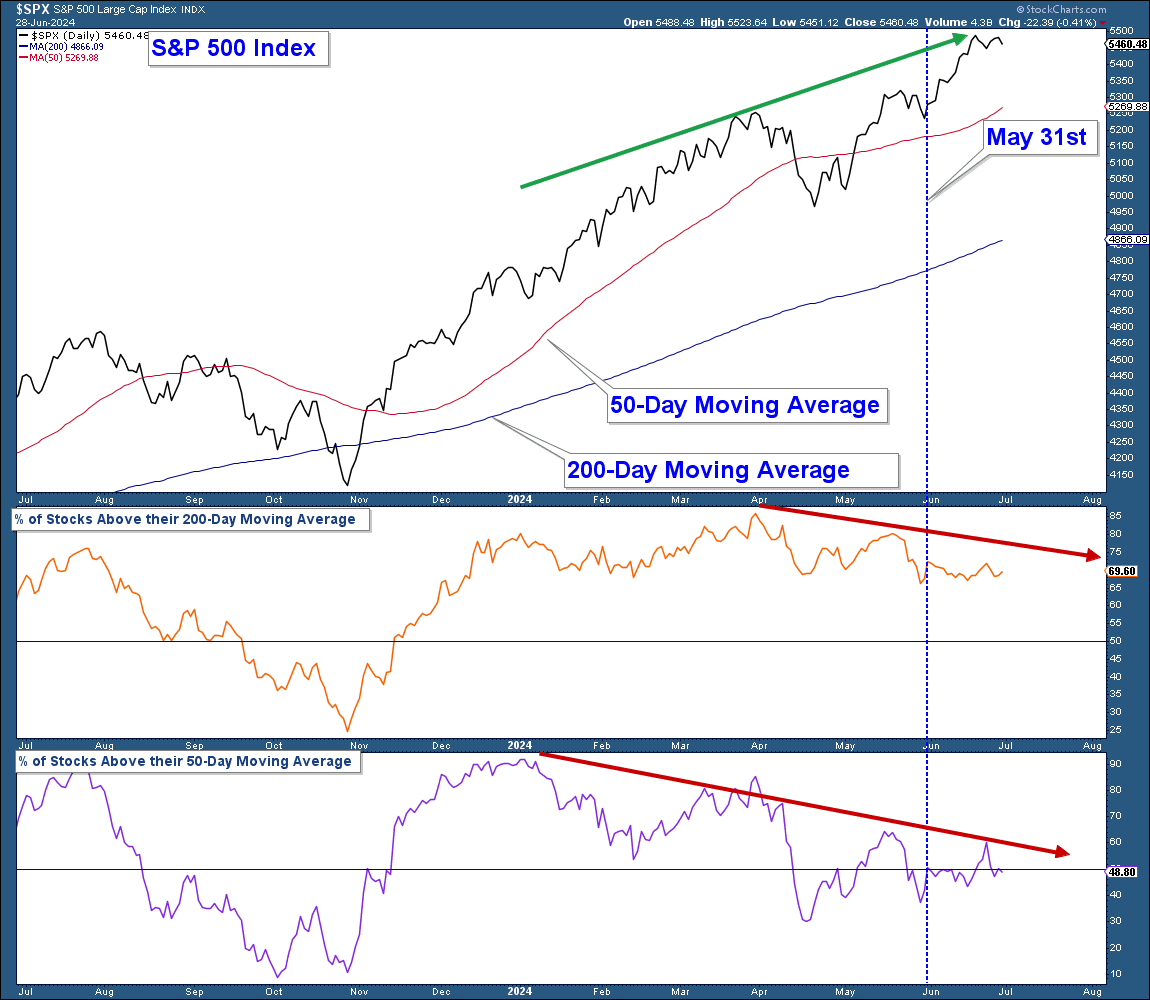

The next chart provides a deeper dive into the evolving landscape of market breadth and further underscores the cautionary signals we've been discussing. The top panel depicts the S&P 500, which has been on an impressive upward trajectory since emerging from a short-term pullback at the end of October 2023. This rally has carried the index to new heights through June 2024, reflecting an ostensibly strong and resilient market.

However, the middle and bottom panels reveal a starkly different narrative. The middle panel tracks the percentage of stocks within the S&P 500 that are above their respective 200-day moving averages, a long-term trend indicator. Since April 2024, this percentage has been in a consistent decline, suggesting that fewer stocks are maintaining their long-term uptrends despite the index's continued advance.

The bottom panel paints an even more concerning picture, showing the percentage of stocks above their 50-day moving averages, a short-term trend indicator. This percentage has been falling since January 2024, indicating that a majority of stocks are failing to sustain even their short-term momentum. The divergence between the S&P 500's performance and the weakening trend participation of its components is clear and concerning.

Notably, the chart highlights the month of June 2024 with a vertical blue line, drawing attention to the continued advance of the S&P 500 during this period. Despite this upward movement, both the middle and bottom panels indicate that the percentage of stocks above their moving averages remained flat, failing to confirm the index's gains. This sideways movement in June suggests a further erosion of market breadth, highlighting that the index's rally is increasingly being driven by a shrinking number of outperforming stocks.

Conclusion

In summary, despite the impressive advance of major indexes like the S&P 500, underlying market strength is weakening. The declining participation of stocks in this rally highlights a troubling divergence and signals a fragile foundation. Investors should approach the market with caution, mindful that the impressive gains of a few cannot indefinitely mask the broader market’s fragility and the increased risk of a significant pullback.

Current Portfolio Allocation: Emphasizing Defense

Given the current market environment, we have positioned all client accounts with a distinctly defensive posture. Our strategy includes an oversized allocation to cash and high-yielding money market funds, ensuring liquidity and stability amid market uncertainties. Additionally, our equity exposure is kept deliberately low, complemented by strategic short positions to serve as hedges against potential market downturns.

One of the key reasons behind our conservative stance on stocks is the prevailing market dynamics that tend to undermine stock performance in environments like this. As discussed earlier, market breadth has been deteriorating, meaning that an increasing number of stocks are struggling or declining.

In such scenarios, the chances of successfully navigating the stock market diminish significantly. Historically, investing in stocks during periods of narrowing breadth often results in subpar returns, as overall market strength is primarily driven by a select few outperformers, while the majority lag or falter.

By maintaining a cautious allocation and focusing on defensive assets, we aim to protect capital and reduce the potential for losses, positioning our clients to weather any volatility that may arise from the current market fragility.