Street Calls of the Week

- Reports Q2 2021 results on Thursday, July 22, after the market close

- Revenue Expectation: $17.8 billion

- EPS Expectation: $1.07

During the past year, for investors in the semiconductor sector, Intel (NASDAQ:INTC) has been a dead investment. At a time when competitors enticed customers with new and faster chips, production setbacks have hurt the largest U.S. chipmaker.

While other chip manufacturers saw their share prices skyrocket over the past 12 months as they benefited from the pandemic-fuelled demand for chips used in cars, laptops and gaming consoles, Intel's stock has barely budged. In fact, it fell more than 9%, while NVIDIA (NASDAQ:NVDA)—one of its largest competitors—gained more than 80% in value.

Given these deep-rooted production problems and the company’s ongoing restructuring, it’s unlikely that the California-based Intel will produce earnings that create excitement among investors.

That trend was obvious when the company released its Q1 earnings in April, reporting a drop in data center revenue and a steep decline in gross profit margins. That was a signal for investors that the company is losing market share to rivals and customers who are designing their own components.

For the quarter that ended June 30, analysts expect sales to decline about 10% from the same period a year ago to $17.8 billion. And the profit per share is predicted to fall to $1.07 from $1.23 a share.

New Foundry Business

While the company's short-term earnings remain under pressure, there are some hopes that Intel’s new Chief Executive Officer Pat Gelsinger will bring a turnaround, helping the semiconductor giant to overcome its production challenges. Gelsinger has put Intel in “investment mode” during a critical period for its return to leadership, and promised he’ll deliver products that are again the best in the industry.

Early this year, Gelsinger unveiled a plan that included creating a new $20-billion foundry business that will manufacture chips for other companies. He also plans to use rivals’ factories to outsource production of other Intel components.

Last week, the Wall Street Journal reported that Intel is exploring a deal to buy GlobalFoundries Inc. to accelerate its plans to make more chips for other tech companies. If that deal goes through, according to the paper, it will be Intel’s largest and could value GlobalFoundries at around $30 billion.

Wall Street analysts, however, are dividend on Intel’s prospects despite the company’s push to remodel its business to become a chip manufacturer for others, a market dominated by Taiwan Semiconductor Manufacturing (NYSE:TSM).

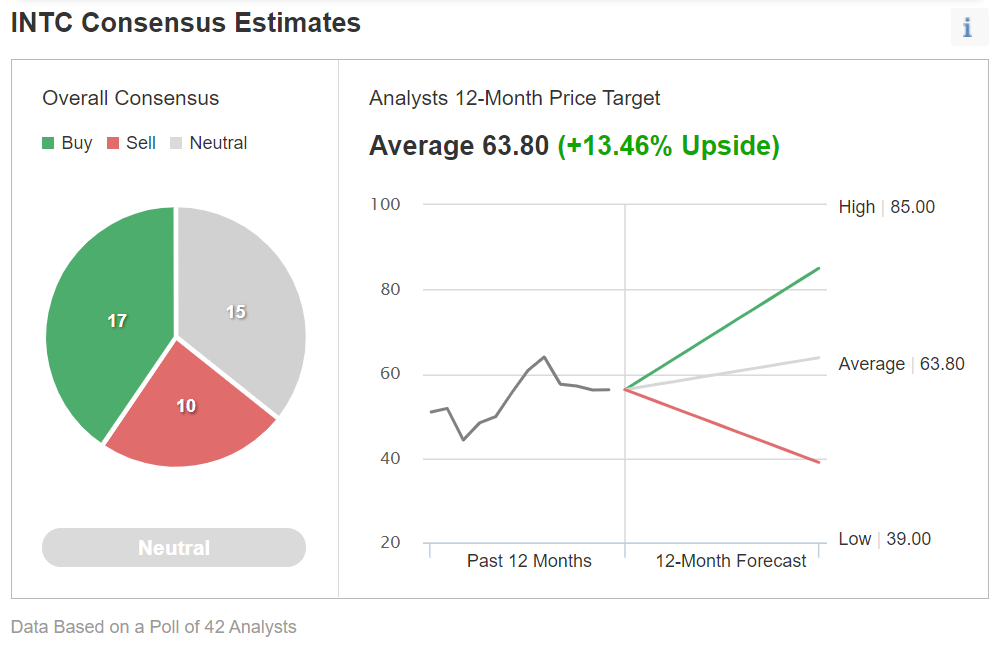

Chart: Investing.com

In a poll of 42 analysts covering the stock by Investing.com, 17 have a buy recommendation, 15 are neutral, while 10 are calling to sell the stock. The consensus price target for the next 12 months indicates an almost 14% upside.

Bottom Line

Intel remains in a bearish spell, hurt by its production missteps and market share loss to competitors. That situation is unlikely to change in the short-run, making its shares suitable for a long-term turnaround bet. In line with that trend, today’s earnings will likely show weakness in both sales and margins.