Two National Guard members shot near White House

Immortalized by Christian Bale in The Big Short, Dr. Michael Burry is stirring ‘animal spirits’ in the stock market again. John Maynard Keynes defines this phenomenon as nonquantifiable psychological factors that drive investment activity.

Dr. Michael Burry holds that driving potential because he correctly called out the subprime mortgage crisis that facilitated the 2008 Global Financial Crisis (GFC). More importantly, through his predictive power of analysis, Burry placed bets (shorts) against the failing market, earning a personal profit of $100 million and over $700 million for his clients.

On Monday, Burry’s hackling of animal spirits began with the Form 13F filing to the Securities and Exchange Commission (SEC). As a required quarterly investment report, the form revealed that Burry’s hedge fund, Scion Asset Management, placed several put options against the stock market.

Put Options as Safeguard Market Bets

Opposite to call options, put options are investment contracts typically used to safeguard against downside market risk. Being optional, the contract enables the contract buyer to sell the equity at a set price (strike price) without being obligated to do so.

If the buyer exercises the put option, the put option seller must buy the equity at that strike price at the predetermined expiration date. If the buyer does NOT exercise the put option, the seller still takes in the upfront-paid contract premium.

- The investor believes the current stock price, at $110, is overvalued.

- Based on this belief, an investor buys a put option for the stock at a strike price of $100.

- If the stock goes down, under $100 to $90, the investor exercises their put option to sell it at the contract’s set strike price of $100.

- In this buyer-seller equation, the buyer of the put contract has the option by which the seller is obligated to buy the stock at the strike price.

Therefore, the initial investor (put contract buyer) would gain $10 profit per share, minus the premium for the put contract itself. Of course, this type of contract can be used against the broad market index, precisely what Burry’s Scion Asset Management did.

Foggy Scion Asset Management’s Bets

Under Burry’s guidance, the hedge fund is bearish against two broad market indices, S&P 500 and Nasdaq 100. Against the Nasdaq 100, this is apparent from $739 million in put options against Invesco QQQ Trust ETF(NASDAQ:QQQ), an exchange-traded fund largely composed of Nasdaq 100 companies.

Against the S&P 500, Burry placed $886 million in put options. This constitutes a $1.6 billion bearish bet against the stock market. With that in mind, the filed form doesn’t show if the contracts are already paid for or when they expire.

Moreover, Form 13F has a 45-day filing requirement after the end of each quarter. This doubts the $1.6 billion figure, as it could be outdated.

Nonetheless, what is indicative is that Burry’s Scion Asset Management cut exposure to China. Previously, in Q1 2023, the hedge fund allocated 20% of the portfolio to China-based investments, Alibaba (NYSE:BABA) Group Holding and JD (NASDAQ:JD).com. Burry liquidated these positions since.

Spillover From China?

China is the manufacturing and consumer power hub in the interconnected global economy. If this role undergoes contraction, it will likely spill over to other economies. In recent days, China’s deeper economic problems have started manifesting:

- Suspension of official publication on youth jobless data.

- Pressure on economists to avoid exposing certain macroeconomic data.

These odd measures followed China’s entry into downward economic activity. Year-over-year, China’s July consumer price index (CPI) dropped by 0.3%, and the price producer index (PPI) dropped by 4.4%. These negative figures are reminiscent of the economic stalling in 2020, owed to lockdown implementation.

Due to these indicators, Barclays had already cut China’s 2023 gross domestic product (GDP) forecast from 4.9% to 4.5% growth. This may be optimistic considering China’s hyper-financialization of the housing market, which relies on excessive borrowing and ever-increasing demand.

Some estimates point to the housing market constituting 30% of China’s GDP, making 70% of average household wealth. Accustomed to housing market analysis, this fragility is likely Burry’s main driver to liquidate China exposure.

Stock Prediction: Mixed Results

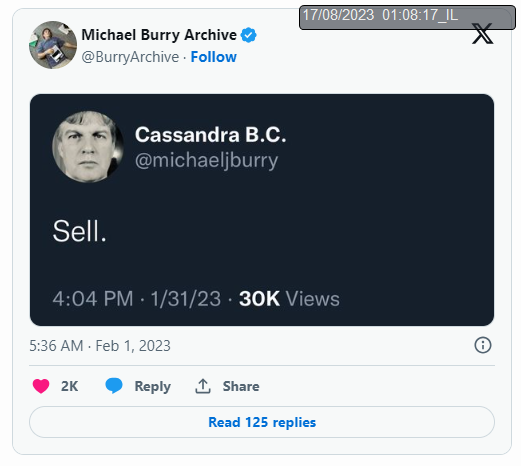

Despite becoming famous for his correct housing market assessment, Dr. Michael Burry is also known to fire blanks. So much so that he regularly deletes failed predictions. In fact, after making one such doomsday prognosis, urging to “sell,” he temporarily deactivated his Twitter account.

At the same time, the inverse-named Jim Cramer correctly called that the market was in bull mode. Since both tweets were made, at the end of January, S&P 500 (SPX) is up nearly +11% while Nasdaq 100 (NDX) is up +27%.

However, it should be noted that the market has been showing a downturn since August 1st, with both indices down, -2.85% (SPX) and -4% (NDX). Despite Fed Chair Jerome Powell claiming to no longer entertain recession this year, the interest rate hike lag may unfold sooner rather than later.

So far, JPMorgan’s Michael Feroli placed the recession outlook “elevated” in 2024. Likewise, Thomas Simons, Senior Economist at Jefferies, sees a recession in Q1 2024.

Historically, just before recessions, the stock market could either be bullish or bearish. For now, Burry seems to be counting on the bearish side to play out.