Bitcoin price today: dips to $92k as Fed cut doubts spark risk-off mood

Successful traders and investors tend to watch junk bonds performance to understand when the financial market is bullish (junk bonds do well) versus when the market is bearish (junk bonds don’t do well).

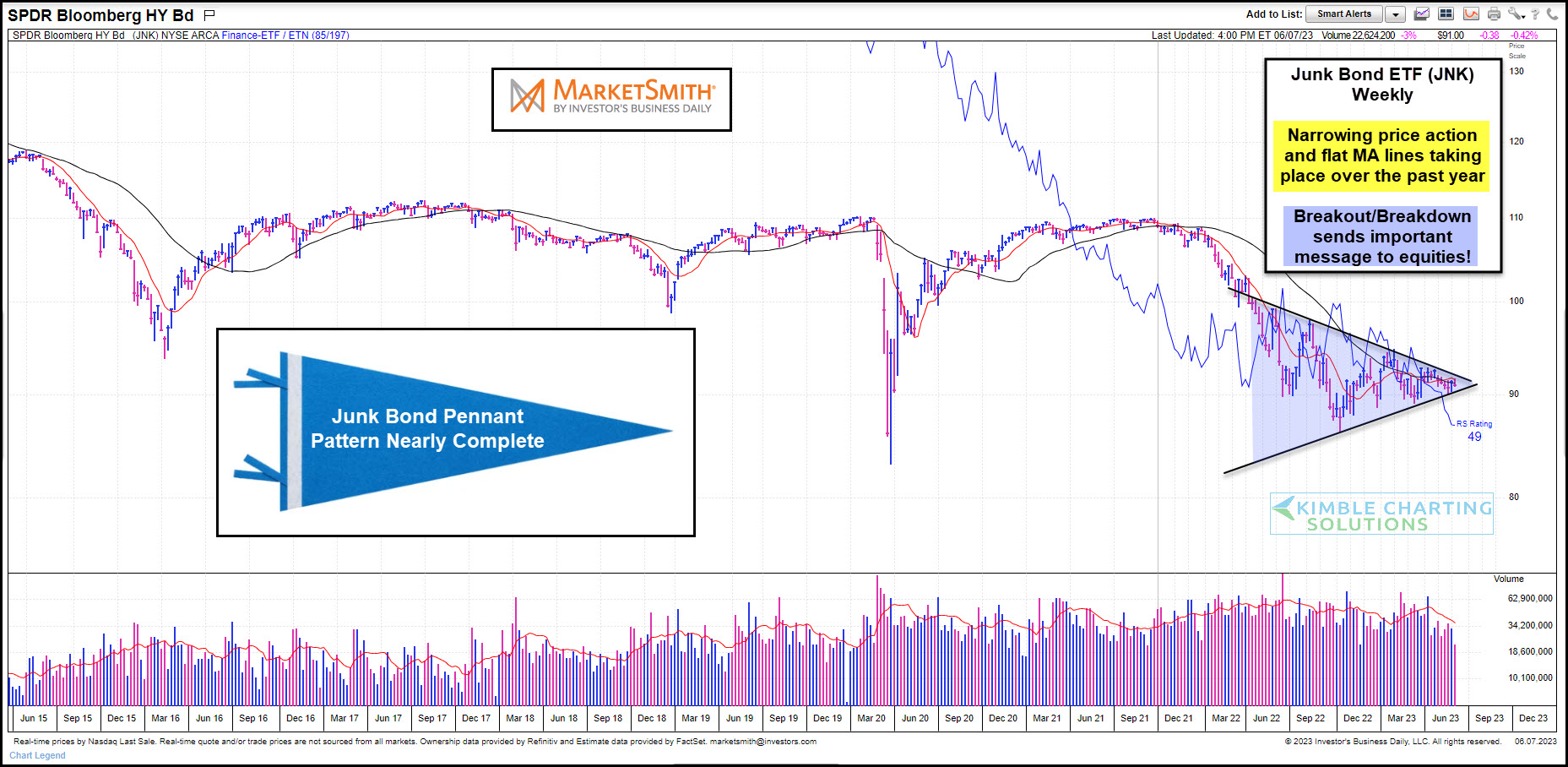

Looking at today’s intermediate-term “weekly” chart of SPDR® Bloomberg High Yield Bond ETF (NYSE:JNK), it’s apparent that junk bonds have not performed as well as bulls hoped for. And this correlates to the stock market’s counter-trend rally…which has fallen short of its highs.

That said, nothing has been decided. And when we look at junk bonds, we see a narrowing pennant pattern that is likely to resolve soon. This pattern has developed over the past year and continues to narrow. Something has got to give soon.

And this means investors should continue to follow this ETF until the pattern resolves. The resolution to this compression pattern will send an important message to U.S. equities and global stock markets.

Should Junk Bonds break out to the upside, they send a positive message to stocks.