BitMine stock falls after CEO change and board appointments

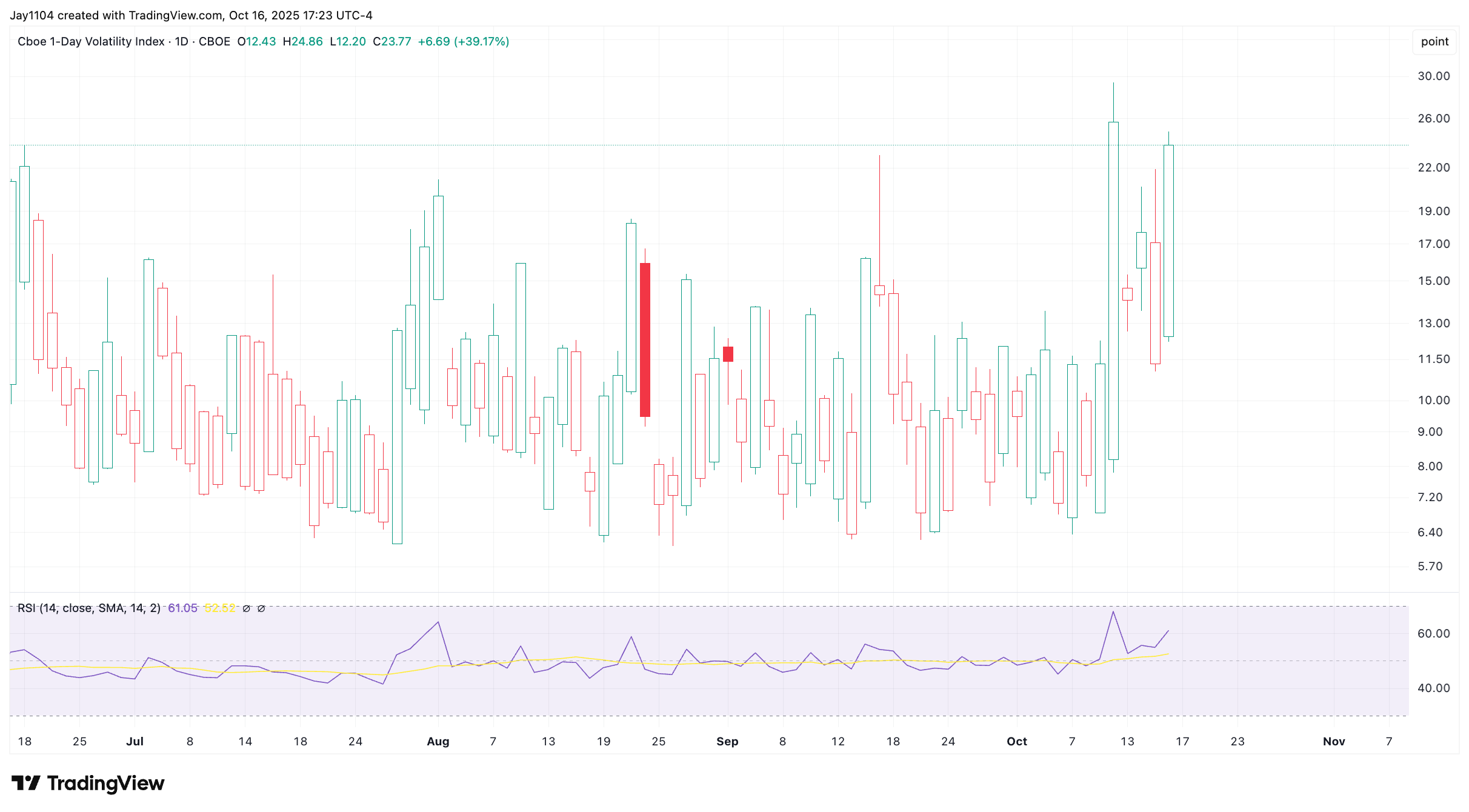

The S&P 500 fell by roughly 60 basis points yesterday, but the volatility complex behaved as if the market had plunged much more sharply. The VIX-1D surged nearly 40% to 23.7 — implying a 1.5% expected move for today when divided by the rule of 16 — yet that magnitude wasn’t reflected in the index itself.

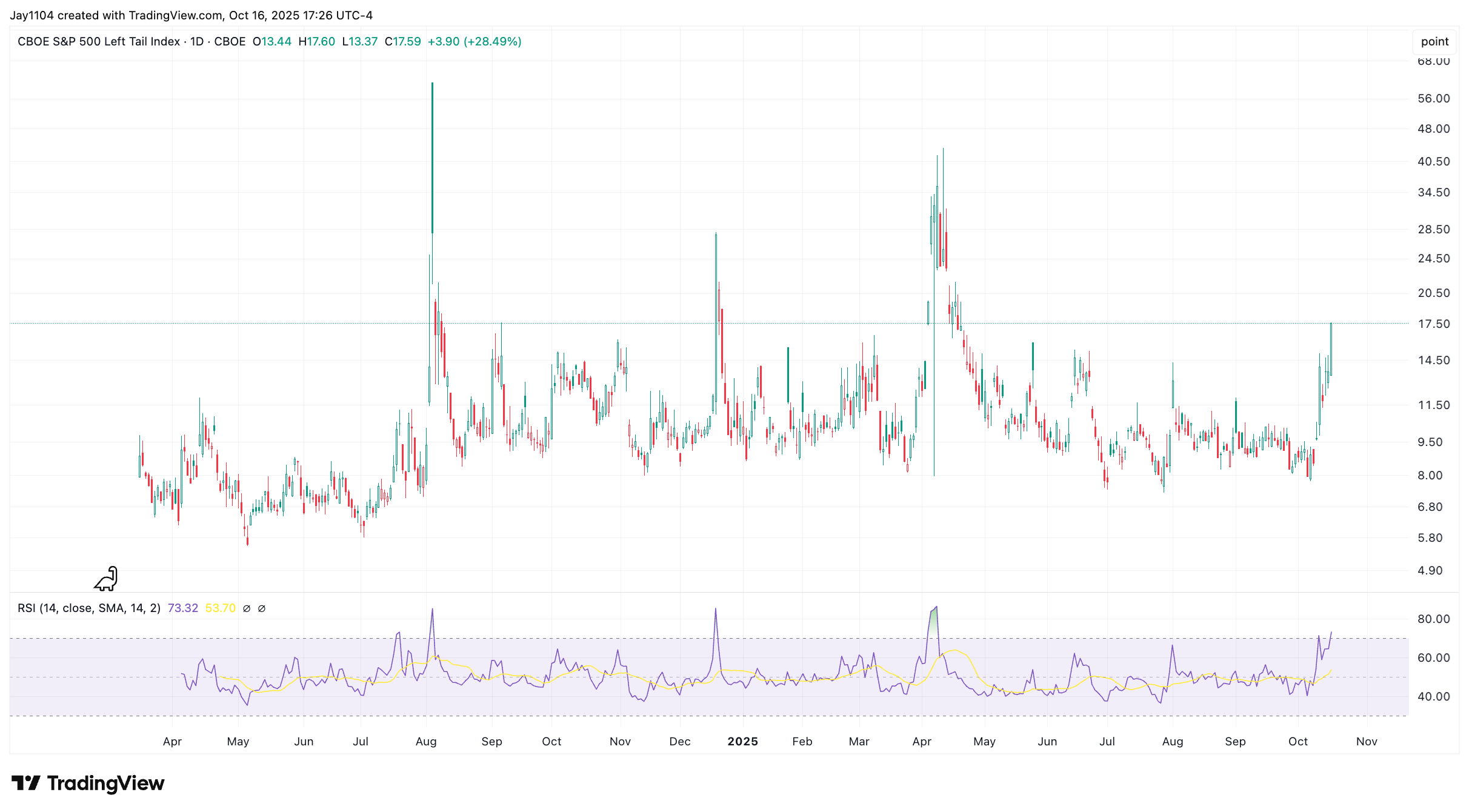

Beneath the surface, volatility measures exploded: the implied correlation index rose 45% on the 1-month to 19 and 25% on the 3-month to 21, while dispersion stayed relatively mild. The Left Tail Index jumped to 17.5, signaling heightened demand for downside protection.

This combination — elevated implied correlations and muted dispersion — often reflects broad-based hedging rather than single-stock panic, suggesting that investors are positioning defensively across the board. The weakness in regional and money-center banks, along with Bitcoin’s breakdown, reinforces the idea that stress is spreading through liquidity-sensitive corners of the market, even if the S&P itself hasn’t yet reflected it.

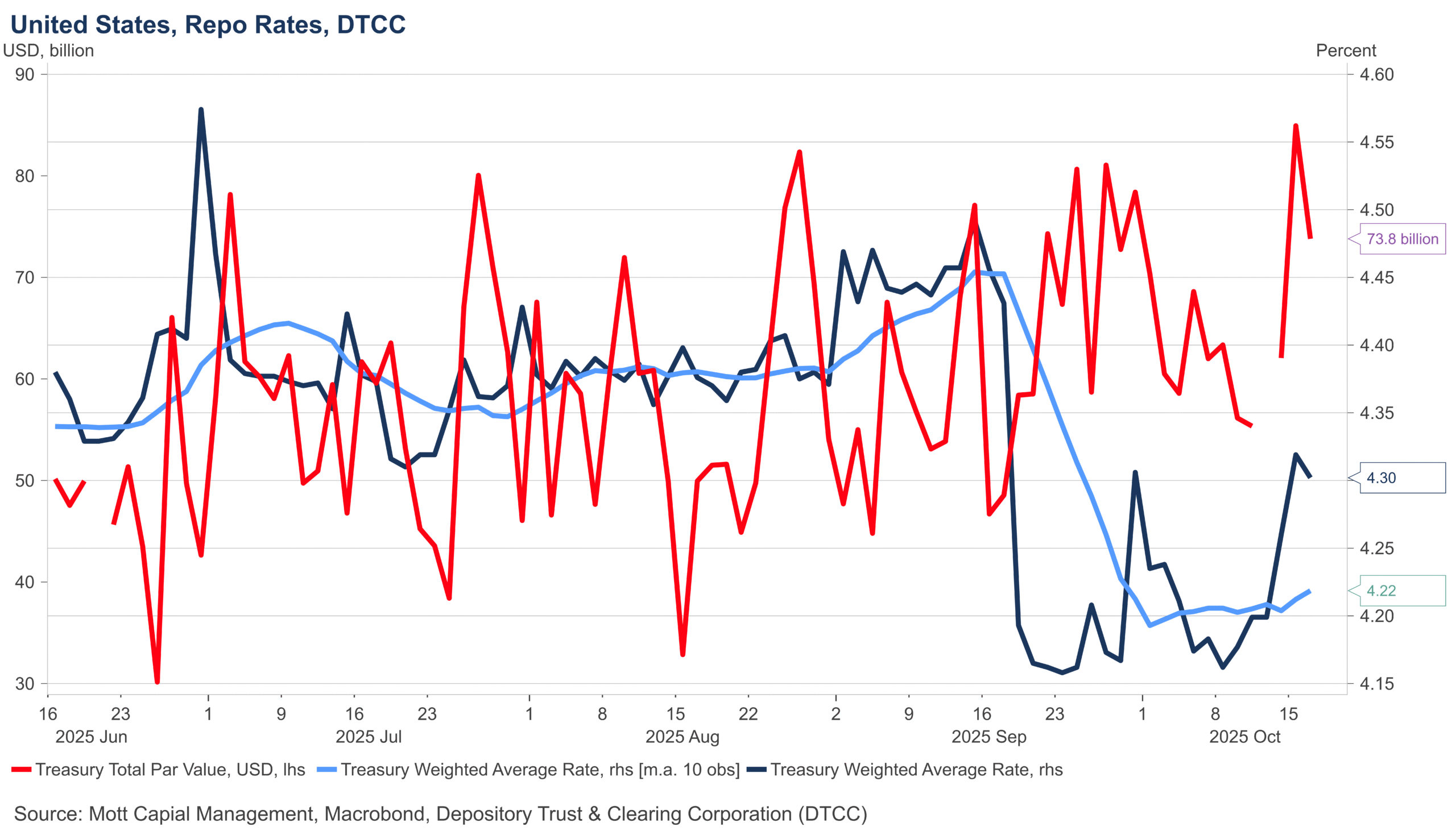

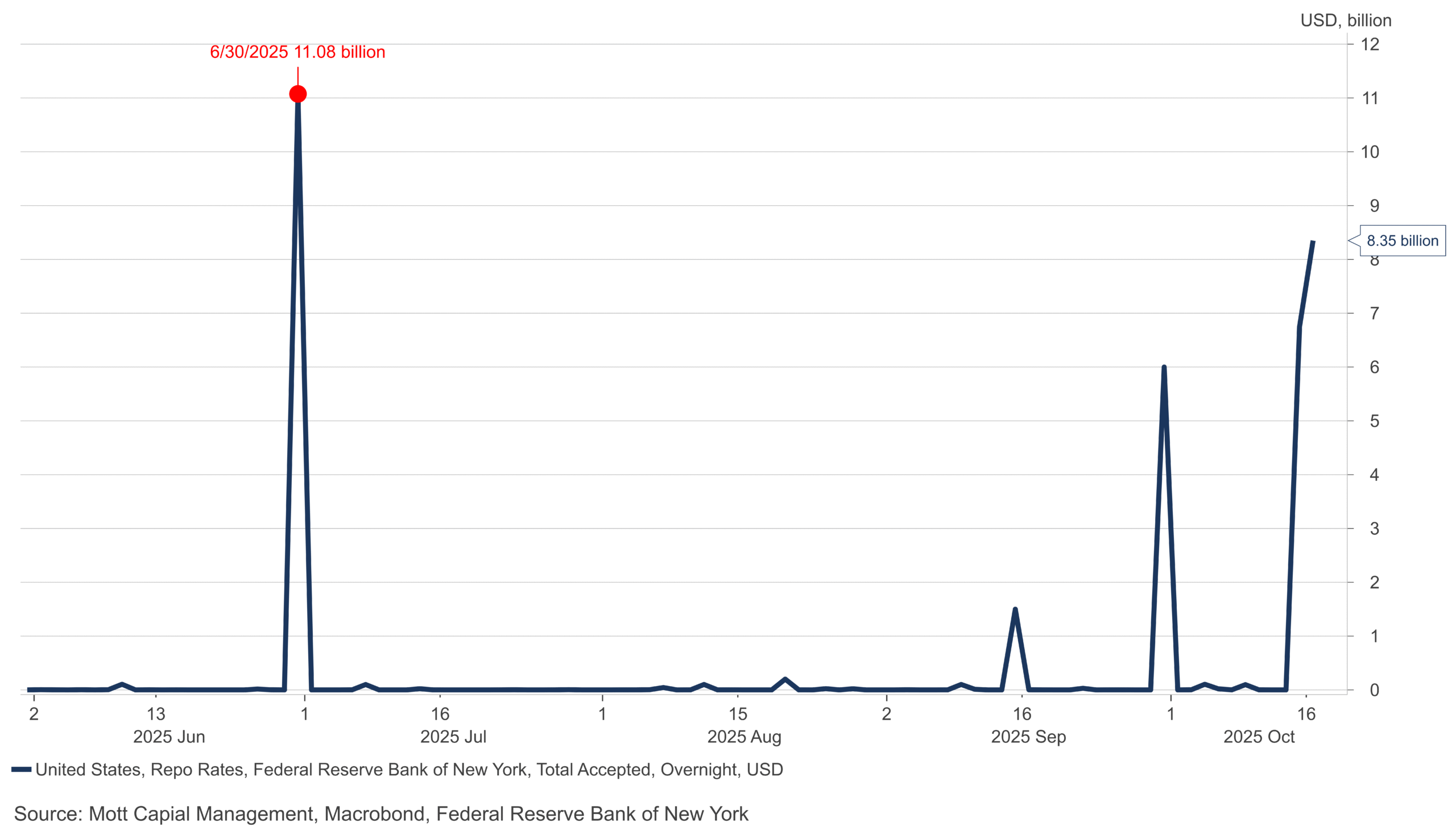

It probably doesn’t help that SOFR printed at 4.29% yesterday, and the average repo rate yesterday won’t alleviate pressure today, trading at 4.3%, down from 4.32%. There was a good amount of transaction volume as reported by DTCC

The standing repo facility rose to over $8 billion yesterday as well, suggesting that funding stress appears to be increasing.

The CDX HY index also rose rather notably yesterday, certainly more than what the drop in the S&P 500 would have suggets.

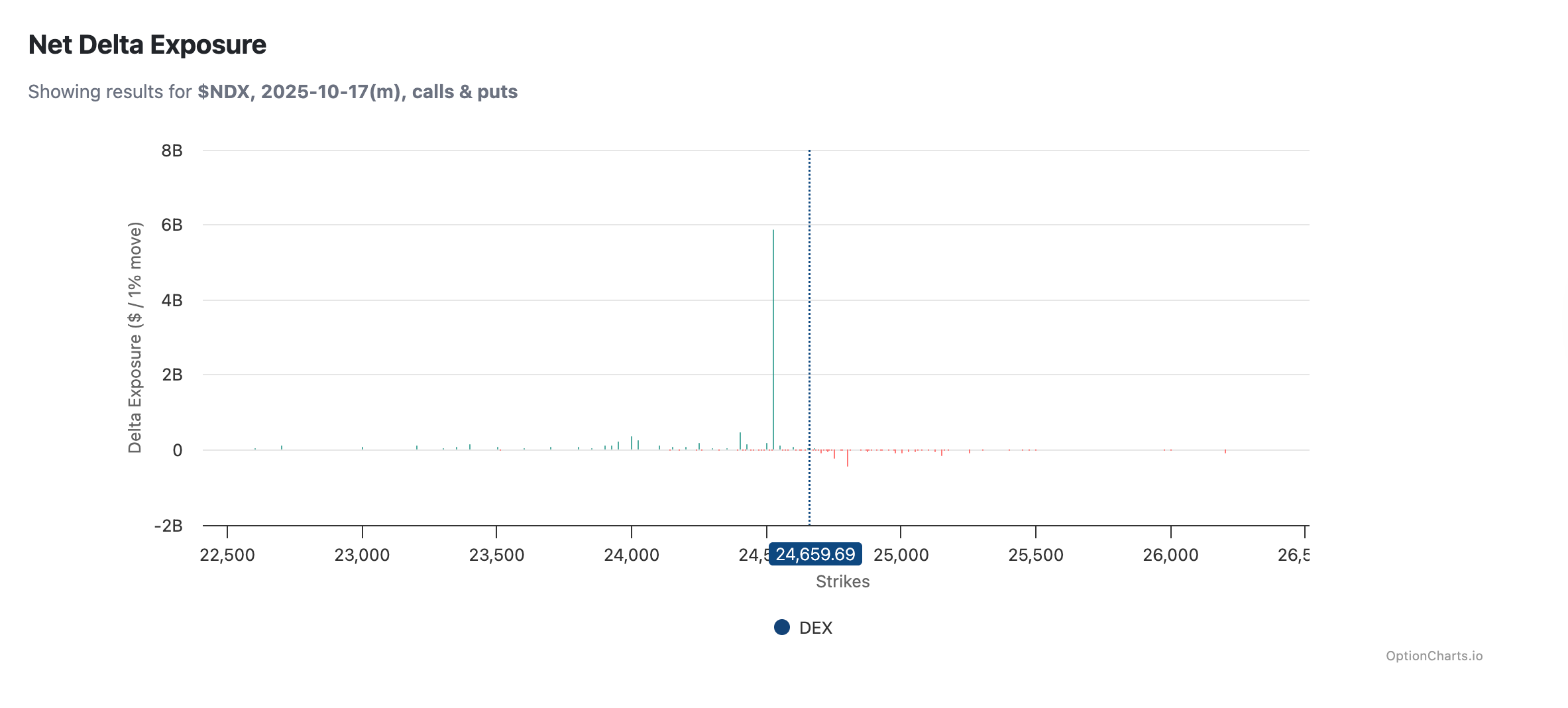

Meanwhile, weakness in the regional banks and private equity continued. My guess is that the QYLD ETF, which we don’t really talk about much anymore, was unwinding its covered call position at the 24,525 strike for October 17, which may have contributed to yesterday’s unusual activity, and may have even caused that nearly $2 billion buy imbalance on the SPX. today, they’ll likely write a new call, which should create stock for sale.