Gold prices rebound as risk-off mood grips markets; US payroll data awaited

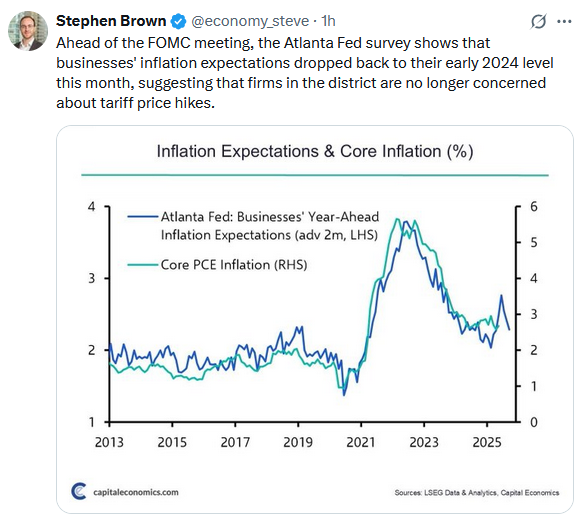

Yesterday, we touched on the continued market bullishness, which seems unstoppable. However, one market area that has seen continued “bearishness” has been longer-duration bonds. Following the significant surge in 2024, bonds’ weakness has been the source for various media narratives of the “loss of US exceptionalism” and the “end of the debt bubble.”

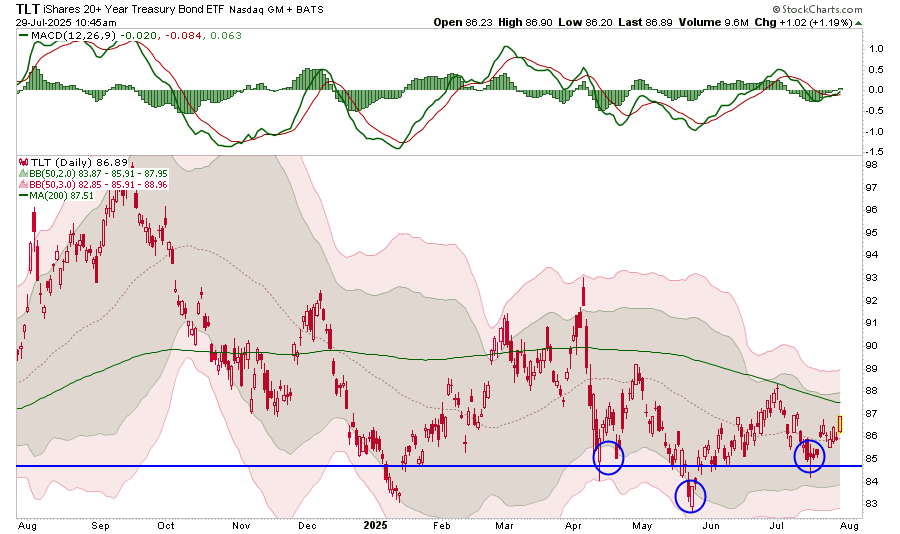

Bond yields currently trade in alignment with economic growth and inflation. However, there is a concern that economic growth is slowing, which would lead to lower bond yields and higher prices. The price chart of the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) may suggest the same.

However, from a trading perspective, bonds have been basing since January and have recently formed an inverse “head and shoulders” pattern. That consolidation pattern is a bullish setup for investors, and a break above 88 on the index will likely see significantly stronger bond prices emerge.

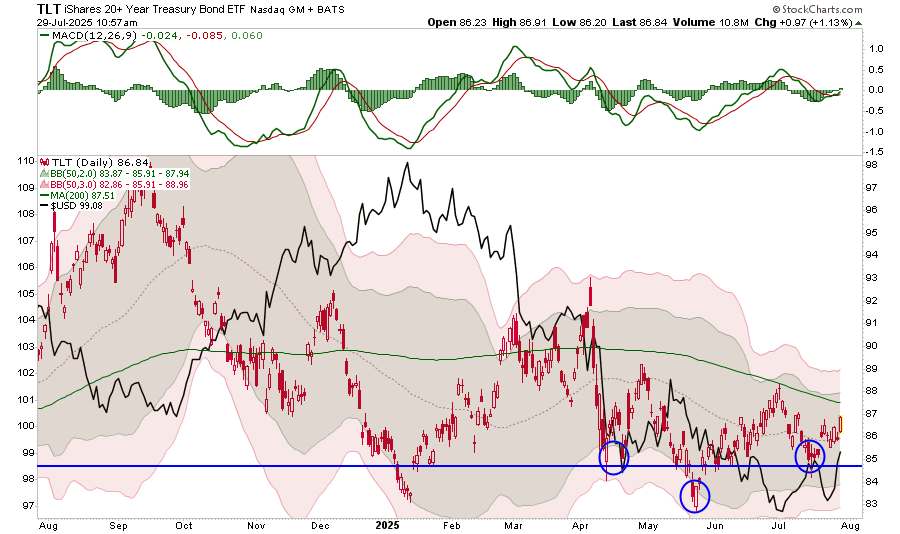

Given that bonds are both a “risk-off” asset and a store for reserve currencies, we also see support for bond prices building in the US Dollar, which is also forming a base. If the dollar strengthens, this should lead to inflows into US bonds, helping support higher bond prices.

With the building of exuberance in the stock market, a reversion in speculative assets could result in a rotation into currently undervalued assets. Given the long duration of time these assets have been under pressure, it is worth considering the potential for such a rotation. Historically, reversions to the mean tend to be significant moves, just like in the stock market.

The Dollar Remains Dominant

The graph below, courtesy of GaveKal Research, is making the rounds on X. The point is that the dollar is gaining global market share versus the Euro. Such is also true of the dollar versus other currencies. For those in the imminent dollar demise camp, here are a few facts worth considering:

- Per SWIFT, the dollar’s share of global payments is up to 48%, the highest in 13 years, as shown below. For those thinking the Chinese yuan could supplant the dollar, the yuan is roughly 3% of global payments.

- Almost 60% of global FX reserves are in dollars. That is about 3x gold and the next largest FX reserve, the euro.

- The US Dollar is also involved in nearly 90% of all foreign exchange transactions.

The US economy accounts for about a quarter of the global economy. Additionally, throw in the fact that the US financial markets are the most liquid in the world, and it’s little wonder that there is no viable replacement for the dollar, despite the desires of some countries looking for one and some dollar bears calling for the immediate demise of the dollar.

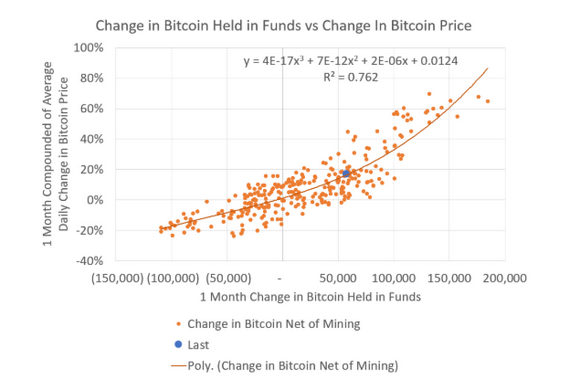

The graph below, from Michael Green, is the best way to show the logic that drives a Ponzi scheme in Bitcoin.

The Ponzi scheme graph illustrates that there is a robust correlation between changes in the amount of Bitcoin held in funds (ETFs) and the price change. Simply, as new capital is used to buy Bitcoin, the price goes up. Conversely, when they sell, the price goes down. The graph below allows us to quantify that change. Per his research:

Buying 50k in Bitcoin in a month raises the price of Bitcoin by about 18%.

MicroStrategy (NASDAQ:MSTR), as we previously wrote HERE, is a money-losing company. However, they (and others) have been issuing stock and using the proceeds to buy Bitcoin. The graph illustrates that as funds accumulate, the price of Bitcoin increases reliably.

Fund flows and prices of most other assets are not nearly as statistically correlated as the relationship shared below. However, what the graph doesn’t show is that as MicroStrategy and others add to their hoards, the profits on MicroStrategy’s existing Bitcoin holdings increase. For example, the company just issued $2.5 billion of preferred stock. That will allow MicroStrategy to buy approximately 21k Bitcoin. Based on the graph, that purchase should increase Bitcoin prices by over 7%. Here is the kicker: MicroStrategy already owns 607k Bitcoins. Thus, the $2.5 billion purchase is expected to result in a $5 billion gain on its existing holdings.

As long as funds and companies like MicroStrategy and others continue to accumulate in aggregate, and the statistical correlation holds, the Ponzi scheme will work. However, selling, or even the threat of selling, could be very problematic and would reverse the Ponzi scheme spectacularly. Like all Ponzi schemes, this one will not last forever. In the words of legendary investor John Bogle:

All Ponzi schemes ultimately fail because they depend on an ever-increasing flow of new money to sustain the illusion of profitability.

What To Watch Today

Earnings

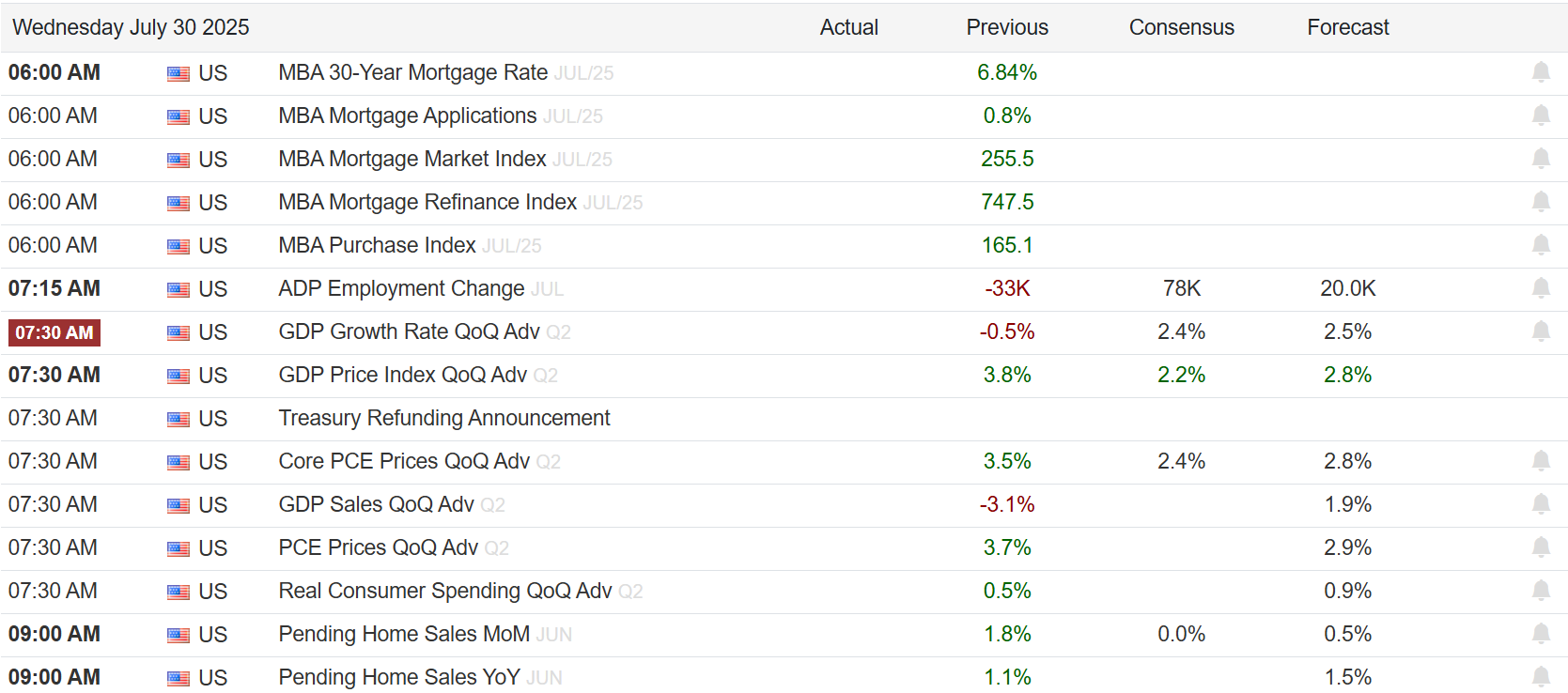

Economy

Tweet of the Day