Janux stock plunges after hours following mCRPC trial data

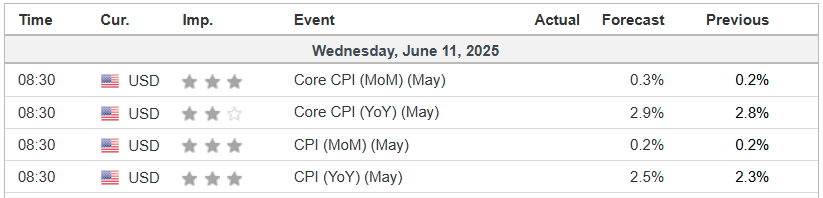

- The closely watched U.S. May CPI report comes out today.

- Headline annual inflation is seen rising by 2.5% and core CPI is forecast to increase by 2.9%.

- With stocks hovering near all-time highs, investors should brace for volatility.

- Looking for more actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to ProPicks AI winners.

All eyes are on the U.S. May CPI report landing Wednesday morning—where a surprise in either direction could jolt markets already riding a wave: the Nasdaq is up a robust 10% in the past month, with the S&P 500 up 6.7%.

Source: Investing.com

With President Donald Trump’s aggressive trade war heating up, inflation data may decide whether Wall Street’s rally has more life, or meets a policy headwind.

CPI’s Tariff Test

This month’s CPI report isn’t just about inflation—it’s a referendum on the real-world effects of Trump’s “reciprocal” tariffs amid ongoing trade negotiations with China. Analysts and traders are bracing for the data to reveal whether supply chain pressures or tariff threats are sneaking back into consumer prices.

Headline CPI is expected to accelerate 2.5% year-over-year, up slightly from April’s 2.3% YoY reading. Meanwhile, core CPI, which excludes food and energy prices, is projected to rise 2.9% on an annual basis, compared to 2.8% in April.

Source: Investing.com

Recent headlines highlight a market that’s cautiously optimistic, but some analysts are warning of a potential “hawkish shock” if CPI exceeds expectations.

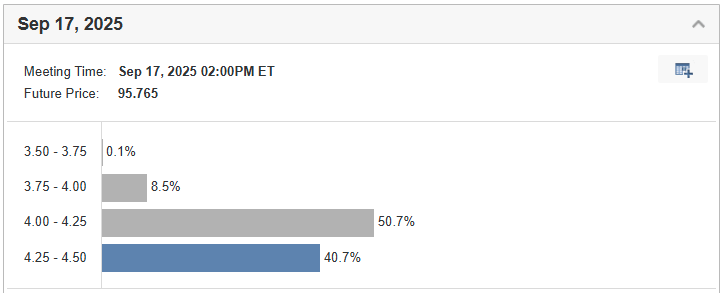

Fed’s Dilemma: Cut or Hold?

Here’s where it gets interesting: Futures traders are pricing in a roughly 60% chance of a Fed rate cut in September, hinging on CPI showing tame inflation. If Wednesday’s print surprises on the upside—suggesting tariffs are feeding price pressures—the Fed could hit pause on cuts, or even signal a wait-and-see stance. On the flip side, a cool reading keeps September’s cut firmly on the table.

Source: Investing.com

The Federal Reserve, which has held the federal funds rate at 4.25%–4.50% since December 2024, signaled a “wait-and-see” approach at its May meeting, citing rising risks of both higher inflation and unemployment. Fed Chair Jerome Powell noted that near-term inflation expectations have increased due to tariffs.

Stocks: Rally or Roadblock?

The S&P 500 is about 2% below its February peak; the Nasdaq, roughly 3% off its December high. A soft CPI print could be the “green flag” for a new leg higher, with tech stocks poised to benefit. But a hot CPI risks slamming the brakes, especially for rate-sensitive sectors and mega-cap tech.

Source: Investing.com

Investors will also watch Treasury yields, which recently hit 4.5% on tariff concerns; a cooler CPI might ease yields, supporting bond prices and equities.

Conclusion

The May CPI report will be a critical test of how Trump’s tariff war is reshaping inflation dynamics. A hotter-than-expected print could unsettle markets, delay Fed rate cuts, and amplify stagflation risks, while a cooler reading might spark optimism for monetary easing and equity gains.

As tariffs ripple through the economy, Wednesday’s data will offer a crucial glimpse into the balance between inflation and growth, guiding investors and policymakers alike.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.