Street Calls of the Week

Though fast-food behemoth McDonald’s (NYSE:MCD) has bounced back from the COVID-driven crash in earnings, the company still faces three challenges that continue growing.

First, employers in the United States are encountering what appears to be a radical shift in the domestic labor market. Workers are simply not interested in lower-paying service jobs. At a recent job fair at Denver International Airport, with available jobs concentrated in food services, the goal was to have 5,000 attendees.

Only 100 people showed up to apply for 1,000 available jobs. McDonald’s restaurants, along with other fast food providers, report having to close part or all of their dining areas because of staff shortages.

The second major challenge for MCD is dealing with inflation in food commodities. After more than a decade of low inflation, food prices have shot up in 2021. The company is raising prices in response to cost pressure, but low-priced restaurants like MCD may face even tighter margins as they balance customer price sensitivity with the cost escalation in food commodities.

A third consideration, albeit one not nearly as immediate as the labor shortage and inflation, is the increasing concern about healthier food options from investors and consumers. MCD has recently announced a limited offering of a vegetable protein “burger” sourced from Beyond Meat (NASDAQ:BYND), the McPlant, to explore demand for non-meat protein.

Still, it's not obvious that MCD customers are clamoring for healthier food options. I see products like McPlant as more of a pitch to investors, who have been sufficiently optimistic about non-meat protein products to drive valuations to tech company levels. While Beyond Meat is far below its 12-month high, the shares trade at 13 times trailing sales vs. less than 3 times sales for the S&P 500 as a whole.

Source: Investing.com

Primarily due to COVID-19, 2020 was a bad year for MCD, with Q2 EPS at less than third of the value from a year earlier. Over the entire period, however, it is notable how closely the analyst consensus EPS matched the realized numbers in unprecedented conditions. Going forward, the EPS is expected to continue to recover and grow.

Green (red) values are amount by which the quarterly EPS beat (missed) consensus expected EPS

Chart Source: ETrade

MCD’s expected EPS growth is 8.1% for the next 12 months and 13.3% per year (compounded) over the 3-5 year time horizon. The dividend growth rates over the past 3-, 5-, and 10-year periods are 8.5%, 7.7%, and 7.8%, respectively. With the current forward dividend yield of 2.3%, it is not unreasonable to expect 10%-11% in annualized total return, given the dividend growth rate and anticipated EPS growth (based on the Gordon Growth Model). With a 5-year beta of 0.62, 10% in expected total return is not unattractive.

In analyzing stocks, I rely on two forms of consensus outlooks. The first is the Wall Street analyst consensus rating and price target.

The second is the consensus outlook of buyers and sellers of options that is implied from options prices. The price of an option on a stock represents the market’s consensus estimate of the probability that the share price will rise above (call option) or fall below (put option) a specific level (the strike price) between now and when the option expires.

By analyzing the market prices of options at a range of strike prices, it is possible to calculate a probabilistic forecast for the stock price that is implied from the options prices. This is called the market-implied outlook. For more information on market-implied outlooks, see my overview, including links to the relevant financial literature.

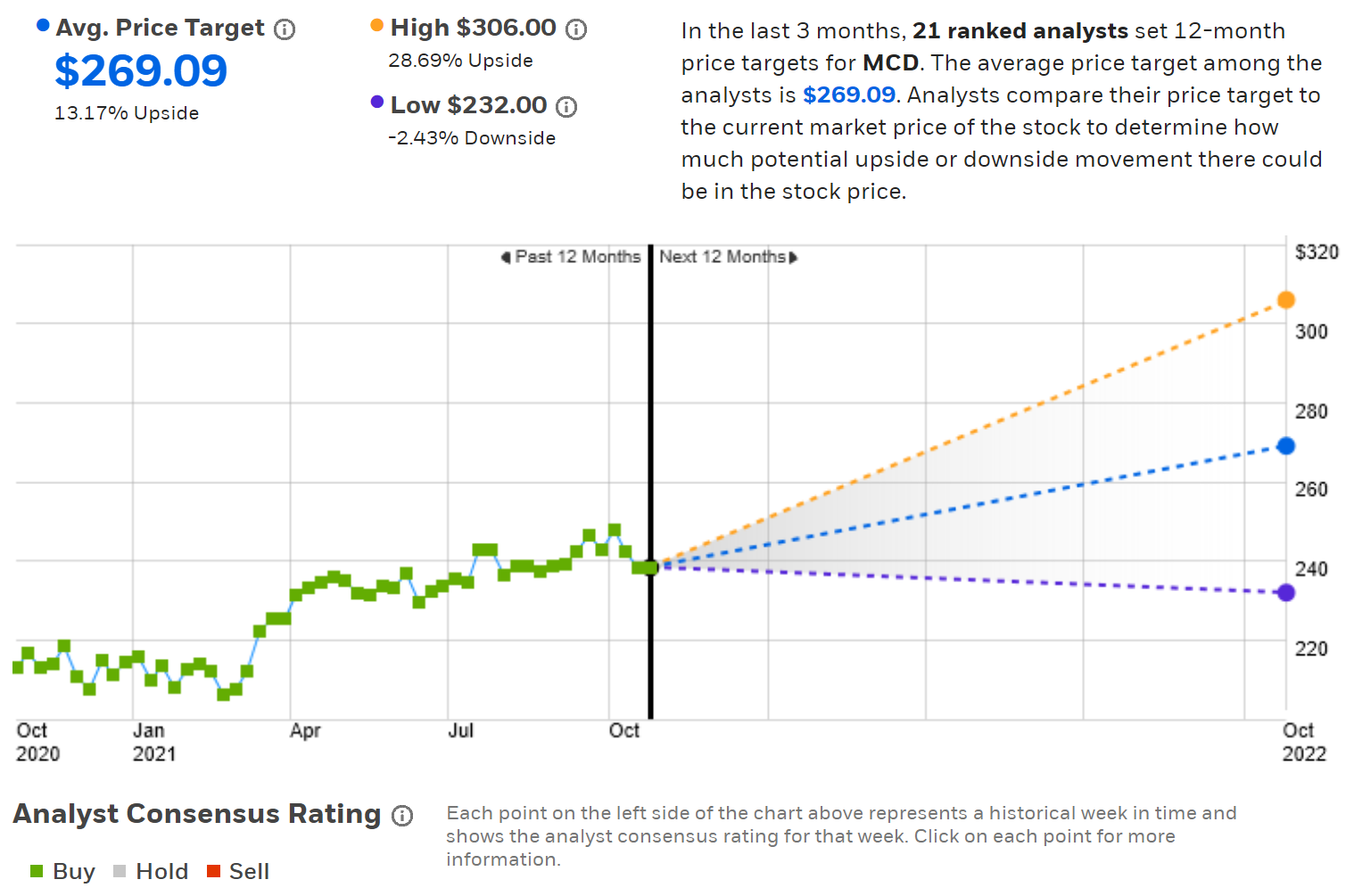

Wall Street Consensus Outlook for MCD

ETrade calculates the Wall Street analyst consensus from ratings and price targets from 21 ranked analysts who have updated their views within the past 90 days. The consensus rating for MCD is bullish and the consensus 12-month price target is 13.2% above the current share price. Of the 21 analysts, 18 assign a buy rating and 3 have a hold rating.

Source: ETrade

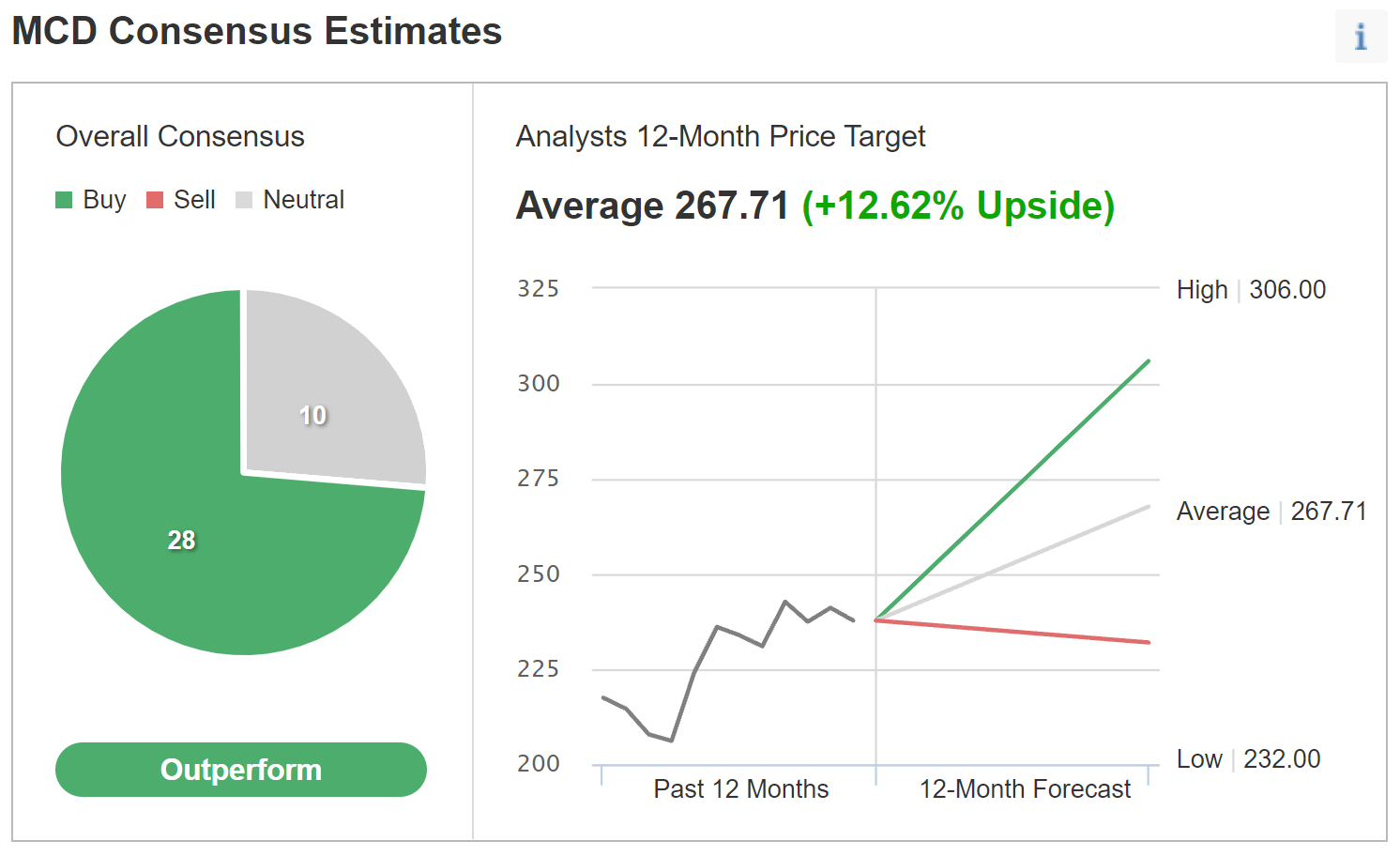

Investing.com’s version of the Wall Street consensus is calculated using ratings and price targets from 38 analysts. The consensus rating is bullish and the consensus 12-month price target is 12.6% above the current share price.

Source: Investing.com

The 12-month price targets from these two calculations for the Wall Street consensus are very close to one another (this is not always the case), with an average expected price return of 12.9% and expected total return of 15.2% for the next 12 months. The trailing 3-year annualized total return is 14.97%, remarkably close to the consensus 12-month outlook.

Market-Implied Outlook for MCD

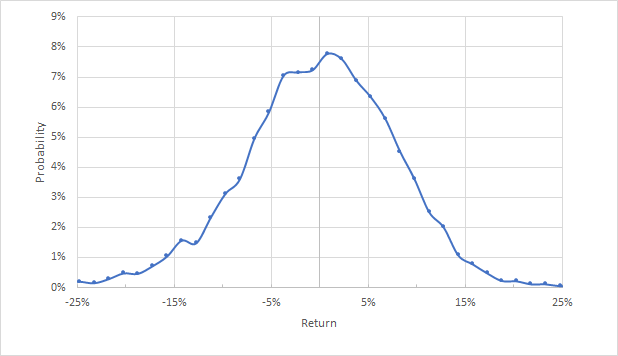

I have analyzed the prices of put and call options at a range of strike prices, all expiring on January 21, 2022, to generate the market-implied outlook for MCD for the next 2.9 months (from now until that expiration date). I have also calculated the market-implied outlook for the 7.7-month period from now until June 17, 2022 using quotes on options that expire on that date. I selected these two periods to provide a view to early- and mid-2022 and because the options that expire on these dates tend to be quite liquid.

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Market-implied price return probabilities for MCD for the 2.9-month period from now until Jan. 21, 2022

Source: Author’s calculations using options quotes from ETrade

The market-implied outlook to Jan. 21, 2022 is generally symmetric, indicating that the the consensus outlook from the options market is fairly balanced, although the peak in probability is slightly tilted towards positive returns. The maximum probability corresponds to a price return of +1% over the next 2.9 months. The annualized volatility calculated from this distribution is 19.6%.

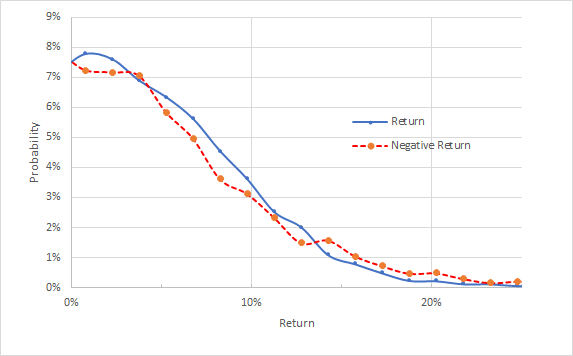

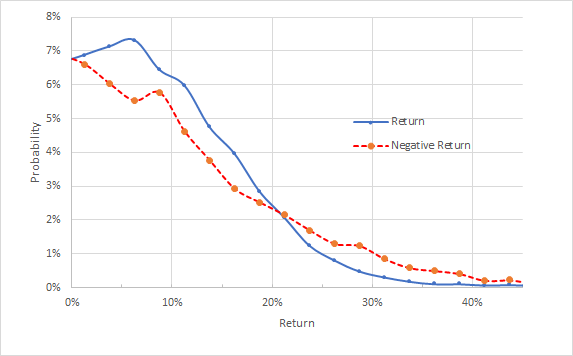

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Market-implied price return probabilities for MCD for the 2.9-month period from now until Jan. 21, 2022. The negative return side of the distribution has been rotated about the vertical axis

Source: Author’s calculations using options quotes from ETrade

This view shows that even though the peak probability return is only slightly above zero, the probabilities of positive returns are consistently higher than for negative returns for a wide range of the most-probable outcomes (the solid blue line is above the dashed red line for returns with highest probabilities). This is a bullish view from the market-implied outlook.

Theoretically, the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus overpay for put options. With this effect in mind, the market-implied outlook would be more bullish than it appears.

Looking out to the middle of 2022, using options that expire on June 17, 2022, the market-implied outlook for MCD is even more bullish, with higher probabilities of positive returns relative to negative returns for returns in the range from -20% to 20% (returns from 0% to 20% on the chart below). The probability of large-magnitude negative returns is higher than for positive returns, a standard characteristic of dividend-paying stocks. The annualized volatility derived from this outlook is 21.7%.

Market-implied price return probabilities for MCD for the 7.7-month period from now until June 17, 2022. The negative return side of the distribution has been rotated about the vertical axis

Source: Author’s calculations using options quotes from ETrade

The market-implied outlook for MCD suggests a moderately bullish view to early 2022, becoming more bullish as the year progresses. The expected volatility is low, albeit increasing slightly from the January outlook to the June outlook.

Summary

Despite labor shortages and rising food commodity prices, both of which squeeze earnings potential from restaurants, the outlook for MCD looks solid. The Wall Street analyst consensus rating is bullish and the consensus 12-month price target is 12.9%, for an expected total return of 15.2%.

The market-implied outlook for MCD is bullish, with the positive outlook stronger by mid-2022 than at the beginning. The expected volatility derived from the market-implied outlook is about 21%.

As a rule of thumb for a buy rating, I want to see an expected 12-month total return that is at least half the expected volatility. Taking the analyst consensus price target at face value, MCD substantially exceeds this threshold.

Even looking at the lower expected returns from the dividend discount model (aka the Gordon Growth Model), MCD is on the threshold for a buy rating. With the bullish outlook from Wall Street and the options market, along with MCD’s solid earnings recovery coming out of COVID, I am assigning a buy rating on MCD.