Street Calls of the Week

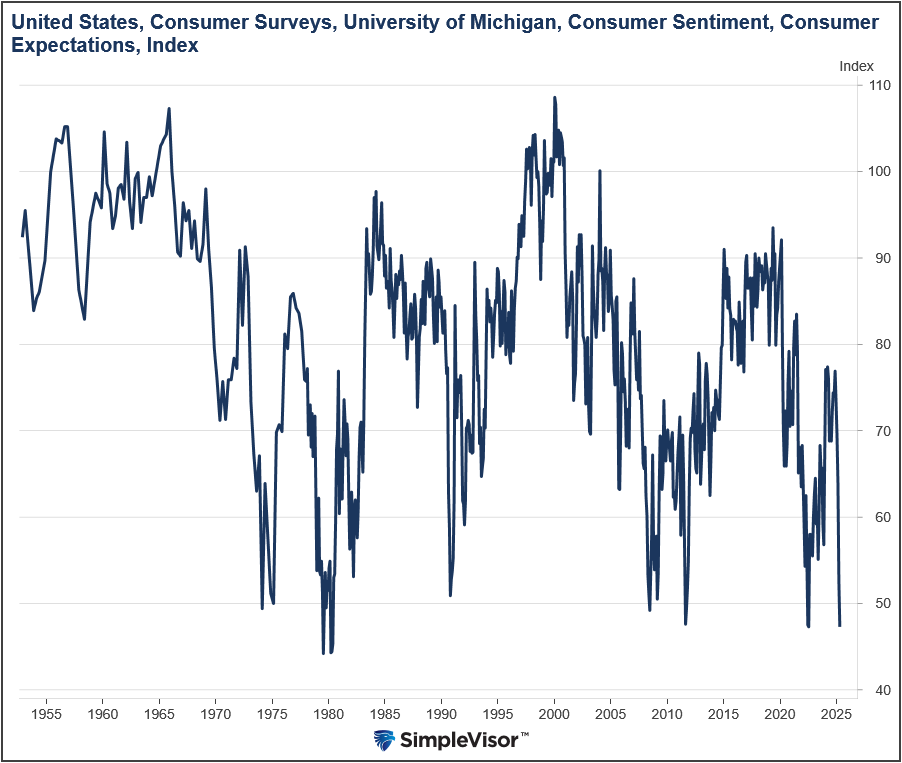

This past week, two lower-cost food and beverage retailers posted earnings, which conveyed the underlying message that consumers are struggling. McDonald’s (NYSE:MCD) and Starbucks (NASDAQ:SBUX) reported significant domestic sales declines for the first quarter.

McDonald’s saw its US same-store sales fall by 3.6%, driven by a decrease in its “guest count.” This was the worst decline in same-store sales since 2020. Starbucks saw its revenues decline by 4% in its US stores.

Executives at McDonald’s and Starbucks spoke to similar themes. They see their clientele dealing with uncertainty from tariff-related economic concerns. Moreover, persistent inflation is resulting in more frugal behaviors, such as eating and making coffee at home. They both note that low-income customers are particularly affected.

- “Consumers today are grappling with uncertainty“- Chris Kempczinski – CEO of McDonald’s.

- “Starbucks faces challenges in reviving its business… with inflation and economic uncertainty driving up costs and dampening U.S. demand.“- Brian Niccol – CEO, Starbucks.

Two key takeaways from McDonald’s, Starbucks, and other lower-end retailers this quarter: First, it appears they are not able to pass on higher prices to their customers. Second, poor consumer sentiment is weighing on personal consumption.

We end with a comment from Chipotle’s CEO following a 0.4% decline in same-store sales, the first decline since 2020:

In February, we began to see that the elevated level of uncertainty felt by consumers are starting to impact their spending habits. We could see this in our visitation study, where saving money because of concerns around the economy was the overwhelming reason consumers were reducing the frequency of restaurant visits.

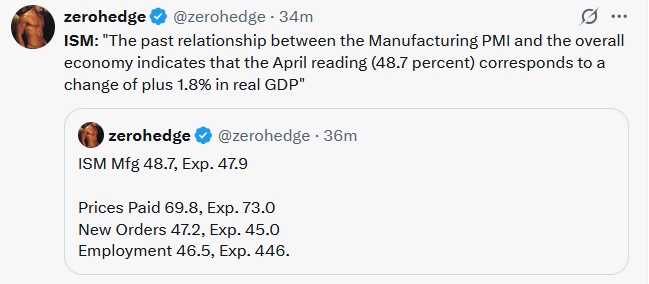

What To Watch Today

Earnings

Economy

Market Trading Update

Yesterday, we discussed oil prices and their impact on inflation and the economy. While economic growth remains a concern in 2025, the market has been inflating over the past two weeks. The S&P 500 is currently in an 8-day winning streak, decently long without a down day.

However, yesterday, the market rallied above the 50-DMA following better-than-expected earnings reports from Microsoft (NASDAQ:MSFT) and Meta Platforms (NASDAQ:META). That rally is likely limited given the short-term overbought condition of the market and the reality that the 200-DMA is just ahead, with the 100-DMA just above it.

The good news is that the previous resistance level developed when the pre-tariff announcement lows were broken has now been returned to support. Therefore, any short-term correction will find support at the 50-DMA and then at those previous bottoms.

However, breaking that support will also violate the recent market uptrend and suggest a retest of lows is possible. While the markets are behaving more bullishly in the near term, we should not dismiss the possibility of another correction phase over the next few months.

This is why we increased a short S&P 500 hedge position this week and are carrying higher cash levels. Once the bullish trend is reconfirmed, we will reduce hedges and increase equity exposure accordingly. While we may not buy the bottom of the market and may suffer some short-term underperformance, the preservation of capital and reduced volatility will give us a long-run advantage over benchmarking an index.

Trade accordingly.

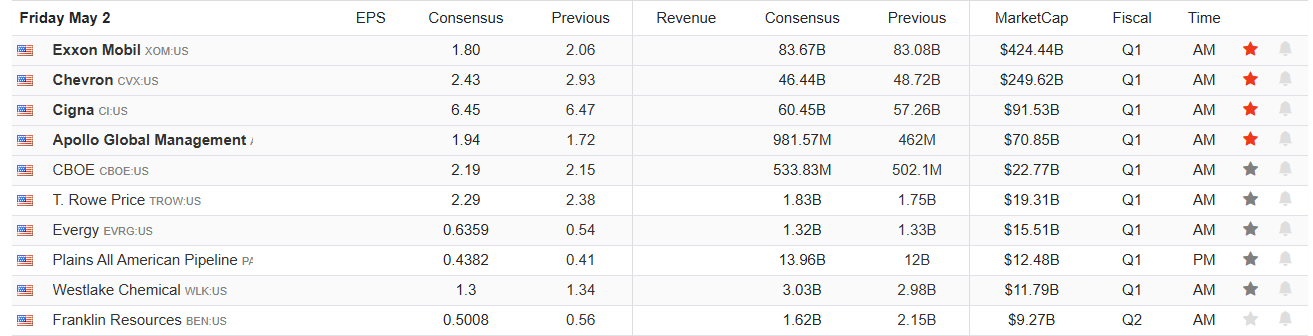

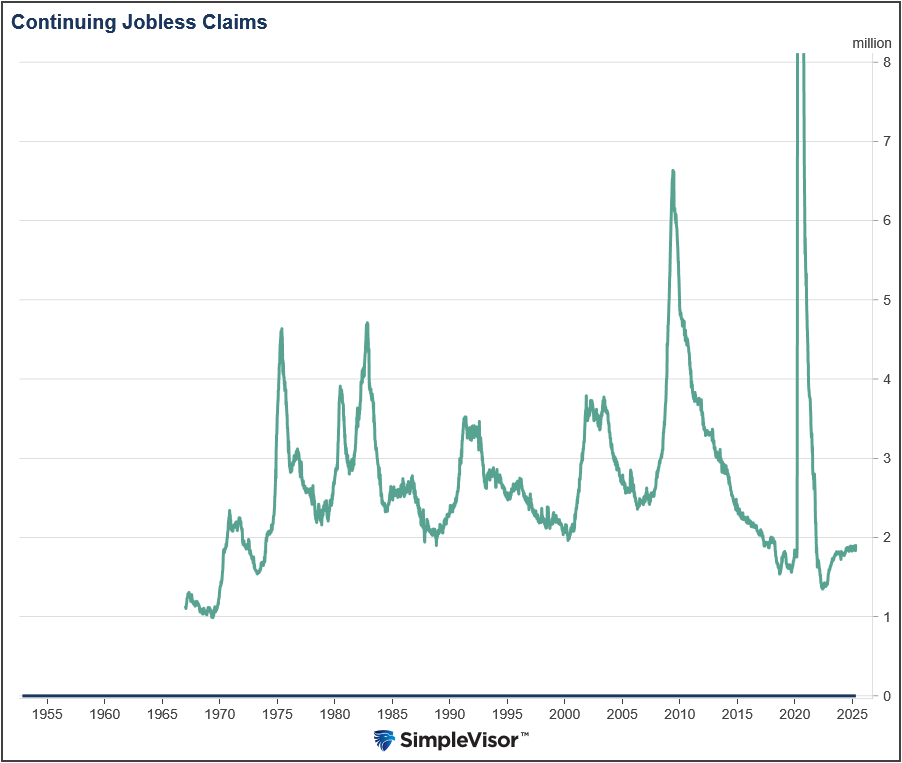

Continuing Jobless Claims Continue To Drift Higher

Continuing jobless claims rose to 1.916 million, up from 1.841 million last week. This marks the highest level since November 2021. Accordingly, it signals that an increasing number of job seekers face difficulties finding new employment. Initial jobless claims increased to 241,000, surpassing estimates of 223,000 and the prior week’s 222,000.

Like ADP, the data point to a weaker-than-expected BLS employment report today.

Continuing jobless claims, unlike initial claims, which track new unemployment filings and are considered a leading indicator, reflect the number of people still unemployed and receiving benefits. Thus, they serve as a coincidental measure of economic conditions.

In the current environment, layoffs are low, but new hires are weak. Simply, the underlying labor market is not as robust as the headline data suggests. An increase in layoffs will be problematic as potential job openings decline.

As the graph below shows, continuing jobless claims are historically low but have slowly risen to their highest level since late 2021.

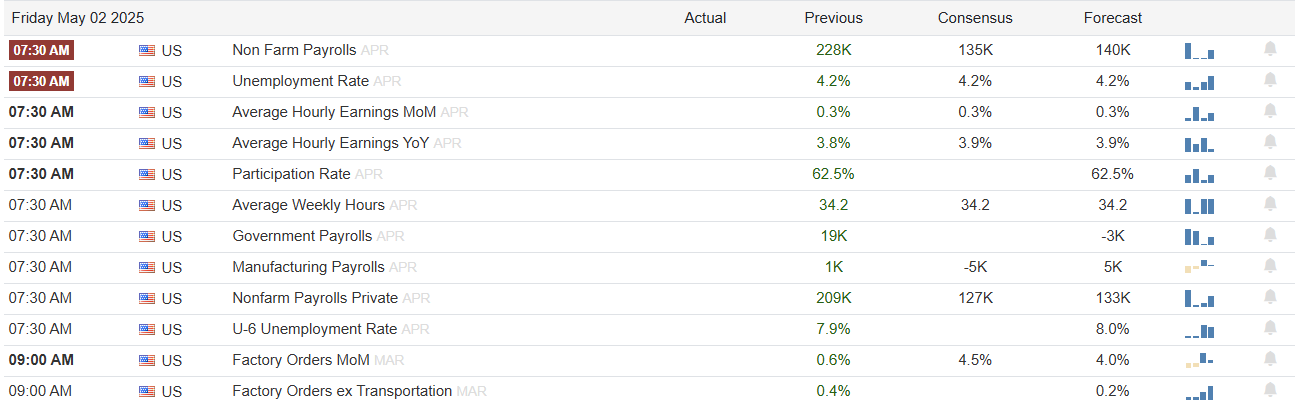

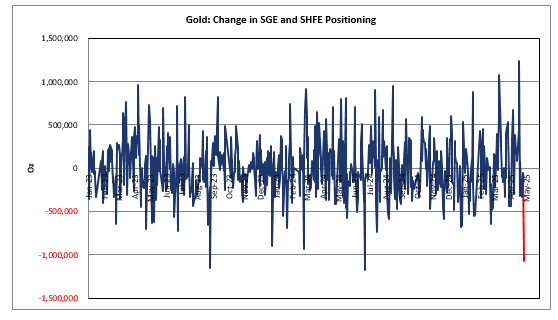

China Sells Gold

It is being reported, and as shown below, courtesy of ZeroHedge, that China sold “millions of ounces” of gold Thursday morning.

Gold fell by three percent on the news. There are many rumors that China is trying to replace its dollars with gold. While there may be some truth to that, they are still heavily dependent on the dollar. Accordingly, they are unlikely to make any radical adjustments to their dollar or gold holdings, as it will work against their broader economic interests. In other words, be cautious when buying gold on the thesis that China is rapidly abandoning the dollar.

Tweet of the Day