U.S. stocks rise on Fed cut bets; earnings continue to flow

- Meta may raise AI spending above $72B to match rivals and scale data centers.

- Stock correction continues, with key support between $680 and $695 under close watch.

- Strong fundamentals, but earnings must beat expectations to avoid a deeper 10% drop.

- Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners for up 50% off amid the summer sale!

This week, many of the biggest companies in the stock market will report their quarterly results. This includes Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Meta Platforms Inc (NASDAQ:META).

Tech firms are currently spending heavily on AI, and Google’s parent company, Alphabet (NASDAQ:GOOGL), just said it will raise its AI investment to $85 billion this year. Meta is also focused on AI and may announce plans to boost spending. Investors will be watching closely to see what Meta says about its spending and earnings.

Right now, Meta’s stock is going through a dip and looking for support before it can possibly start rising again.

Will Meta Raise the Stakes in the AI Race?

Meta originally planned to invest between $64 billion and $72 billion in AI this year. But that amount could go up, especially since its rivals are moving fast and Meta needs to keep pace. A large share of this spending is going into building and expanding massive data centers under the Hyperion project.

Meta has also made some notable hires recently, bringing in top talent like Alexander Wang, Nat Friedman, and Ruoming Pang, who previously worked at Apple.

Advertising still makes up a big part of Meta’s revenue, and AI is playing a bigger role here too. It helps the company target and deliver ads more effectively. A key tool in this area is Advantage+, which uses automation and optimization to improve ad performance. How well ad revenues match up to expectations will likely be an important factor in how the market reacts to Meta’s results.

Strong Fundamentals, but Correction Risk Still Lingers

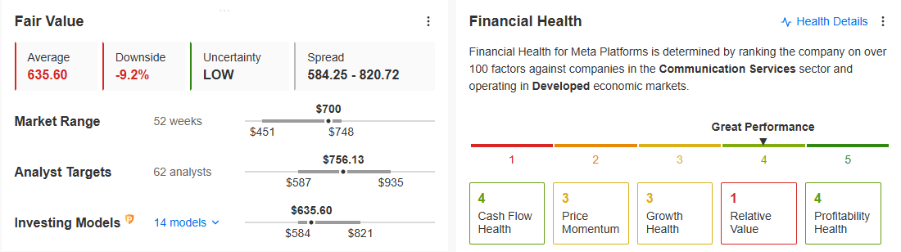

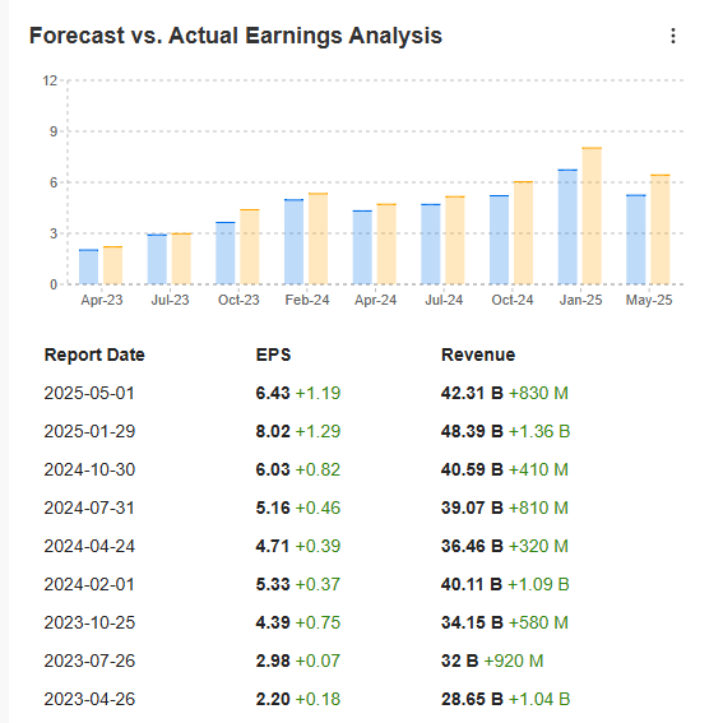

From a fundamentals perspective, Meta is in strong financial shape. Its revenue and profit figures are solid, and its overall financial health is rated 4 out of 5.

There is still a chance that Meta’s stock could drop by 9 to 10%, based on InvestingPro’s fair value estimate. But a lot depends on today’s earnings report, which the market seems optimistic about. This is clear from the many recent upward revisions to forecasts. To avoid a downside move, Meta will likely need to deliver results that at least match or beat expectations again.

A 10% drop would reflect a very pessimistic view right now and would suggest that Meta’s results came in much weaker than expected.

Is Meta Platforms’ Stock Correction Likely to Ease Soon?

After failing to break back into an uptrend and getting pushed back from the resistance near $724, Meta’s stock continues to move in a corrective phase. Sellers are now focused on the next key zone of support, which lies between $680 and $695.

If the earnings come in stronger than expected, a move above both the upward trendline and the $724 resistance level would be a key technical signal. This breakout could pave the way for a push toward Meta’s all-time highs.

***

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services.