Uxin shares drop 45% as predicted by InvestingPro’s Fair Value model

First, our Elliott Wave Principle (EWP) updates on one of the most critical major indexes, the Nasdaq 100, will continue for 2024. Second, to those new to our work, we reviewed our forecasts since August in our last update of 2023, showing we anticipated most market moves correctly, albeit sometimes inevitably missing the finer nuance.

In that update, we noted that since the October 26, 2023, low at $14058, "The most significant “pullback,” the December 4 low, was only -2.8%. Hence, the current rally is a significant outlier that is unforeseeable when it starts. However, therefore it smells of a 5th wave. Thus, our primary expectation is for the index to top out, as we forecasted it could almost two months ago, at $16100-660+."

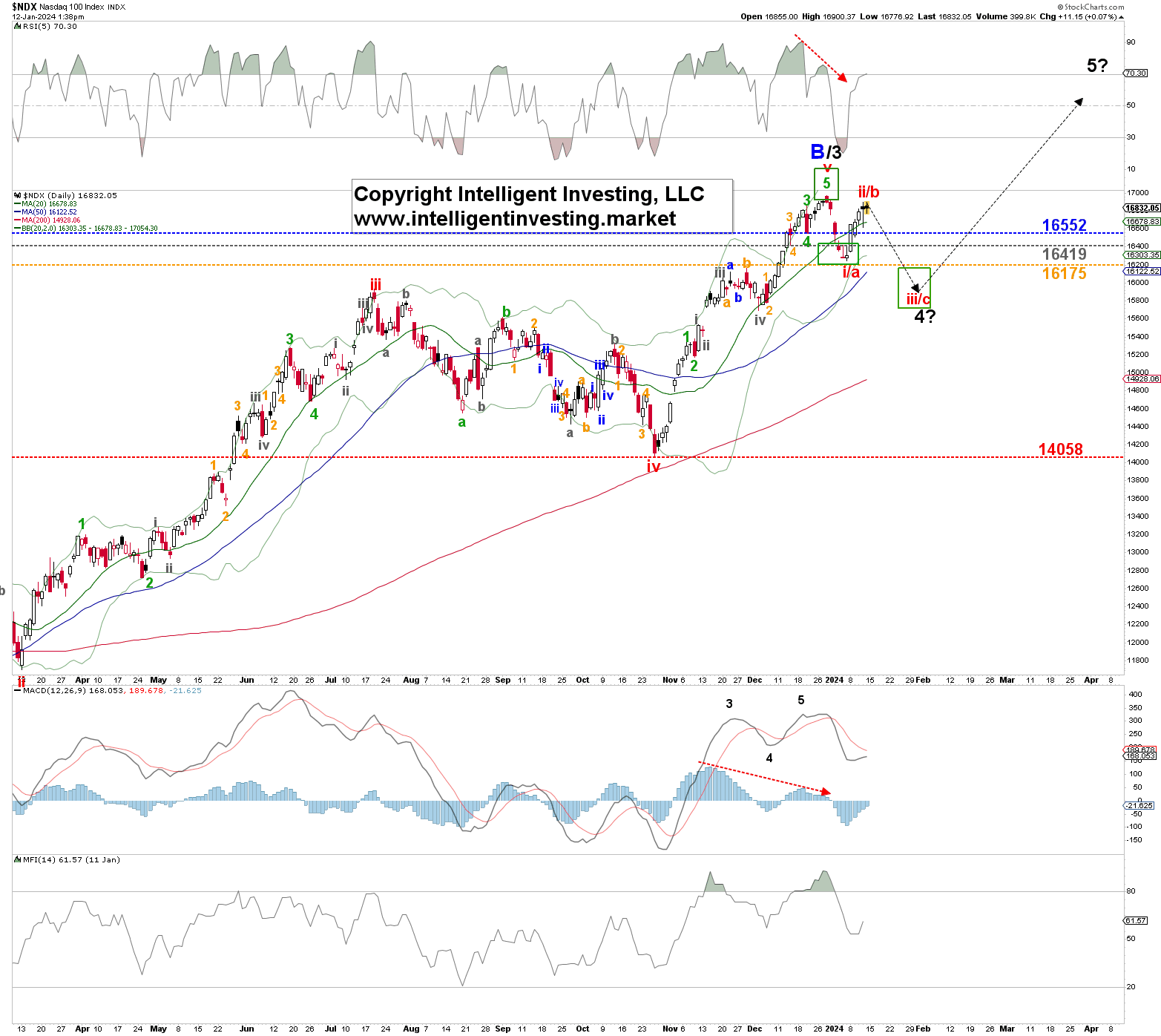

On December 28, 2023, the index reached $16969 and started to decline to the January 5, $16249 low. That was the most profound and protracted correction since that October low, strongly suggesting the rally had ended. Allow us to explain with Figure 1.

Figure 1. Daily NDX chart with detailed EWP count and technical indicators

In an EWP impulse pattern, we expect a correction to the downside to unfold after five completed waves. In this case, we can count five green waves at the December 2023 high. The first warning level for the Bulls to confirm this thesis was below the blue dotted line at the previous (green) 4th wave low: $16552. The 2nd warning was the grey level at $1641. The 3rd warning was the orange level at $16175, the 61.80% retrace of the rally from the grey W-iv low made in November.

Thus, the question is: What kind of top are we dealing with? We already discussed this in our December update, but let's recap. Figure 1 shows the blue Wave-B (W-B) and black W-3 labels. The former suggests the index has completed its counter-trend rally from the October 2022 low as a regular B-wave and is now ready to embark on a devasting C-wave to $8600+/-2000. However, it will ultimately require a break below the red warning level, October 2023 low at $14058, with a severe warning below $15600, to tell us this potential is the case.

The latter suggests the index has "only" completed the black (major) W-3, is now in black W-4 back down to ideally $16170-15730 before the black W-5 to ideally $2000+/-1000 kicks in. From there, we can then anticipate the more significant decline. It requires at least a break below yesterday’s low at $16618 while staying above $14058 to allow this potential.

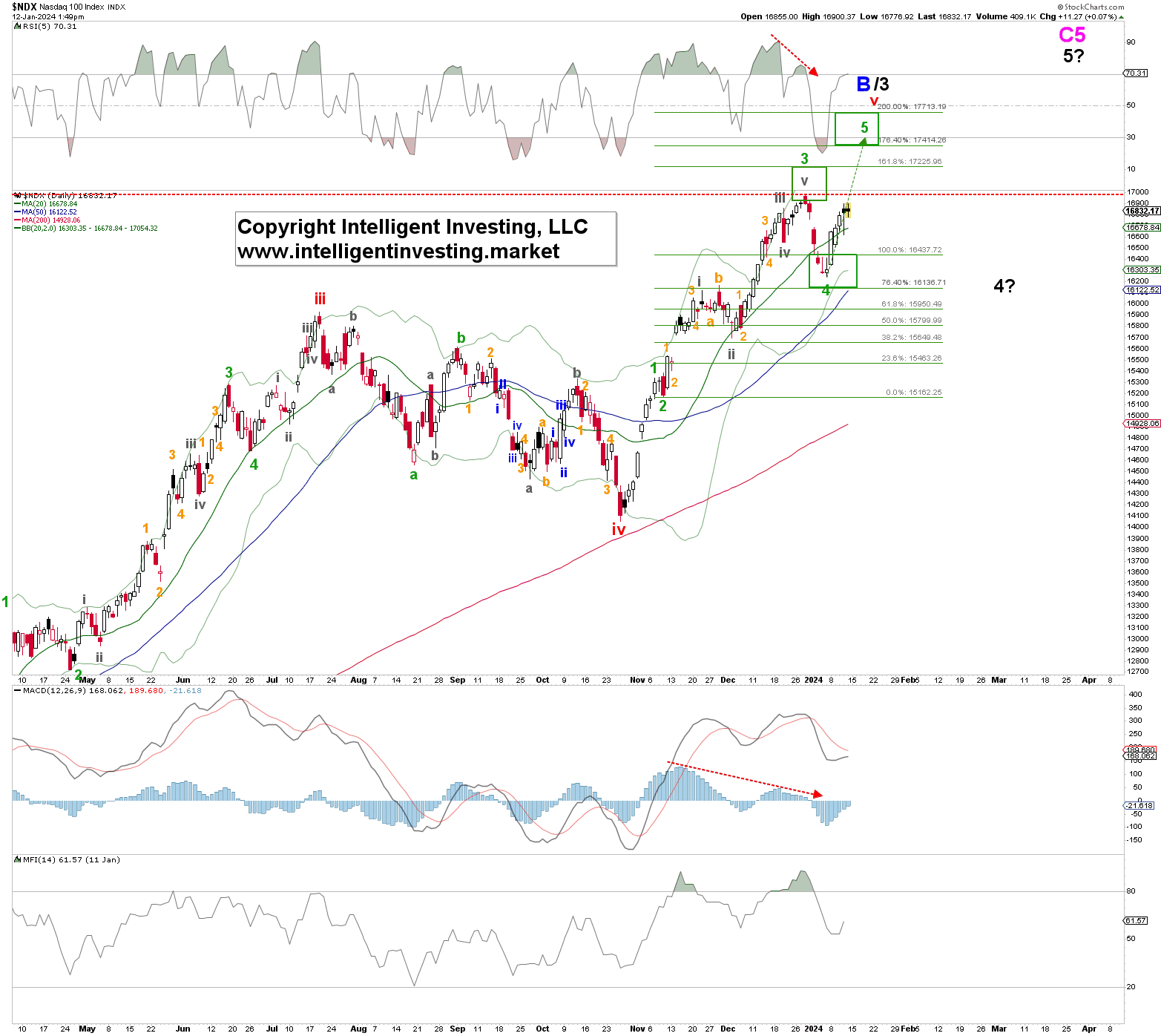

Our alternative scenario is in Figure 2 below.

Figure 2. Daily NDX chart with detailed EWP count and technical indicators

Namely, as stated in our last update, "Since the October 27, 2023, low, the price pattern, is truly out of the ordinary for stock markets, which renders the smaller wave structures less clear." We can, therefore, interpret the recent decline as a potential green W-4, which bottomed in the ideal target zone, followed by another green W-5 to ideally $17414-713. This option will be confirmed above the December 28, 2023, high and invalidated below the $15600 as the decline will be too significant to reliably assess it as a smaller degree (minor) 4th wave.

Thus, our primary expectation "for the index to top out, as we forecasted it could almost two months ago, at $16100-660+" was correct. As such, and as stated in December, our primary expectations remain

- either a long-term top (blue W-B) and set course for $8600+/-2000 or

- a drop to ideally around $15800+/-200 for the black W-4?, before a final rally to as high as $20000+/-1000 for the black W-5?. Our alternative is

- For a mild correction to have ended on January 5, a rally to $17414-713 is underway.

Unfortunately, at this stage, we can't discern between A), B), or C). We always wish things to be more transparent, but we are not dealing with a linear environment. We are not prophets. Nobody is; we can never be certain and not tell you which way the market will go daily. Still, we certainly can provide the most likely scenarios and the parameters, i.e., price levels to look for, so you will know what to expect.

Thus, the final statement in our last update, when the index was trading only 160p higher than now, remains relevant, "Hence, at this point, it would be appropriate to assess the short- to long-term risk/reward at current price levels, and the warning levels above can be used as one's insurance policy to prevent havoc on one's portfolio."