Bubble or no bubble, this is the best stock for AI exposure: analyst

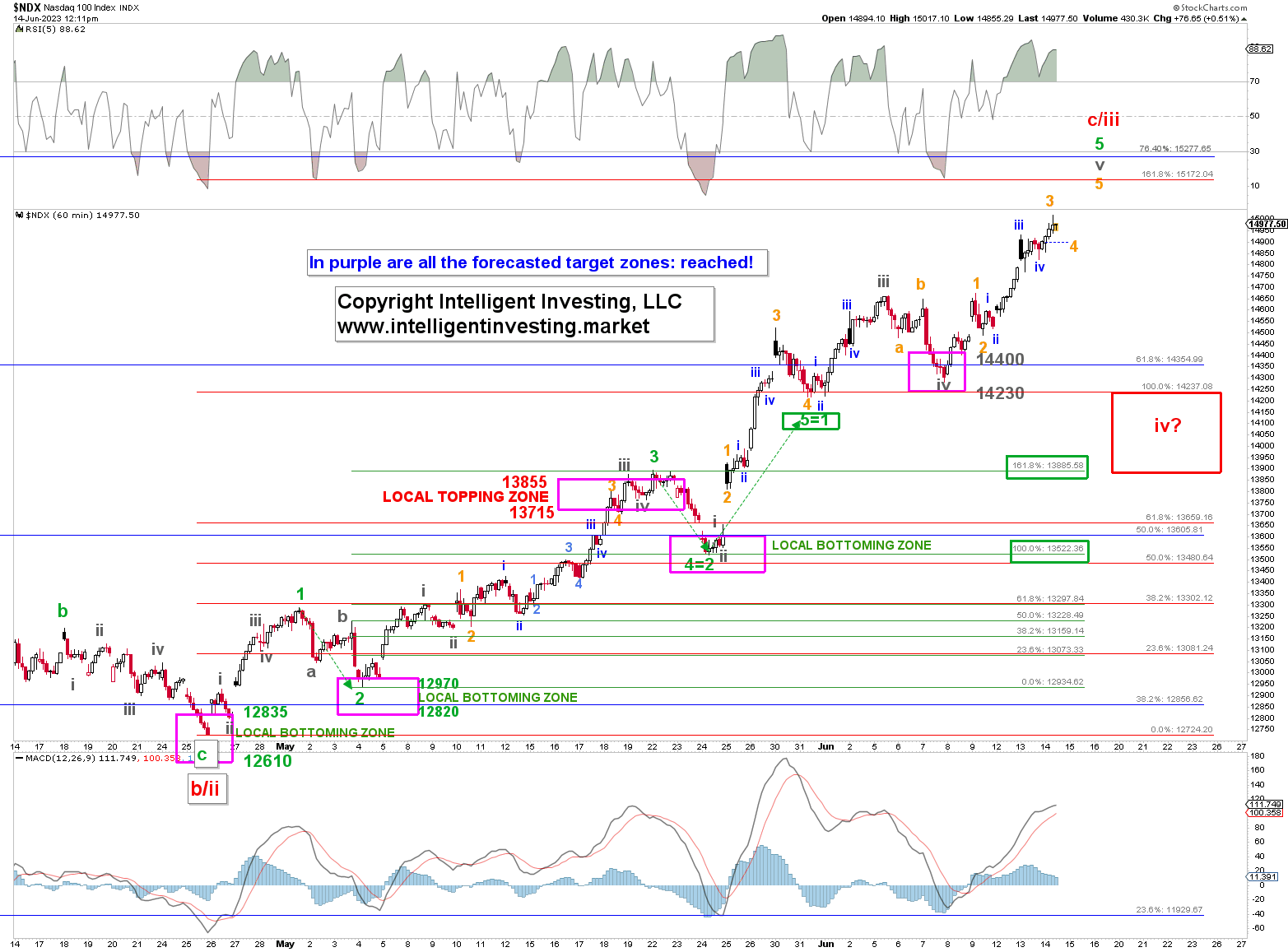

At the end of May, we used the Elliott Wave Principle (EWP) to determine where the Nasdaq 100 could potentially top. Back then, we were looking for a top around $13940-14230 based on the following facts:

"In a standard Fibonacci-based impulse pattern …

The 3rd wave then often reaches the 138.2-161.80% extension of W-1, measured from the W-2 low.

The 4th wave then often retraces to the 123.60-76.40% extension of W-1.

The 5th wave then often extends to the 176.40-200.00% extension of W-1 ($13940-14075).

Moreover, in a standard impulse pattern, wave-2 = wave 4 and wave 5 = wave 1. Note these relationships are not set in stone but a great rule of thumb. As long as W-3 is not the shortest wave and W-2 and W-4 do not overlap, extensions and truncations can always happen."

As underlined and in bold as well as stated at the end of our previous article:

"The index will have to trade above $14230 to tell us an extension of the red W-c and therewith the green W-5 is underway."

Figure 1

And boy, did we get an extension. Figure 1 above shows the index surpassed the ideal target zone by a wide margin, as green W-5 of red W-c/iii extended tremendously. Thus, while the NDX ticked off all the boxes for green waves 2, 3, and 4, the green W-5 decided not to comply. This is why we always say we are ~70% reliable, as one can often get three to four out of the five waves correct because the markets are never perfect and throw the occasional curve ball. And as you can see in Figure 1, waves 2, 3, and 4 were picture-perfect Fibonacci precision.

Instead of a red W-c = W-a relationship, the index decided to go for the red W-c/iii = 1.618x a/i extension at $15170+/-5, which is close to the 76.40% retrace of 2021 all-time high to the 2022 low. That, in turn, means the index could try for a complete impulse (red W-iii, iv, and v, with the latter not shown).

Closer to home, we expect the orange W-3, 4, 5 sequences to complete over the next few hours/days to ideally the above-mentioned extension. But note we are now talking about the most minor and most likely final wave of the rally since the late April low. So, risk management is prudent at this stage. Once the orange W-5 completes, the red W-iv? will likely kick in, bringing the price of the NDX back to ideally $14230, akin to the green waves 3 and 4 we discussed. Then another red W-v to ideally $15565+/-75 should commence.

To close, please remember that "The hard, cold reality of trading is that every trade has an uncertain outcome." - Mark Douglas