Eos Energy stock falls after Fuzzy Panda issues short report

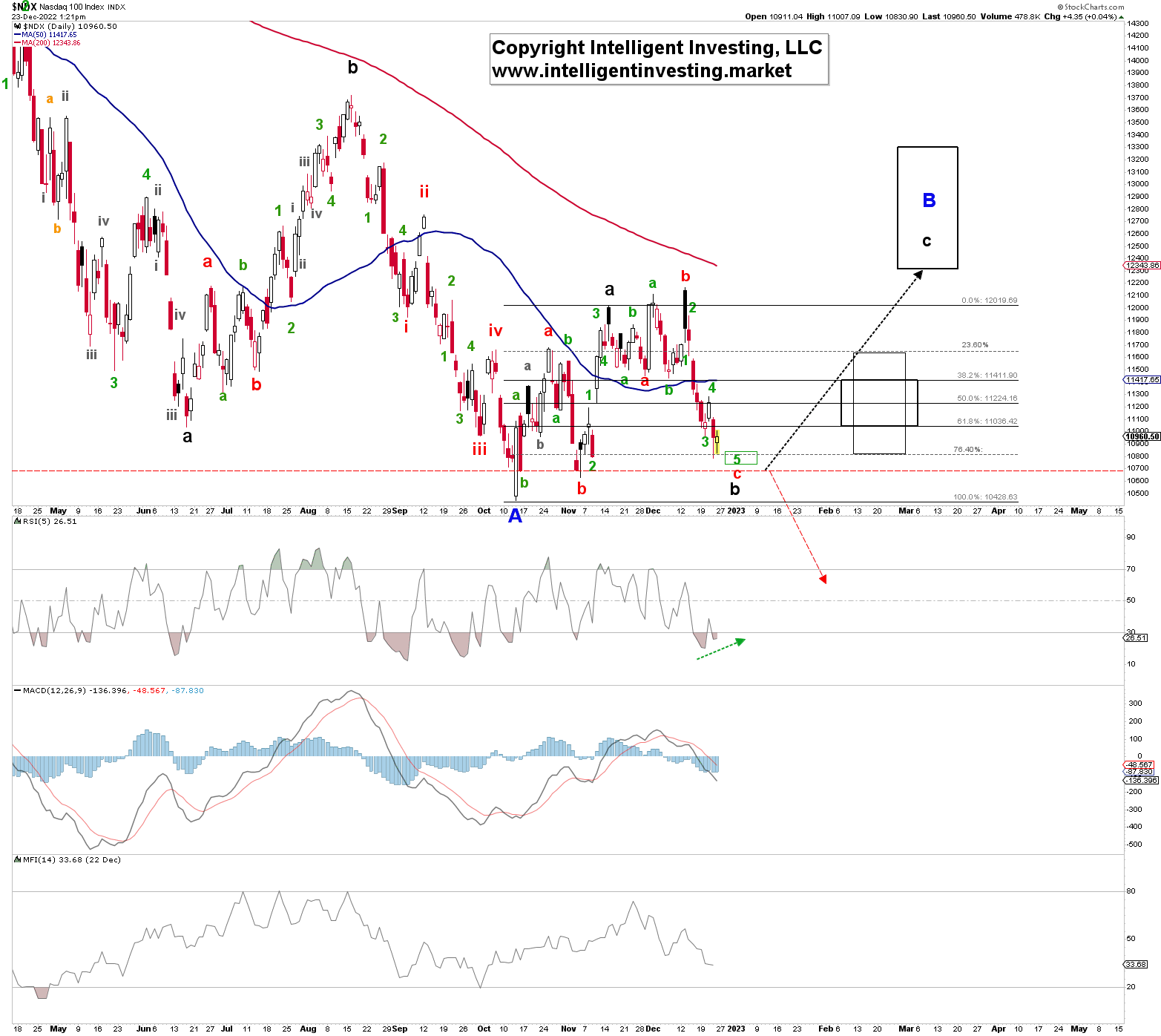

Last week we found for the Nasdaq 100, using the Elliott Wave Principle (EWP), that

"the primary expectation of black W-b from a month ago remains the same; it simply morphed twice. We now have a zigzag+flat pattern, which gives us an overall larger flat (black) W-b. We currently track five waves lower because flat corrections end in five waves. "

In addition, we found that

"W-3 should ideally reach $11100 +/- 100. Green W-4 should bounce back to around $11500+/-100 before green W-5 takes hold to ideally $11000 +/- 100. Note these target zones are based on standard Fibonacci-based extensions and retrace. The market can always decide to deviate, i.e., extend."

Like the S&P 500, the NDX decided not to follow an ideal Fibonacci-based impulse pattern to the T but to extend the waves a little bit. Or, as D. Rumsfeld would say, "a known unknown." Namely, the index bottomed Thursday at $10784, which is only 1.1% below the W-5 target zone of this ideal pattern forecasted last week. See Figure 1 below.

Figure 1

In the daily chart above, we were already tracking the five sub-waves of the red W-c of black W-b last week. Why five waves? Because of the C-wave of a flat correction. The internal structure of a flat is a-b-c which in turn is a 3-3-5 pattern. Here green W-3 bottomed at $10967 (vs. $11100 +/- 100 forecasted). Wednesday's high was green W-4, and green W-5 has most likely bottomed.

Thus, as said over the last several weeks, "W-5 of W-c of W-b takes us to ideally $11000 +/- 100. From there, my primary expectation remains the next more significant rally (black W-c) to $13.4+-/-0.5K to complete the blue W-B. The index will still have to break below $10,800 and $10,700 (dotted orange and red horizontal lines, respectively) to tell us the black W-c will likely not happen." So far, so good. But the index did manage to trade as low as $10.8K. Thus the Bulls have been put on a watch.

Thus, for our primary focus to play out, the index will have to

- Hold Thursday's low and not break below $10,700 on a daily closing basis.

- Break back above the green W-4 high made this week ($11286).

- Break above $11650, followed by the December 13 high.

If the index fails to follow these steps, stalls out at around $11400 +/- 150, and then drops below Thursday's low, our primary expectation will be invalidated. The stock market will be heading for $9000 instead.

However, the famous Santa Rally is the last five trading days in December and the first two trading days in the following January. With the US stock markets closed on 12/26 and 01/02 in observance of Christmas and New Year, the window of opportunity for a Santa Rally will officially open Friday and end on January 4. Moreover, sentiment is exceptionally Bearish (see my tweet here). When combining these facts with the EWP count, we have been tracking over the last few weeks; it is prudent to conclude that a sustained bottom could be close.