Futures slip, bank earnings ahead, Powell to speak - what’s moving markets

A week ago, it was described as a blast that would take about a million tonnes of liquefied natural gas exports off the market, providing some relief to US gas storage running critically below five-year averages.

Now, the Freeport LNG crisis appears bigger than initially thought; its estimated outage widened to three months from a prior three weeks, with commensurate relief for gas storage too.

It’s also a bigger problem for gas bulls coasting with a market at 14-year highs until the June 9 explosion at the LNG plant on the Texas Gulf Coast.

Freeport used to account for around 20% of all US LNG processing, liquefying up to 2.1 billion cubic feet (bcf) of natural gas per day.

Guessing how US gas demand for cooling in the summer would fare and how much of that would be offset by what Freeport will not be liquefying could be a challenge to longs in the game.

At the least, the runaway market for natural gas might be pausing and sliding a little more over the next three months, evidenced by Tuesday’s more than 16% plunge on the Henry Hub that culminated in one of the biggest intraday losses for gas prices.

“In total, at least 180 bcf of additional gas would be available according to the 90-day outage timeline,” Houston-based gas markets consultancy Gelber & Associates cautioned its clients in an email it sent out on Wednesday that was seen by Investing.com

Gelber adds:

“180 bcf is the equivalent of around 55% of the current storage deficit. Freeport’s outage could significantly alleviate market tightness associated with our 300+ bcf storage deficit as well as place long-term storage estimates on a path to a more normal outlook.”

But is the Freeport outage an outright game-changer for summer gas?

One also needs to be cautious in estimating the market impact of the estimated 180 bcf that will come free, especially with the uncertainty over summer demand for cooling, which could surprise the upside.

The start of seasonal declines in wind energy combined with aggressively hotter June temperatures could fuel heavier natural gas usage in the power mix.

Blistering June weather, which is on track to surpass previous cooling requirements for the month, could limit the impact of the 14 bcf per week boost achieved from Freeport’s outage in the near term.

The only certainty: As the storage injection progresses, the impact of the shutdown will make itself evidently more clear in longer-term storage forecasts.

So while more pauses and declines on the Henry Hub are likely after the virtually unstoppable rally from March through May, price volatility could exercise itself in greater amounts too—exhibiting a return to the inherent nature of the gas market.

One example is the cumulative rebound of more than 5% in gas prices over the past two sessions after Tuesday’s plunge. Ahead of Thursday’s open in New York, Henry Hub’s front-month was hovering at around $7.55 versus the 14-year highs of $9.66 hit on June 8.

“Currently, natgas is showing signs of a bounce-back from the support hit on Tuesday, though it is still below the Henry Hub’s 50-Day Exponential Moving Average of $7.71,” said Sunil Kumar Dixit, chief technical strategist at skcharting.com.

He adds:

“If gas continues to be supported at $7.00, it will attempt to go above the $7.71 level, which is required for the leg higher to make the daily middle Bollinger Band of $8.54.”

“On the flip side, breaking below $7.20 and $7.00 will call for further drop to the 100-Day Simple Moving Average of $6.34 and the 200-Day SMA of $5.55.”

Analysts at Tudor, Pickering, Holt & Co also say the path of least resistance could be lower. In comments carried by naturalgasintel.com, they said the odds of summer natural gas prices surpassing the $10 mark have “materially lessened.”

But while the “risk-reward for the summer months is clearly changed,” a continuation of recent hot weather trends could see prices “retrace some of the recent move as we trend through summer,” they said.

Additional weather demand from adjusted weather forecasts, summer temperature anomalies, and a retraction in the storage deficit to the five-year average are all fair game over the next three months.

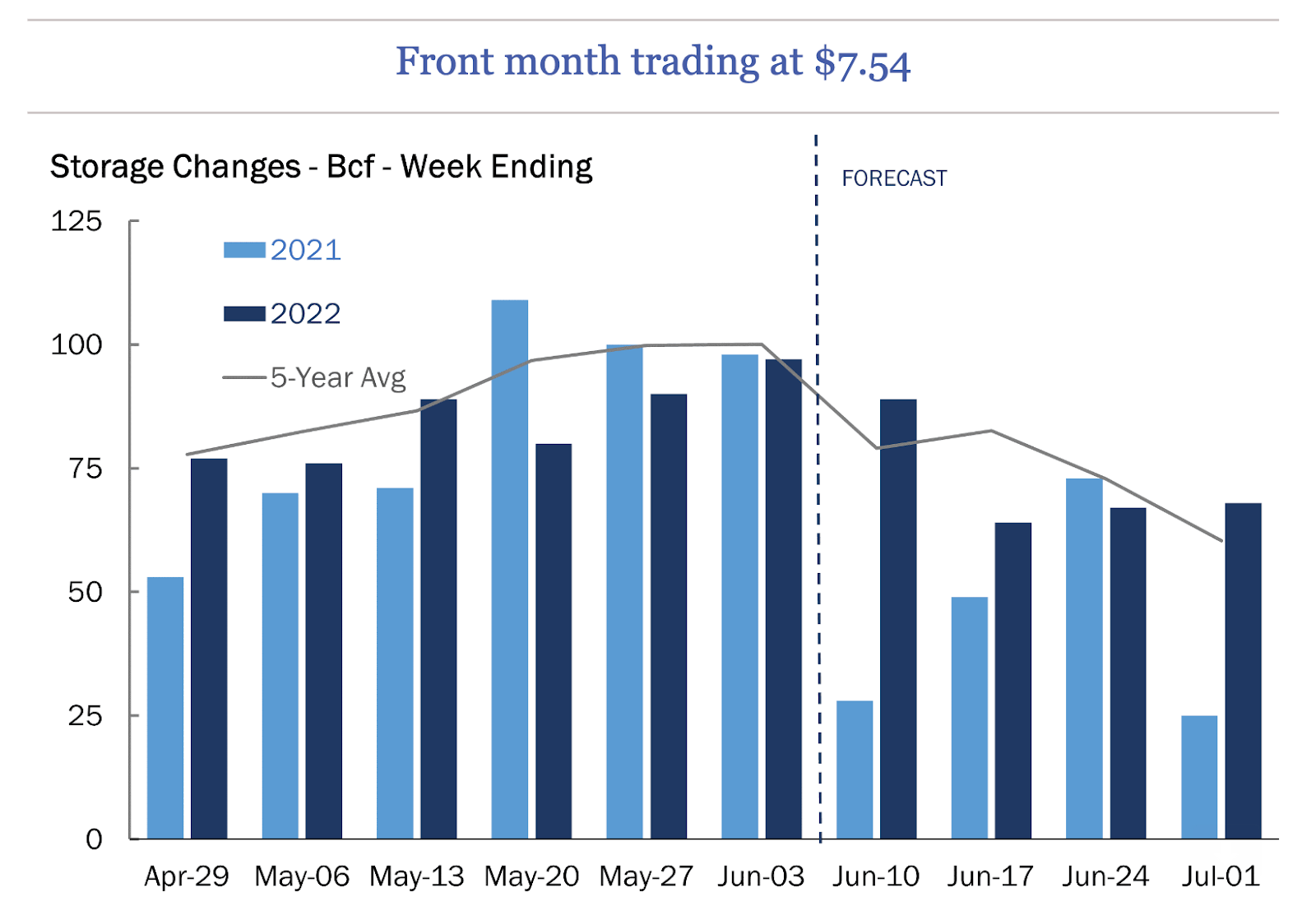

For the latest situation on storage, forecasters tracked by Investing.com expect on average a stockpile build of 96 bcf for the week ended June 10, barely changed from the 97 bcf for the previous week to June 3. The US Energy Information Administration is expected to report that number at 10:30 AM ET today (14:30) in its weekly update on gas storage.

Some market participants are calling for a higher storage build, accounting for the notional Freeport supply already suspended from liquefaction since last week. Analysts at Gelber are among them, saying in their note:

“If we refocus and shift towards near-term storage expectations, the EIA is expected to release a 89 bcf injection; this is 10 bcf higher than the five-year average injection and nearly 70 bcf higher than the injection of last year, which was crippled by PG&E’s reclassification of 51 bcf of working gas to base gas.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.