Diamyd Medical’s phase 3 diabetes trial passes final safety review

- Netflix bulls have built buy narrative on company’s new advertising service, monetization of account sharing and superior content generation

- A lower-priced, ad-supported service could help Netflix reduce number of people canceling, appeal to new customers

- Despite this optimism, some risks still hurt this bull case

The shares of video-streaming giant, Netflix (NASDAQ:NFLX), have shown remarkable strength over the past month. They are up more than 20%, outperforming other mega technology companies included in the FAANG group of stocks.

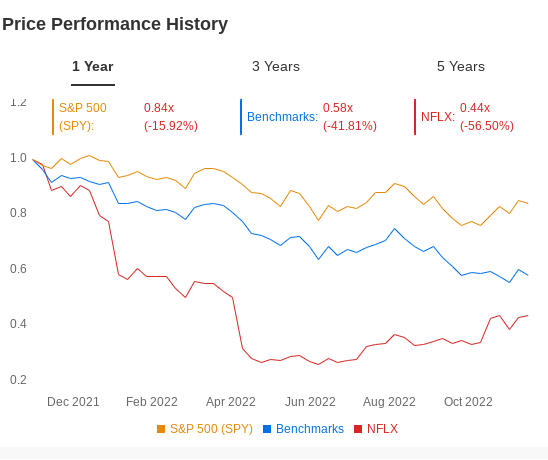

This strength comes after a devastating year in which Netflix lost its investment appeal that cut more than $200 billion from its market capitalization. Despite its recent rebound, NFLX stock is still down 50% in the year.

Investors shunned the California-based media company on concerns that the best days of its growth are behind it and fears that it will struggle to compete in the crowded video-streaming market.

Their fears weren’t without a reason. As the pandemic-led surge in home-based entertainment ended, Netflix lost 1.2 million customers in the first half of this year. Its customer base in the U.S. – its most lucrative market – also shrunk.

Source: InvestingPro

The Worst Is Over

But after a year of losses, there are now signs that the worst is over for the world’s most popular streaming service. Netflix added 2.41 million customers in the quarter that ended Sept. 30, beating its internal forecasts as well as expectations on Wall Street. Netflix grew in all regions of the world. In a letter to shareholders, it said it expects to sign up another 4.5 million subscribers globally this period.

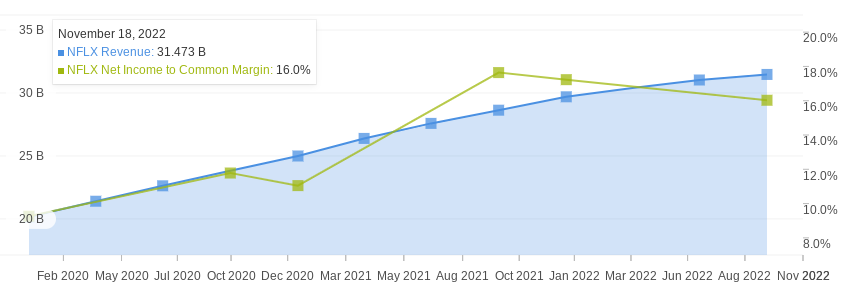

Revenue for the quarter expanded about 6% to $7.93 billion, beating analysts’ projections. Profit of $3.10 a share also topped estimates, while the number of paying customers increased to 223.1 million.

Despite this positive trajectory, the biggest dilemma for investors is whether this momentum is sustainable amid the challenging economic environment and the competitive landscape in the streaming industry.

Netflix bulls have largely built their buy narrative on the company’s new advertising service, monetization of account sharing and superior content generation.

Netflix has introduced an advertising-supported version of the streaming service mostly in developed markets. A lower-priced tier could help Netflix reduce the number of people canceling their service or appeal to new customers in markets where growth has slowed.

JPMorgan, which upgraded NFLX to overweight from neutral, said in a recent note to clients that Netflix’s ad service will pay off over time.

Its note said:

“Coming out of 3Q earnings, we have increased conviction in NFLX’s ability to accelerate revenue growth with the help of advertising and monetization of account sharing, expand operating margins and increase FCF.”

Source: InvestingPro

Despite this optimism, there are still some risks that could hurt this bull case. First, the jury is still out on the real benefit of an ad-supported service. It could prompt many existing subscribers to downgrade their package if the economic situation gets worse and people start losing their jobs.

The new subscription plans were introduced in 12 markets from Nov. 3, which means the company’s fourth-quarter report in late January will be the first chance to see how its subscribers are responding.

Even if the ad service succeeds and arrests the slide in growth, the streaming landscape remains extremely competitive going forward where more than half a dozen deep-pocketed companies, including Amazon (NASDAQ:AMZN) and Disney (NYSE:DIS), are trying to win market share.

Disney in the previous quarter signed up 12.1 million new customers at its flagship Disney+ service alone. Total subscribers, including those for its Hulu and ESPN+ products, rose to almost 236 million.

As consumer spending heads for a potential slowdown with the rising risk of a recession, and cost pressures remain elevated, investors have begun to judge growth-oriented companies in terms of their profit margins. On that account, Netflix is unlikely to produce stellar numbers, just like its peers.

Bottom Line

The recent rebound in Netflix stock has raised hopes that the streaming giant is back on a growth path after a tough year that turned many investors away from this tech darling of the past decade. That said, there is not much upside potential from here as investors await the outcome of the company’s latest growth initiatives, including its ad-supported service.

In order for its stock to rebound in a major way from here, the company has to prove that its new initiatives are meaningfully contributing to healthy top- and bottom-line growth and that its free cash flows are growing.

Disclaimer: As of the time of writing, the author doesn’t own NFLX stock. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.