Oklo stock tumbles as Financial Times scrutinizes valuation

- Nvidia is scheduled to release its Q1 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET.

- The AI chipmaker’s results will serve as a crucial test for both the tech sector and the broader market.

- A beat-and-raise quarter could quiet skeptics who fear an AI bubble, while a disappointing report or conservative guidance could trigger a fresh selloff.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners for 45% off!

As Nvidia (NASDAQ:NVDA) prepares to report its first-quarter results, Wall Street anticipates another exceptional performance from the AI chip juggernaut that has become the face of the artificial intelligence revolution. The company’s upcoming earnings release will be closely scrutinized not only for its financial metrics but also for insights into the broader AI landscape and semiconductor industry dynamics.

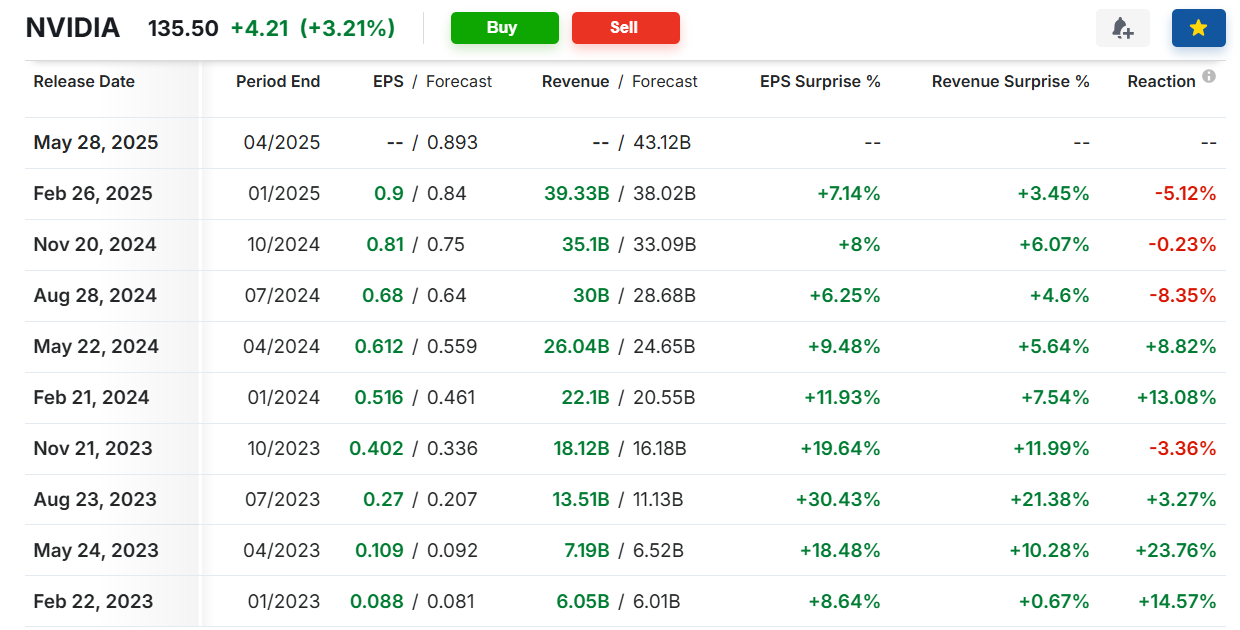

Past earnings surprises from NVDA have been market-moving events, and this quarter is unlikely to be an exception. Here’s what you need to know heading into the print:

Key Expectations

Nvidia’s Q1 numbers are due on Wednesday at 4:20 PM ET. A call with CEO Jensen Huang and CFO Colette Kress is set for 5:00 PM ET.

- Earnings per Share (EPS): Analysts project adjusted EPS of $0.89, a 45.9% increase from $0.61 in the year-ago quarter. This would mark a slowdown from the explosive triple-digit EPS growth seen in prior quarters, reflecting tougher comparisons and potential margin pressures.

- Revenue: Consensus estimates peg revenue at $43.1 billion, a 65.6% year-over-year surge from $26.0 billion in the year-ago period. NVIDIA’s own guidance is slightly more conservative at $43.0 billion, plus or minus 2%.

- Gross Margins: Nvidia expects GAAP gross margins of 70.6% and non-GAAP gross margins of 71.0%, down from 73.5% in the preceding quarter, primarily due to the high costs of scaling Blackwell production.

Source: Investing.com

The company’s track record is impeccable, having beaten estimates for both the top and bottom line for nine straight quarters.

Guidance Outlook

Nvidia’s forward guidance will be pivotal, as investors are hypersensitive to signs of slowing growth. Analysts expect Q2 revenue guidance of approximately $45.8 billion and full-year FY2026 revenue of $198.8 billion, up from $130.5 billion in FY2025, with EPS projected at $4.32.

Specific areas to watch in the guidance include:

- AI Demand and Supply Chain: Clarity on how Nvidia plans to address ongoing global supply chain challenges and manage AI chip production will be critical. Insights on demand forecasts and potential bottlenecks will shape investor sentiment.

- U.S.-China Trade Restrictions: Recent export controls on Nvidia’s H20 AI chip, designed to comply with earlier restrictions, are estimated to cause a $700 million revenue hit in Q1 FY2026, with a total impact of $9 billion across Q2 and Q3. Investors will seek clarity on how the company is navigating these challenges, including price hikes of 10-15% on GPUs to offset tariff-related costs.

- New Product Developments: Updates on upcoming product launches, particularly those tailored to specific markets like China, where geopolitical considerations influence strategy, will be closely watched.

A conservative outlook, particularly if impacted by U.S.-China trade restrictions, could trigger volatility.

The Stakes for NVDA

Nvidia’s stock is trading at a premium valuation, leaving little room for error. Any miss on earnings or guidance could lead to significant downside, while a beat-and-raise quarter could trigger a rally to new record highs.

Market participants expect a sizable swing in NVDA shares following the print, with options markets pricing in a potential $11 move in either direction post-earnings.

Source: Investing.com

Shares are currently at $135.50, earning the tech giant a market cap of roughly $3.3 trillion. The stock is roughly flat year-to-date.

Analyst sentiment remains overwhelmingly bullish, with 53 of 62 analysts rating Nvidia as a “Strong Buy” and a mean price target of $162.77, implying 20.1% upside from current levels. However, the quanititaive models in InvestingPro show that the average ‘Fair Value’ price for NVDA stands at $125.20 - a potential downside of 7.4% from current levels.

Market Implications

Nvidia’s earnings report carries significance well beyond its own stock price, given its outsized influence on the tech sector and the benchmark S&P 500 index.

Source: Investing.com

As the leading provider of AI infrastructure, the company’s results and outlook will be viewed as a barometer for the entire AI ecosystem.

Cloud service providers, enterprise software companies, and other semiconductor manufacturers could all see market reactions based on Nvidia’s commentary about AI adoption trends and infrastructure spending patterns.

A strong beat-and-raise could reignite enthusiasm for AI stocks, while any sign of weakness—particularly in guidance or Blackwell updates—could spark broader market volatility.

Final Thoughts

With Nvidia shares having already appreciated substantially over the past 24 months, the bar for positive surprise is undoubtedly high. However, the fundamental story around AI acceleration appears to remain intact, with enterprise adoption still in its early stages.

For now, Nvidia remains a top pick for investors looking to capitalize on the AI revolution. Those with long-term confidence in Nvidia might use any post-earnings dip as a buying opportunity.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.