IonQ CRO Alameddine Rima sells $4.6m in shares

- Nvidia kept its expectation-beating streak alive with its latest earnings.

- This came alongside the CEO announcing that a new industrial revolution is now underway.

- The company also announced a stock split to boost investor appeal, with positive sentiment likely to fuel a rally above $1,000.

- Invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Nvidia (NASDAQ:NVDA) shattered market expectations with its latest quarterly results, signaling that the company's momentum is showing no signs of slowing.

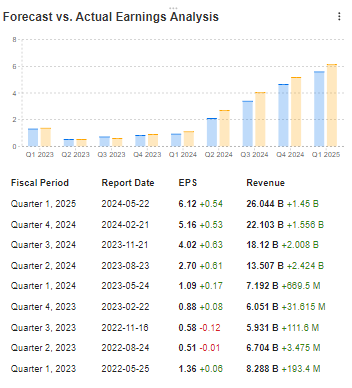

Despite high benchmarks and 35 upward revisions versus only three downward ones, the chip giant exceeded consensus estimates, posting $26 billion in revenue and earnings per share of $6.12.

This marks over a year of uninterrupted positive surprises, driving demand and pushing share prices potentially above the critical $1,000 mark.

A New Industrial Revolution?

Nvidia CEO Jensen Huang declared,

"The next industrial revolution has begun - companies and countries are working with Nvidia to move $1 trillion worth of traditional data centers to accelerated computing and build a new type of data center."

This statement underscores Nvidia's ambitious plans to dominate the AI-driven technological landscape.

Looking ahead, Nvidia forecasts continued growth, with next quarter's revenue expected to reach $28 billion, with a 2% deviation. Gross margins are projected at 74.8% GAAP and 75.5% non-GAAP, with a potential deviation of 50 basis points. Central to this anticipated success are the new Blackwell chips, now in full production, attracting eager buyers among major tech giants.

In a bid to enhance accessibility and appeal to a broader investor base, Nvidia announced a 10:1 stock split during its earnings report. This corporate move is expected to increase the attractiveness and availability of the stock.

The AI Boom Continues to Fuel Soaring Revenue

Nvidia's rapid growth in the AI sector began impacting financial results in early 2023, with significant increases in both revenue and earnings per share. Yesterday's results confirm that this trend is far from over, as Nvidia continues to capitalize on the booming demand for AI technologies.

Source: InvestingPro

While Nvidia's performance is impressive, the company's rapid growth raises expectations and pressure for future results. Any misstep could trigger a substantial market correction. For now, however, Nvidia shows no signs of slowing down, continuing to lead the charge in the AI revolution.

Nvidia Poised to Stay Above $1000 Level

Nvidia's stock has recently crossed the significant $1,000 threshold, and it appears poised to sustain this momentum. Yesterday's trading session saw a modest decline of less than 0.5%, with the stock consolidating as investors awaited key data. Despite this brief dip, indicators suggest that today's opening will feature a demand gap, pushing prices further above the $1,000 mark.

The prevailing scenario points to continued growth, with NVIDIA likely to remain above the $1,000 barrier in the short term. Investors are optimistic about the company's prospects, anticipating robust performance that could solidify its position at these elevated levels.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $9 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - claim your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.