Pilgrim Global buys Sable Offshore (SOC) shares worth $14.7m

New Zealand’s unemployment rate edged up to 5.2%, beating market expectations but softer details highlight growing slack and limited wage pressures.

- New Zealand unemployment up to 5.2%, matching RBNZ forecasts

- Employment, participation drop

- Underutilisation rises to 12.8%, youth unemployment steady

- NZD firms slightly, but mid‑2% cash rate still a risk

NZD/USD Outlook Summary

New Zealand’s Q2 jobs report showed further signs of labour market weakness, even as the unemployment rate marginally undershot market expectations. Falling employment, softer participation, rising underutilisation and elevated youth unemployment point to a weak backdrop that should keep wage pressures contained.

The Kiwi firmed slightly on the headline unemployment beat, but with swaps still treating 2.75% as a floor for the cash rate, we see scope for deeper cuts should these trends persist. That may limit upside for NZD/USD over the medium to longer term.

Q2 Jobs Report: Soft Underlying Detail

New Zealand’s Q2 employment data delivered another soft set of underlying details despite the headline unemployment rate coming in slightly better than markets expected. Seasonally adjusted unemployment rose to 5.2% from 5.1% in Q1, matching the RBNZ’s forecast but below the 5.3% rate expected by markets.

Employment fell 0.1% versus the RBNZ’s projected 0.2% rise, while participation eased to 70.5%, undershooting the bank’s 70.8% forecast. Weaker participation helped limit the rise in unemployment but points to ongoing softness in labour market conditions. The employment rate fell to 66.8%, down from 67.1% in Q1 and three-tenths below what the RBNZ anticipated.

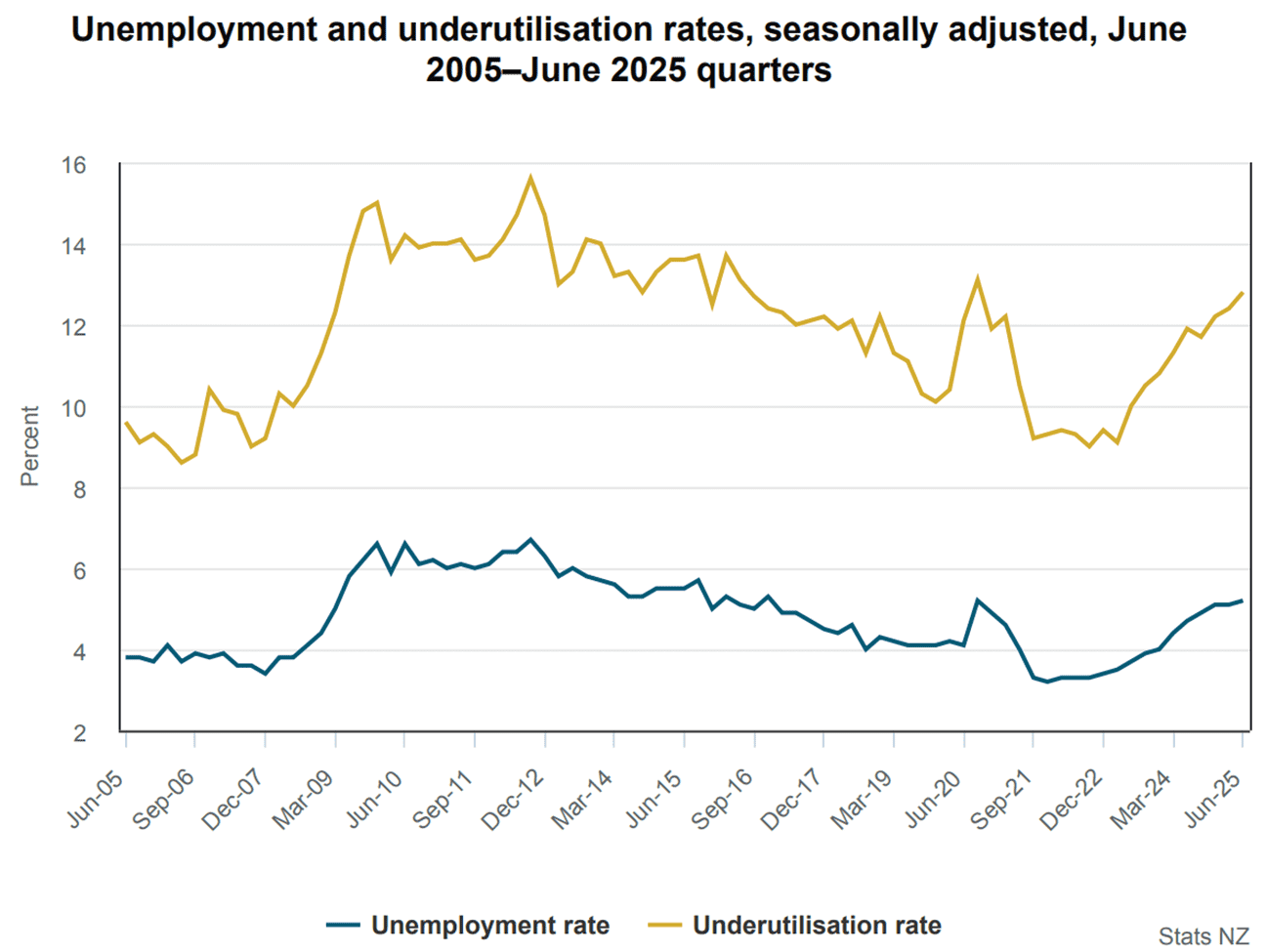

Source: StatsNZ

Despite lower participation, labour market slack continued to build with underutilisation climbing to 12.8% from 12.4% in Q1. This figure combines both unemployed and underemployed workers, along with potential labour market participants.

Youth unemployment remained elevated, holding at 12.9%. This underlines how the most responsive parts of the labour market continue to feel the pressure from weaker economic growth.

Private sector wages excluding bonuses rose 2.2% from a year earlier, a touch below the 2.3% pace expected, reinforcing that wage pressures remain contained. Despite the marginal beat on the headline unemployment rate, the details signal a labour market that is loosening further, limiting the risk of a renewed pickup in domestic-driven inflation.

Markets Favour 2.75% RBNZ Cash Rate Floor

Despite the soft underlying detail, traders are focusing on the small undershoot in unemployment relative to expectations, helping the Kiwi to strengthen against the US Dollar. There has been little movement in swaps markets with traders continuing to favour 2.75% as the floor for the RBNZ cash rate this cycle.

Given trends in underutilisation and wage growth, and with a sizeable proportion of the working-age population not even participating in the labour market, that comes across as too optimistic in our book. To get the private sector firing, policy settings need to be stimulatory, not neutral, pointing to the potential for the cash rate to be reduced to the mid-2s or lower. That’s the risk we continue to see.

NZD/USD Technical Analysis

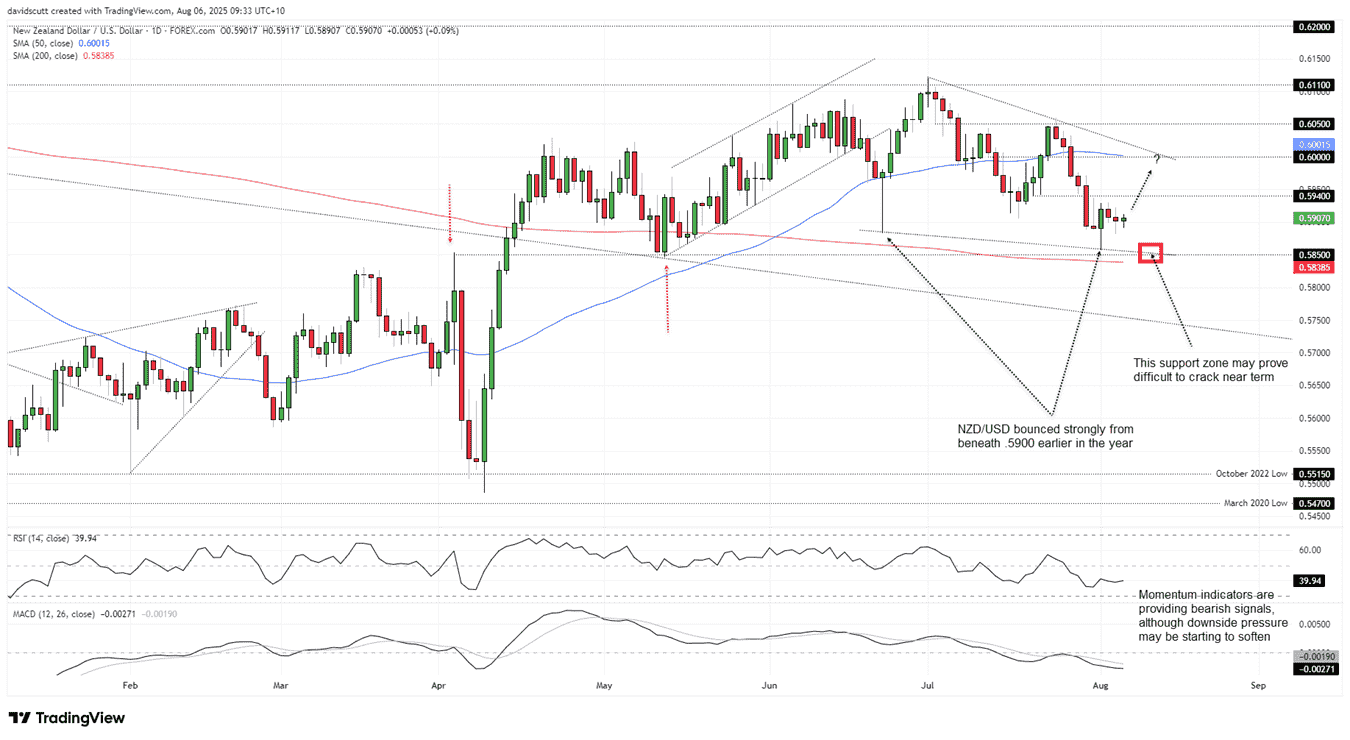

Looking at NZD/USD, the pair trades towards the lower end of the post-Liberation Day range established in May, recording a series of lower highs and lower lows over the past month since a brief foray above .6100 in early July.

Source: TradingView

While RSI (14) sits below 50 with MACD continuing to push lower in negative territory, having crossed the signal line from above in late July—two momentum signals that favour playing the Kiwi from the short side—with known support at .5850 and the key 200-day moving average just below, it’s difficult to get too bearish right now unless there’s a clean downside break of both levels.

Zooming out, the pair may be in the process of forming a falling wedge, providing another warning that downside may be hard won over the medium to longer term.

For now, buyers have been nibbling away on dips beneath .5900, likely noting the bullish price action seen on deeper probes below the level earlier in the year. For those contemplating countertrend longs, positions could be established around .5900 with a stop order beneath for protection. Depending on the desired risk-reward, this could extend down to beneath the 200-day moving average.

.5940 is a minor resistance level above, providing an early test for bulls. If it’s cleared, .6000 and the 50-day moving average loom as a potential target. Wedge resistance, .6050 and .6110 are other possibilities if the Kiwi really gets a wriggle on.

On the downside, .5883 was the low set on Tuesday, making that an initial level of note. Below, wedge support, .5850 and the 200-day moving average are the key levels to watch. If the latter is broken cleanly, there’s little visible support until the long-running downtrend established in January 2021.