SoFi stock falls after announcing $1.5B public offering of common stock

- Shares of Occidental Petroleum have more than doubled in 2022

- Energy giant among top 10 holdings of Warren Buffett’s Berkshire Hathaway

- Long-term investors could consider buying OXY at next pullback

- Looking for more top-rated stock ideas to add to your portfolio? Members of InvestingPro+ get exclusive access to our research tools, data, and pre-selected screeners. Learn More »

Occidental Petroleum (NYSE:OXY) operates energy and chemical assets primarily in the U.S., the Middle East, and North Africa. OXY stock gained 110% so far this year and almost 100% over the past 12 months.

Source: Investing.com

By comparison, the Dow Jones U.S. Oil & Gas has returned 45.5% in 2022. Meanwhile, the S&P 500 is currently down almost 20.5% in the same period.

Like many of its energy peers, Occidental Petroleum has benefitted from the rise in the price of oil. Brent crude is up well over 55% this year.

In addition, Warren Buffett’s Berkshire Hathaway (NYSE:BRKa) (NYSE:BRKb) has been piling into Occidental. It now owns more than 15% of the energy company. According to InvestingPro, OXY stock is among the leading 10 holdings, and comprises more than 2% of Berkshire’s portfolio.

As a result of these tailwinds, on May 31, OXY shares went over $74 to hit a multi-year high. The stock’s 52-week range has been $21.62-$74.04, while the market capitalization currently stands at $5.68 billion.

Recent Metrics

Occidental Petroleum issued Q1 financials May 10. Revenue was $8.53 billion, up 58% year-over-year. Adjusted earnings per diluted share came in at $2.12, compared with $1.48 in the same quarter in the previous year.

Cash and equivalents ended the quarter at $1.95 billion. Wall Street was pleased to see that Occidental repaid 12% of its debt, or $3.3 billion, during the quarter.

On the results, CEO Vicki Hollub said:

“Our OxyChem business delivered its third consecutive record quarterly earnings, as our employees continued to meet the increasing demand for the basic chemicals…”

Management plans to increase production by more than 6% during the second quarter. Full-year production and capital guidance, however, remained unchanged.

Prior to the release of the quarterly results, Occidental stock was changing hands at around $59.50. At the time of writing on Wednesday, it is at $60.40.

What To Expect From Occidental Petroleum Stock

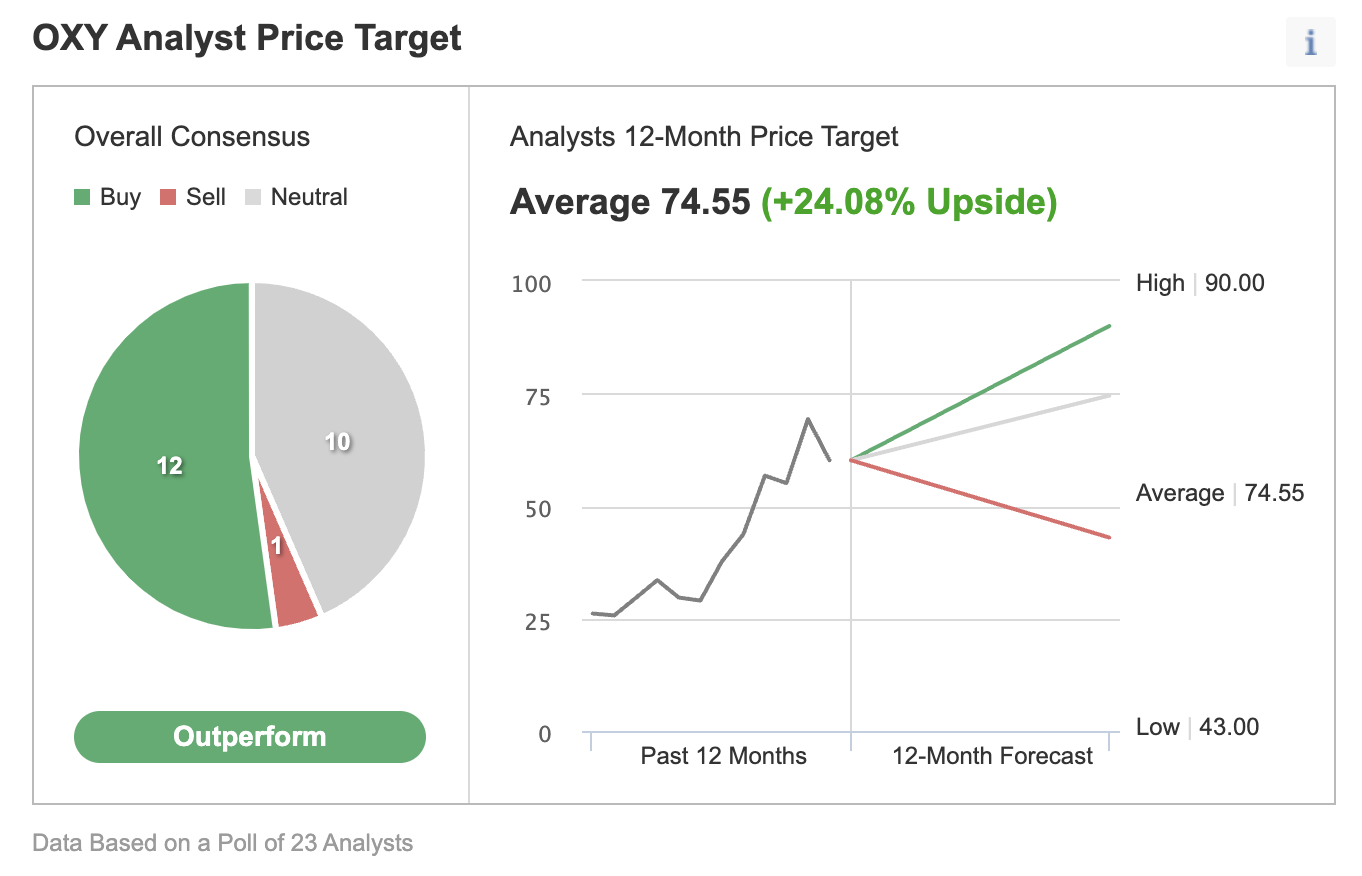

Among 23 analysts polled via Investing.com, OXY stock has an "outperform" rating. Wall Street has a 12-month median price target of $74.55 for the stock. Such a move would suggest an increase of 24.08% from the current price. The 12-month target range stands between $43 and $90.

Source: Investing.com

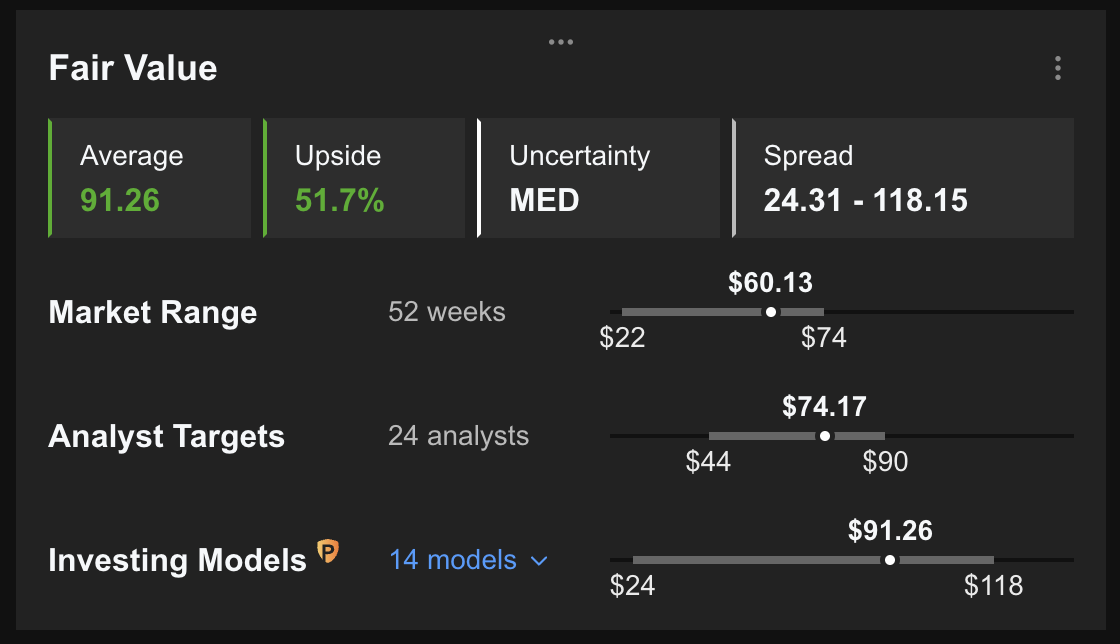

Similarly, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for OXY stock on InvestingPro stands at $91.26.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase by almost 51%.

We can also look at OXY’s financial health as determined by ranking more than 100 factors against peers in the energy sector.

For instance, in terms of growth and price momentum, it scores 4 out of 5. Its overall score of 4 points is a great performance ranking.

At present, OXY’s P/E, P/B, and P/S ratios are 8.9x, 3.8x, and 2.0x. Comparable metrics for peers stand at 4.8x, 1.6x, and 1.6x.

Understandably, the overall performance of an energy name like Occidental is closely tied to volatile oil prices. Our expectation is for OXY stock to come under pressure due to profit-taking, and trade between $55 and $60 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding OXY Stock To Portfolios

Occidental Petroleum bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $74.55, as provided by analysts.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has OXY stock as a holding. Examples include:

- John Hancock Multifactor Energy ETF (NYSE:JHME)

- Invesco Dynamic Energy Exploration & Production ETF (NYSE:PXE)

- First Trust Natural Gas ETF (NYSE:FCG)

- Invesco S&P 500® Equal Weight Energy ETF (NYSE:RYE)

- SPDR S&P® North American Natural Resources ETF (NYSE:NANR)

Finally, investors who are slightly bearish on OXY stock as they expect profit-taking could set up a bear put spread.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on OXY stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bear Put Spread On OXY

Current Price: $60.40

For the first leg of this strategy, the trader might buy an at-the-money (ATM) or slightly out-of-the-money (OTM) put option, like the OXY Aug.19 60-strike put option. This option is currently offered at $6.30.

For the second leg of this strategy, the trader sells an OXY put, like the OXY Aug.19 55-strike put option. This option’s current premium is $4.10.

In our example, the maximum risk will be equal to the cost of the spread plus commissions. Here, the net cost of the spread is $2.20 ($6.30 – $4.10 = $2.20).

As each option contract represents 100 shares of the underlying stock, the maximum risk is $220 ($2.20 X 100).

In a bear put spread, potential profit is limited to the difference between the two strike prices minus the net cost of the spread plus commissions. So in our example, the maximum profit is $2.80 ($5 – $2.20 = $2.80) per share less commissions. When we multiply $2.80 by 100 shares, the maximum profit for this option strategy comes to $280.

Readers who have traded options before are likely to know that short put positions are typically assigned at expiration if the stock price is below the strike price (i.e., $55 here). However, there is also the possibility of early assignment. Therefore, the position would need monitoring up until expiration.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »