Asia FX cautious amid US govt shutdown; yen tumbles after Takaichi’s LDP win

- Oil and gas uptrend halted in the short term

- European natural gas reserves remain robust as the heating season approaches

- Long-term, however, there are still no apparent indications of a global shift away from fossil fuels

Long-term energy bulls have no reason to frown, even against the backdrop of the recent halt in oil price rises.

On top of last quarter's rally, the latest projections from Wood Mackenzie indicate that global investments in exploring new resources in the oil industry will reach approximately $21 billion a year over the next five years, marking a 5% year-on-year increase.

The upward momentum is also expected to continue on the demand front. The International Energy Agency predicts a record demand of 102.2 million barrels per day for this year, with further improvements anticipated in 2024.

While conservative estimates suggest a potential shift to a downward trend towards the end of the decade due to the growth of renewable energy sources (RES) and electromobility, the march of demand-side influence on oil prices, including Brent and WTI, which was expected to culminate in reaching $100 per barrel, has so far been halted.

But with high expectations for the next few years, let's take a look at the current state of the prices of oil and natural gas to assess the best entry point for those looking to acquire positions in the two leading fossil fuel industries.

Macro Backdrop

In the context of global commodity pricing, a pivotal factor remains the US dollar, which continues to dominate trade settlements.

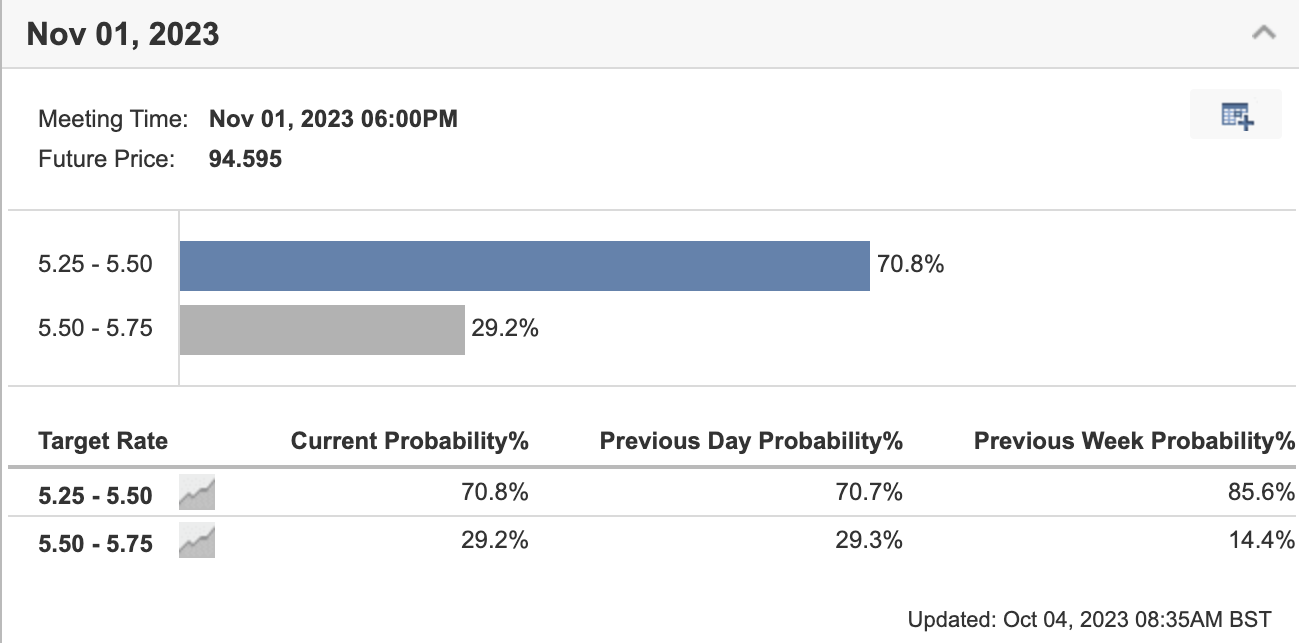

The Federal Reserve's stance remains consistent, emphasizing the maintenance of relatively high interest rates for an extended period, with the possibility of further rate hikes. Currently, the likelihood of another rate hike in November stands at 29.2%, according to our Fed Rate Monitor Tool.

Source: Investing.com

The strong dollar, coupled with output cuts from Saudi Arabia and Russia, has played a pivotal role in bolstering buyers.

The next critical data points to watch are the US jobs report scheduled for release this Friday and the inflation readings due on Thursday, October 12. However, the most significant determinant could be the outcome of the Federal Reserve's November 1 meeting, which may set the course for the dollar's trajectory for the remainder of the year.

Oil: OPEC+ Production Surge Tempers Price Gains

Since last week, we've witnessed a slowdown in the upward momentum of crude oil prices, with WTI currently hovering around $90 per barrel. This correction is primarily attributed to reports of increased production from Iran and Nigeria, leading to a rise in the cartel's production volumes by 120,000 barrels per day in September.

Despite this, taking a broader view, OPEC data indicates a global deficit of approximately 3 million barrels per day in the fourth quarter. Coupled with diminishing reserves, particularly in the US, this could exert pressure on the demand side.

We are currently within a corrective phase, and from a technical perspective, the first significant challenges are anticipated around the confluence of the support level and the upward trend line in the vicinity of $85 per barrel.

The bulls' primary target remains the psychological barrier of $100 per barrel if the upward momentum persists.

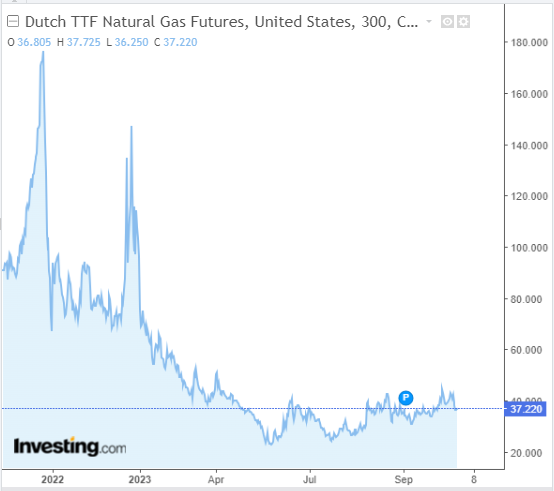

Natural Gas: A Mild Start to Autumn

Natural gas prices at the Dutch TTF have experienced only modest increases in recent months, reflecting a period of replenishment that bodes well for maintaining relatively low prices. European Union countries appear well-prepared for the upcoming heating season, with warehouse filling levels averaging at 95%. Additionally, reduced industrial activity and an unusually warm start to autumn are contributing factors in curbing price escalation.

As a result, it appears that we are unlikely to witness a repeat of last year's challenges, a sentiment reinforced by our decreasing reliance on Russian supplies, which now make up only around 15% of all imports.

The ongoing local uptrend, in place since May, does not exhibit notable signs of robust demand. In the short term, the crucial resistance zone is currently situated around $45, and only a breakout from this level will pave the path toward the $60 neighborhood.

***

Disclosure: The author doesn't hold any of the securities mentioned in this report.